2024 Identity Fraud Study: Resolving the Shattered Identity Crisis

- Date:April 10, 2024

- Author(s):

- Suzanne Sando

- Report Details: 48 pages, 27 graphics

- Research Topic(s):

- Fraud & Security

- Fraud Management

- PAID CONTENT

Overview

The financial landscape experienced meaningful innovation and expansion over the past few decades. The most notable acceleration in advancement has happened in just the past few years. Digital banking, especially in the form of mobile banking apps, is a must for financial institutions to stay relevant with on-the-go consumers. Brick-and-mortar stores have moved into the e-commerce space (with many businesses moving away from physical stores to online-only offerings). Online loan origination is transforming the auto and mortgage industries. The list is endless.

Whether it was the growing adoption of cryptocurrency and digital assets, real-time payments innovation, or frugal savers taking advantage of interest rate increases to employ strategic saving in 2023, consumers seemed to be taking advantage of forward economic momentum.

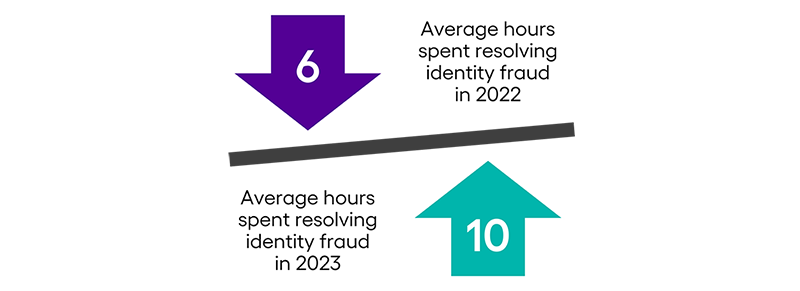

And criminals surely took advantage of this forward momentum. Fraud-related resolution hours skyrocketed in 2023. The average amount of time consumers spent in 2022 resolving issues stemming from identity fraud clocked in at six hours, but in 2023, fraud resolution hours rose steeply, jumping to a nearly 10-hour average, a major disruption for consumers and financial institutions alike.

Skyrocketing Resolution Hours Create Headaches for Consumers

Traditional identity fraud losses amounted to nearly $23 billion in 2023, resulting in a 13% increase in overall losses for U.S. adult victims of identity fraud. And since Javelin began tracking financial losses attributable to scams in 2021, there has been a steady yet nearly imperceptible drop in financial loss. Scams orchestrated by criminals resulted in just over $20 billion in fraud losses to victims.

Javelin makes a distinction between traditional identity fraud and identity fraud scam losses to add perspective to the landscape of identity fraud and provide accurate historical information and relevant recommendations to financial institutions, fintechs, third-party fraud solutions providers, and even consumers. But it’s vital to remember that, to identity fraud victims, it doesn’t matter how the losses are analyzed and categorized.

What matters is how their fraud and scam encounter is managed by the organizations they trust and with which they choose to do business, how they are treated throughout the resolution process, and how they feel after suffering a financial loss and a breach of trust. This must always be top of mind for organizations as they work to improve their efforts to detect and prevent further damage from identity fraud.

2024 Identity Fraud Study Sponsors

The Javelin Strategy & Research 2024 Identity Fraud Study provides a comprehensive analysis of fraud trends in the context of a changing technological and payments landscape. Its goal is to inform consumers, financial institutions, and businesses about the most effective means of controlling identity fraud. The study began in 2003 and serves as the nation’s longest-running analysis of identity fraud, with more than 105,000 consumers surveyed. This study is independently produced by Javelin and made possible with support from the following sponsors:

Interested in sponsoring a future study?

Methodology

Survey Data Collection

This ID fraud survey was conducted online among 5,000 U.S. adults over the age of 18; this sample is representative of the U.S. census demographics distribution. Data collection took place Oct. 23-Nov. 28, 2023. Data is weighted using 18-plus U.S. population benchmarks on age, gender, race/ethnicity, education, census region, and metropolitan status from the most current CPS targets. Due to rounding errors, the percentages on graphs may add up to 100% plus or minus 1%. To preserve the independence and objectivity of this annual report, the sponsors of this project were not involved in the tabulation, analysis, or reporting of final results.

Comparing Research Findings Across Organizations: Please Anticipate Natural Variances in Key Findings Javelin cautions readers to understand the context behind increases and decreases in key findings as they apply to the annual Identity Fraud Report, especially when comparing your own organization’s experiences or comparing research outcomes from other companies or agencies. It is impossible to compare identity fraud key findings across multiple sources and expect to see universal alignment. Key findings never line up across organizations due to how data is collected. Sample sizes (the number of consumers) also vary a great deal.

Book a Meeting with the Author

Related content

Data Transparency in the Age of Cyber and Privacy Risk

As open banking and new privacy regulations accelerate, financial institutions face rising pressure to enhance privacy and cybersecurity transparency to strengthen consumer trust. ...

Crypto Investment Scams: How Banks Can Disrupt These Criminal Operations

Cryptocurrency investment scams have evolved into organized, global operations that are stealing billions of dollars from consumers. Recent enforcement actions and platform disrupt...

Quishing and the Resurgence of BYOD Cyber-Attack Exposure

North Korean attackers’ latest efforts to target foreign policy experts through a technique known as quishing expose long-standing bring-your-own-device vulnerabilities that U.S. o...

Make informed decisions in a digital financial world