2022 North American PaymentsInsights: Frictionless Transactions – Neobank vs. Conventional Banking

- Date:July 21, 2022

- Author(s):

- Nicholas Bisconti

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Frictionless Transactions Addresses Speed, Efficiency, and a Better User Experience

Neobanks, also referred to as challenger banks, have experienced steady growth in popularity for the past few years. The outlook for 2022 seems promising for the global fintech market, as the value for this sector is expected to hit a multibillion-dollar mark with a compound annual growth rate in double digits. The primary reason for this growth has been associated with certain banking consumers’ need for speed, efficiency, and a better user experience from their financial institutions as they leverage the latest emerging technology. How are frictionless transactions evolving?

Mercator Advisory Group’s most recent report, 2022 North American PaymentsInsights: Frictionless Transactions – Neobank vs. Conventional Banking, examines frictionless transactions and consumers' general aptitude for technology as we try to understand if there is indeed a technological link between those consumers who bank with neobanks and those who do not. We will take a closer look at the technological aptitude of all surveyed consumers and their preferences for the use of financial services products, technology-influenced bill payment methods, digital wallets, and peer-to-peer (P2P) payment services, among other topics.

Mercator survey data will highlight nuances about neobank customers that differ slightly from legacy banking consumers. For example, we observe from our data that neobank customers' use of emerging technology seems to go beyond just owning the latest tech gadget; instead, there is a greater willingness to leverage tech to its fullest potential when consumers bank, make the newest purchase, or exercise payment options.

Primary research obtained from an online panel of 3,000 U.S. adult households reflective of U.S. Census-based consumer demographics provides a baseline for our fact-based insights. Mercator analysis provides insight into the latest payment technologies offered to consumers, identifies essential shifts in consumer payment preferences, and reveals consumer use and interest in emerging payment products and services.

This report in slide form is 57 pages long.

One of the exhibits included in this document:

Highlights of this document include:

- The Neobank Customer Persona

- Use of Financial Services Products

- Bill Payment Options

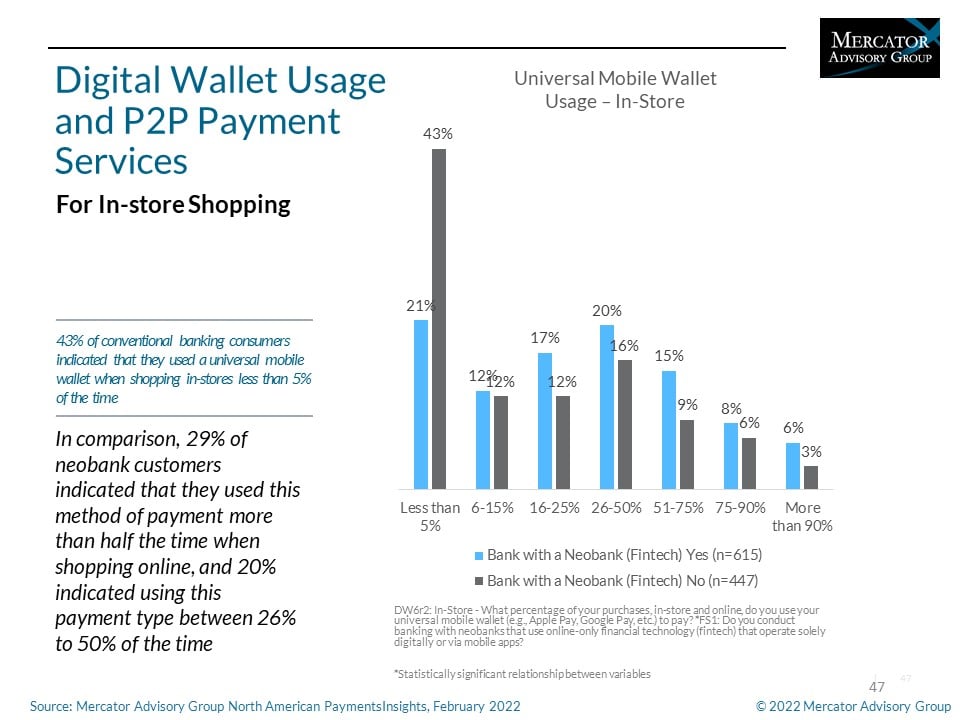

- Digital Wallet Usage and Peer-to-Peer (P2P) Payment Services

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: Canada: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 22 – 30, 2025, using a Canadian online...

Make informed decisions in a digital financial world