2019 U.S. PaymentsInsights - Debit Cards and P2P Payments: Solid Partners

- Date:February 14, 2020

- Author(s):

- Peter Reville

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

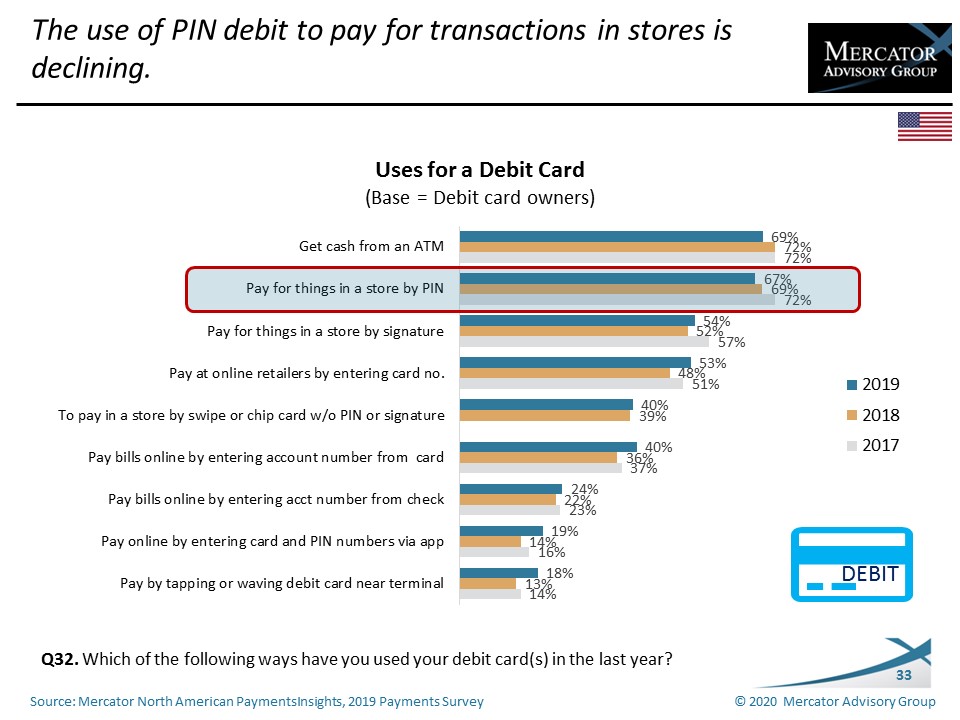

Mercator Advisory Group’s most recent report, Debit Cards and P2P Payments: Solid Partners, a 2019 U.S. PaymentsInsights study, reveals that the debit cards and person-to-person (P2P) payments are both core components of the U.S. payment ecosphere today.

This report from Mercator Advisory Group’s Primary Data service is based on a sample of 3,002 U.S. adults surveyed in the annual online Payments survey of Mercator’s North American PaymentsInsights series, conducted in June 2019.

The study highlights consumers’ use of debit cards relative to other payment types, participation in debit card reward programs, and new account opening. Additionally, the survey covers usage of P2P payment services, key P2P brands, reasons for using and not using P2P payments, and P2P fraud.

“Both debit cards and P2P payments are key components in the payments repertoire of U.S. consumers. Each has strengths in serving different constituencies. Debit card has a core group of users who prefer debit over credit cards and use it for all the transactions for which others would use credit. Person-to-person (P2P) payment services are continuing to grow as people and businesses find more use for it,” stated the author of the report, Peter Reville, director of Primary Data Services at Mercator Advisory Group, which includes the North American PaymentsInsights series.

Companies mentioned in the survey results shown include: Apple, Facebook, Google, MoneyGram, PayPal, PeoplePay, PopMoney, Square, Venmo, Western Union, and Zelle.

One of the exhibits included in this report:

Highlights of this report include:

- Current payment card usage in the U.S.

- The use of payment cards online and off line

- The incidence of debit card fraud

- Debit card rewards

- P2P payment usage

- The types of P2P payments used

- P2P payment fraud

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: Canada: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 22 – 30, 2025, using a Canadian online...

Make informed decisions in a digital financial world