2021 North American PaymentsInsights: Canada – Fraud and Shifting Consumer Payments Preferences

- Date:July 28, 2021

- Author(s):

- Nicholas Bisconti

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group has released a new primary research report titled 2021 North American Payments Insights: Canada – Fraud and Changing Consumer Preferences, summarizing the research findings from the fraud and payments behavior sections of the North American PaymentsInsights survey of 1,001 Canadian-based adults. The report highlights consumer payment behavior in response to experiencing payment related fraud in the pandemic induced shift to online shopping. Additionally, the report draws attention to the shifts in consumer payment habits and changing consumer preferences influenced by the pandemic. Finally, it touches upon consumers’ experience with credit card payment holidays and the implications this may have for credit card issuers. Various aspects of how Canadian consumers interact with the payments’ ecosystem are brought together to highlight key trends in consumer behavior, preferences, and motivations influenced by consumer perceptions and experiences with payment related fraud during a rapidly changing payment environment. Readers will be presented with a detailed analysis of the impact of demographic characteristics on consumer behaviors and inclinations, general consumer trends, as well as actionable insights for industry players to consider.

“The unprecedented expansion of online shopping during the pandemic has created a rise in fraud events that have affected Canadian consumers across all demographic categories. This necessitates a thorough reconsideration of how major players in the payments space deal with fraud prevention and the vendors they use for this. As fraud attacks affect a larger number of consumers, it is vital that payments service providers take measures to assure consumers that their payment information is secure.” - Amy Dunckelmann, Vice President, Research Operations, Mercator Advisory Group.

One of the exhibits included in this report:

Highlights of the 2021 North American Payments Insights: Canada – Fraud Trends and Changing Consumer Preferences Report include:

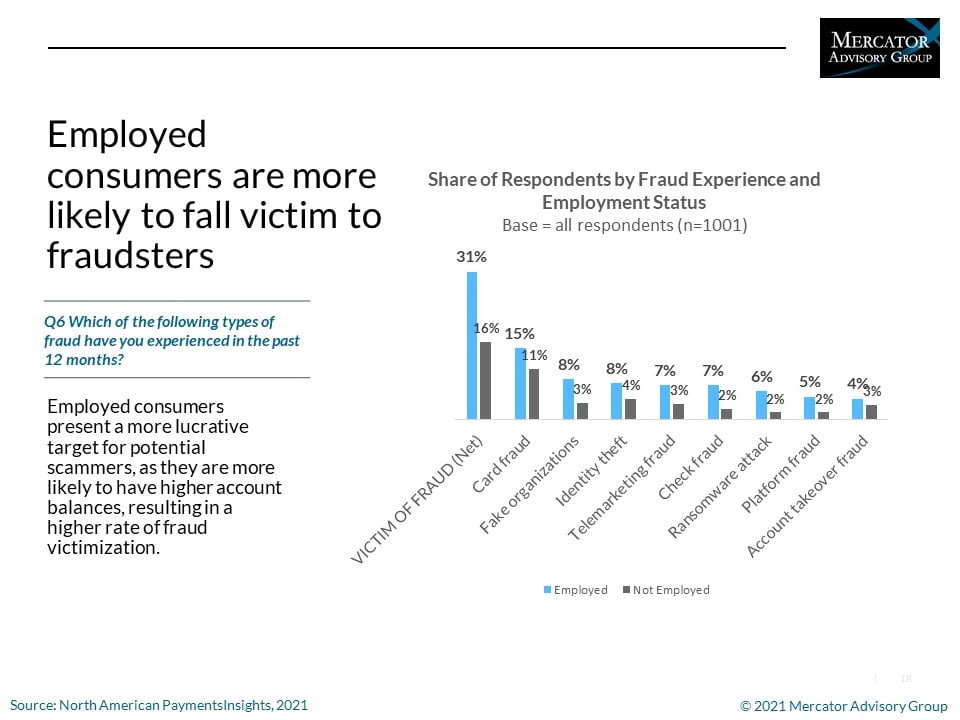

- Card fraud was the most prevalent among the fraud types, easiest to carry out, and most likely to result from card-not-present transactions.

- Young people are more likely to have experienced fraud, with the 18-24 age cohort proving to be most susceptible.

- A credit card lost or stolen incident was more likely to lead to account closure, compared to a comparable incident involving a debit card.

- Consumers reported using less cash and checks, while ramping up their usage of contactless payment methods.

- Low-income and unemployed respondents were most likely to ask for a credit payment “holiday,” reflecting the necessity for more lenient repayment policies based on life events.

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world