Overview

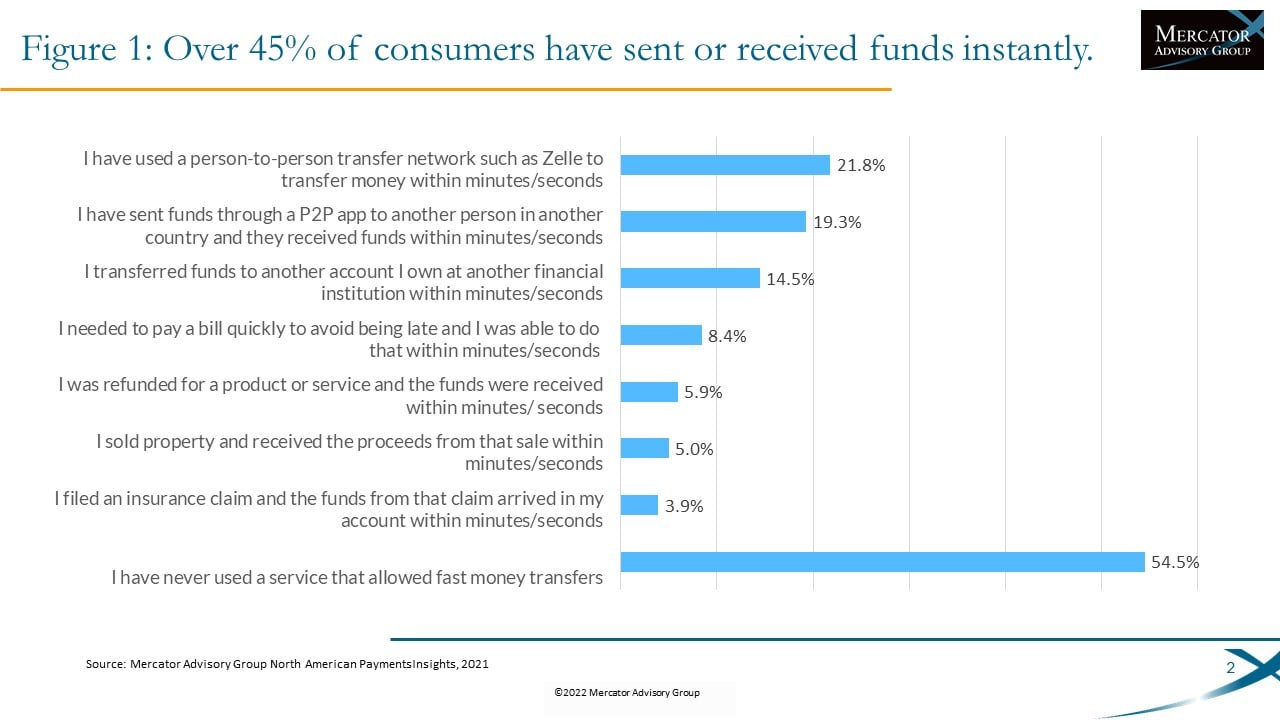

The Growth of Real-time and Faster Payments Is Driving Consumer Demand.

2021 was an important build-out year for real-time and faster payments in the U.S., as explored in Mercator Advisory Group’s annual look at the market; 2022 U.S. Faster Payments Forecast: A Year to Build On. Payment options such as the debit network’s debit push payments, The Clearing House RTP network, Same Day ACH, and Zelle all experienced strong growth dependent on the specific use cases where each predominates and the maturity of their respective solutions. Following through on the pandemic fueled growth in 2020, more financial institutions and technology providers integrated to faster and real-time rails, launched new products, and advanced their strategies.

“We have found in the last year that consumers are becoming much more aware that some payments transact quickly, even instantly, which for transaction types like bill pay, account-to-account transfer and some person-to-person funds movement is beneficial. This leads to a compounding effect that is creating greater demand for faster payments in more use cases,” comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report.

This report has 18 pages and 9 exhibits.

Companies mentioned in this report include: Alloy Labs Alliance, Bank of America, Bank of the West, Block, BNY Mellon Bank, Chime, Citibank, Early Warning Services, JPMorgan Chase, Mastercard, PayPal, PayRailz, The Clearing House, US Bancorp, Visa, Wells Fargo

One of the exhibits included in this document:

Highlights of this document include:

- Consumer’s view of faster and real-time payments through primary data results

- Recent growth trends and forecast dollar volume for Mastercard Send, Visa Direct, Same Day ACH, The Clearing House’s RTP network, and Zelle.

- Discussion of the current use cases experiencing the greatest growth and predicted new avenues for expansion

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world