2021 North American PaymentsInsights – Buy Now Pay Later

- Date:April 26, 2021

- Author(s):

- Peter Reville

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

How is Buy Now, Pay Later Financing Affecting the Consumer Credit Space?

Mercator Advisory Group has released a new primary research report titled 2021 North American PaymentsInsights – Buy Now Pay Later, summarizing the findings from the BNPL and short-term financing sections of the semi-annual North American PaymentsInsights survey of 3,001 U.S-based adults. The report aims to highlight and analyze consumer behaviors, preferences, and motivations as they relate to the rapidly expanding range of point-of-sale financing products. Readers will be presented with a detailed analysis of the impact of demographic characteristics on consumer behaviors and inclinations, general consumer trends, as well as actionable recommendations for industry players.

“The rise of buy now, pay later financing and short-term loans has implications for the consumer credit space as a whole, particularly credit card networks and issuers that have long dominated the industry. With interest rates at record lows, accelerated adoption of online shopping over the past 12 months, and high consumer satisfaction – the conditions have never been better for the reimagining of consumer credit,” stated Amy Dunckelmann, Vice President, Research Operations, Mercator Advisory Group.

This report contains 59 slides and 35 exhibits.

One of the exhibits included in this report:

Highlights of the 2021 North American PaymentsInsights – Buy Now Pay Later Report:

- Young people and those in the middle-income cohort are particularly drawn to BNPL and short-term financing.

- BNPL and short-term financing present themselves as a viable competitors to the credit card industry, especially as many young people are reluctant to use credit cards.

- A variety of risks arise with the expansion of this industry, as many consumers may be borrowing beyond their means and regulatory oversight remains significantly lower than that in the traditional consumer credit space.

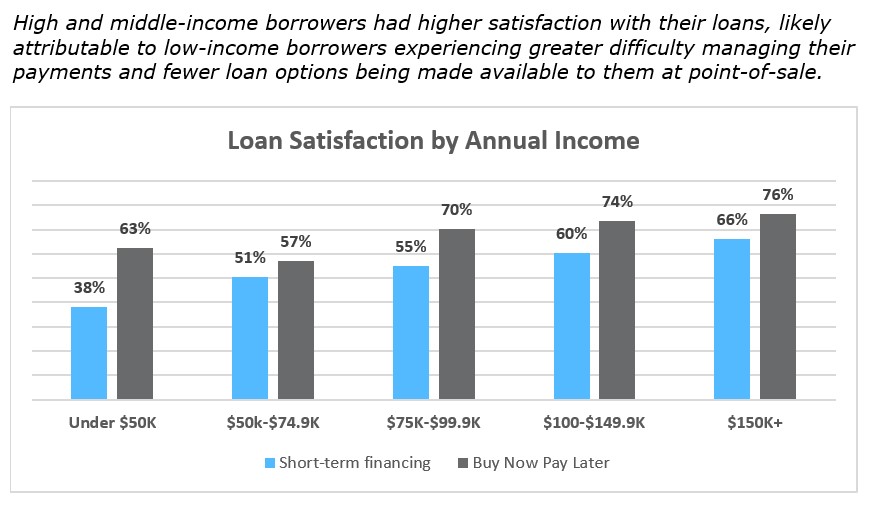

- Consumer satisfaction with BNPL and short-term loans varied significantly across age groups, income lines, and purchase categories.

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world