2018 Identity Protection Service Provider Scorecard

- Date:December 12, 2018

- Author(s):

- Kyle Marchini

- Report Details: 30 pages, 19 graphics

- Research Topic(s):

- Fraud Management

- Fraud & Security

- PAID CONTENT

Overview

Javelin analyzes leading identity protection services providers' solutions, based on current fraud strategies and consumer expectations. For eleven years, Javelin has been benchmarking identity protection vendors and recognizing leading direct-to-consumer providers with the plans that offer the best consumer-facing prevention, detection, and resolution capabilities. In these report, Javelin examines the growth and transformation of the identity protection services industry and assesses fraud trends, new partnership channels, and consumer preferences for identity protection services plans.

Javelin’s Identity Protection Service Providers Scorecard explores changes in the identity protection landscape and identifies the top vendors in the identity protection space based on the Prevention, Detection, and Resolution™ capabilities of their direct-to-consumer products.”

Key questions discussed in this report:

- How do current fraud and financial service trends impact consumers demands on and expectations for the IDPS industry?

- How should providers adjust product offerings to best meet the challenges posed by the changing nature of fraud and the competitive landscape?

- What identity protection service providers offer the widest array of capabilities suited to addressing current and emerging fraud threats?

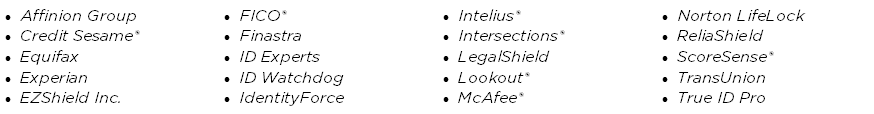

Companies Mentioned: Affinion Group, Credit Sesame, EZShield Inc., Equifax, Experian, FICO, Finastra, ID Experts, ID Watchdog, IdentityForce, Intelius, Intersections, LegalShield, Lookout, McAfee, Norton LifeLock, ReliaShield, ScoreSense, TransUnion, True ID Pro

Methodology

In 2013, Javelin departed from its traditional scorecard data collection methodology by allowing executives to answer questions about their product in a survey format. The rationale behind this change was to solicit input from providers beyond the binary criteria that constitute the Identity Protection Services Scorecard to understand not only what services they provide but also how they are provided. For all scorecard surveys submitted by executives, Javelin conducted spot checks using traditional scorecard methodology. This methodology was continued in 2017. To calculate the overall score, Javelin assessed each provider’s performance across all three categories with the following weightings: prevention is worth 40% of the overall score, detection is worth 35%, and resolution is worth 25%.

Some providers declined to participate in the executive survey. In these cases, Javelin employed traditional data collection methodology to complete the scorecard, using accounts held at each of the providers. These accounts were also used by Javelin employees to answer questions about the products, conduct quality checks, and collect screenshots.

Consumer data in this report is based primarily on information collected in a panel of 2000 consumers in an online survey conducted in August 2018. The margin of sampling error is +/- 2.19 percentage points at the 95% level for questions answered by all 2000 respondents. Margin of error is higher for questions answered by smaller segments.

Identity Protection Service Providers evaluated:

* Identity Protection Service Providers who chose not to participate in the executive survey

Book a Meeting with the Author

Related content

Crypto Investment Scams: How Banks Can Disrupt These Criminal Operations

Cryptocurrency investment scams have evolved into organized, global operations that are stealing billions of dollars from consumers. Recent enforcement actions and platform disrupt...

Foolproof Payments: How AI is Revolutionizing Payment Fraud

Payment fraud is becoming harder to detect as transactions move faster and fraud tactics evolve. Fraud teams are being pushed to make quick decisions with limited context, leading ...

2025 Know Your Customer and Know Your Business Solution Scorecard

KYC and KYB tools play critical roles in preventing fraud and supporting compliance efforts. This report compares 17 leading KYC and KYB vendors in the U.S. market and examines how...

Make informed decisions in a digital financial world