Overview

ATMs Evolve in the COVID-19 era.

As the COVID-19 pandemic ripples across consumer payments, the heavily cash-centric ATM is in a challenging position. Consumers’ use of cash for daily transactional purposes (purchases, person-to-person payments) is on the decline, although larger amounts are being held at home. At the same time, FIs are rationalizing and reducing their branch networks and revising branch configurations and staffing, putting ATMs in the role of supplementing cash handling in the branch. Enhanced cash-recycling ATMs are being deployed to improve the efficiency of cash management. Simultaneously, the move to smartphone-based digital interfaces—and now the delivery of digital goods, namely cryptocurrencies—provides new opportunities for existing and new terminals. A new research report from Mercator Advisory Group titled 2022 ATM Market Summary: Coping in a New Cash and Digital Era looks at the usage related to the pandemic environment, cash usage that influence how consumers use ATMs, and trends in the design, deployment and new capabilities.

"The pandemic environment teaches us once again that consumer behavior can change overnight. Some of the changes in consumers’ use of cash may slowly revert to earlier patterns, while others are here to stay and further grow," comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report.

This research report has 24 pages and 16 exhibits.

Companies mentioned in this report include: Federal Reserve Bank of San Francisco, LibertyX, NCR, Venmo, Walmart, Zelle

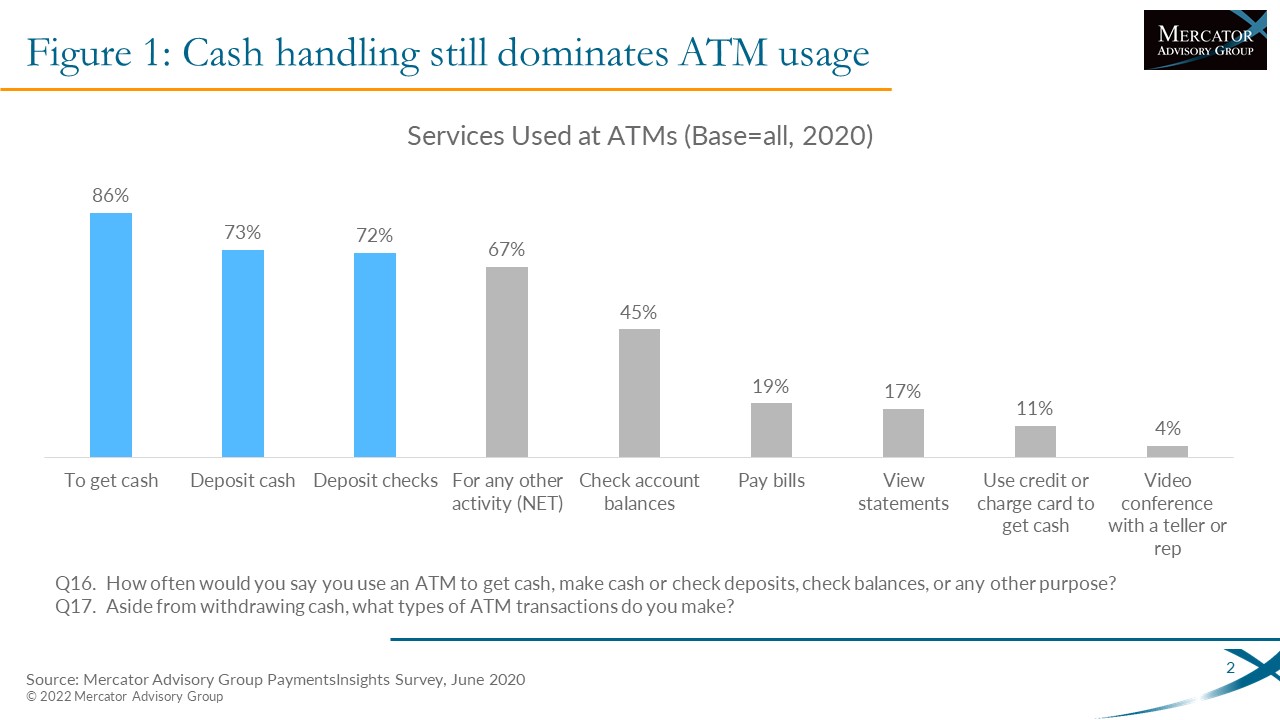

One of the exhibits included in this report:

- Shifts in behavioral baselines

- Overall ATM and cash usage trends

- ATM surcharging

- Capabilities in a shrinking ecosystem

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world