2018 Identity Fraud: Fraud Enters a New Era of Complexity

- Date:February 06, 2018

- Author(s):

- Test

- Kyle Marchini

- Sarah Miller

- Report Details: 49 pages, 37 graphics

- Research Topic(s):

- Fraud Management

- Fraud & Security

- PAID CONTENT

Overview

PERMISSIONS AND COPYRIGHT GUIDELINES

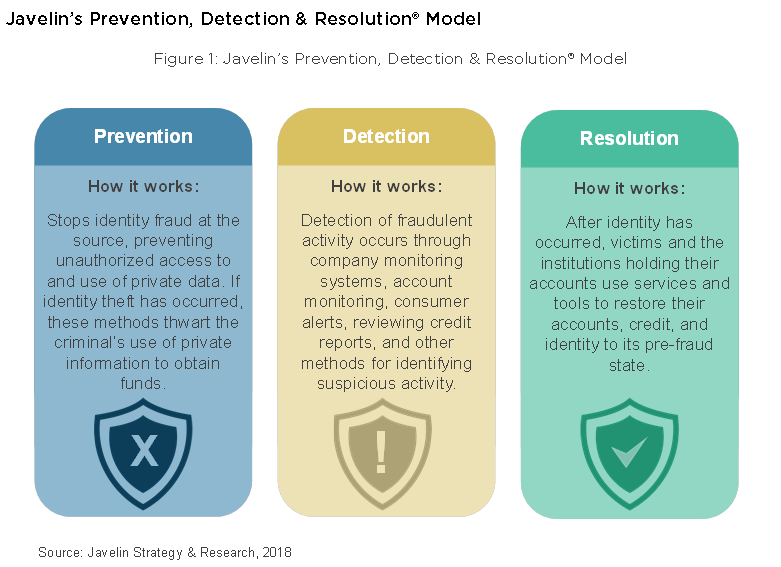

Javelin’s 2018 Identity Fraud Report provides comprehensive analysis of fraud trends in the context of a changing technological and regulatory environment in order to inform consumers, financial institutions, and businesses on the most effective means of fraud prevention, detection, and resolution.

The comprehensive analysis of identity fraud trends is independently produced by Javelin Strategy & Research and made possible with support from Identity Guard, a leading provider of proactive identity theft protection services for consumers. This study is the nation’s longest‐running study of identity fraud, with 74,000 respondents surveyed since 2003.

A thank you to our sponsor, Identity Guard, for making this report available to Javelin Advisory Services clients for their internal use only.

Only Sponsors of this year’s identity fraud study have sole rights to use of any graphics and data listed in the 2018 Identity Fraud report exclusively for their marketing campaigns and any other public purpose.

Javelin retains the ownership of the survey, raw data, methodology and all other project deliverables. While Javelin may selectively grant other non-competing organizations selective rights to use the project’s findings in other public venues, we retain ultimate discretion over such decisions.

Javelin Advisory Services clients and other non-sponsors do not have immediate rights to cite any findings in their marketing campaigns, press releases, webinars, or any other external communications. Please inquire with your Javelin Relationship Manager about licensing rights to cite or otherwise reproduce data findings or graphs.

TABLE OF CONTENTS

TABLE OF FIGURES

Figure 1: Javelin’s Prevention, Detection & Resolution® Model

OVERVIEW

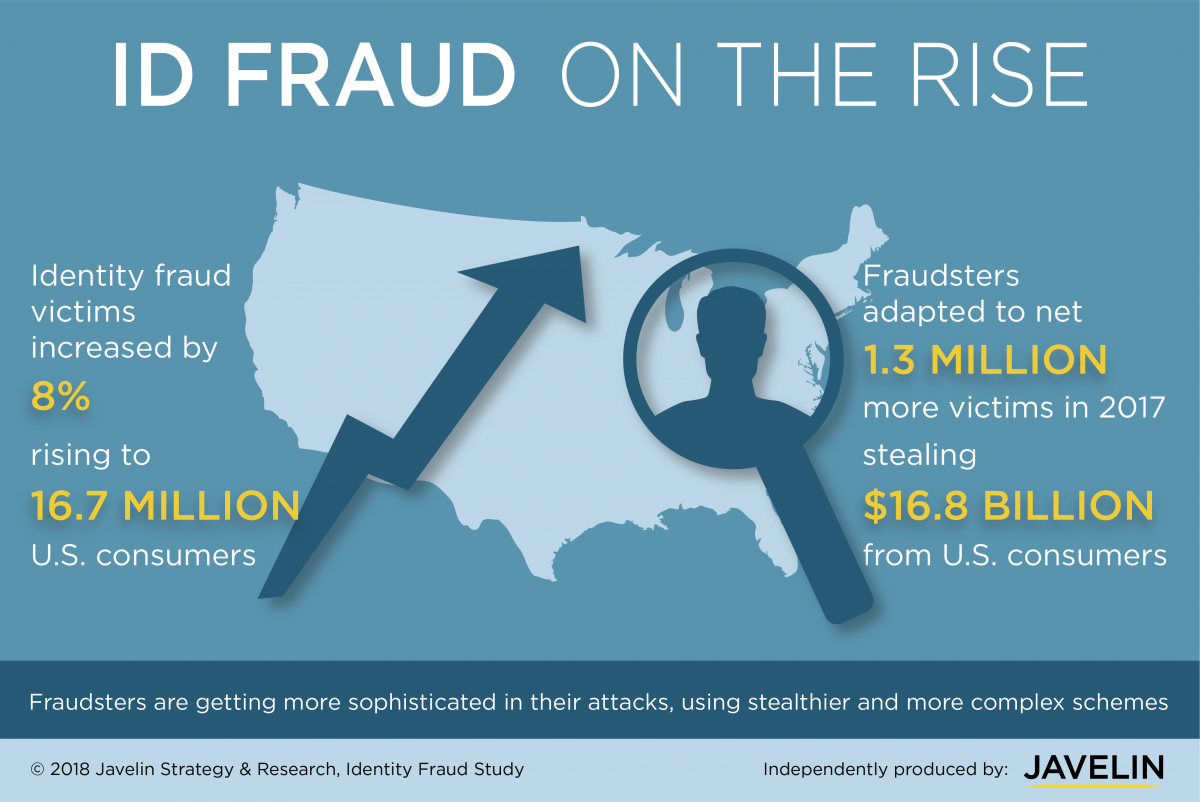

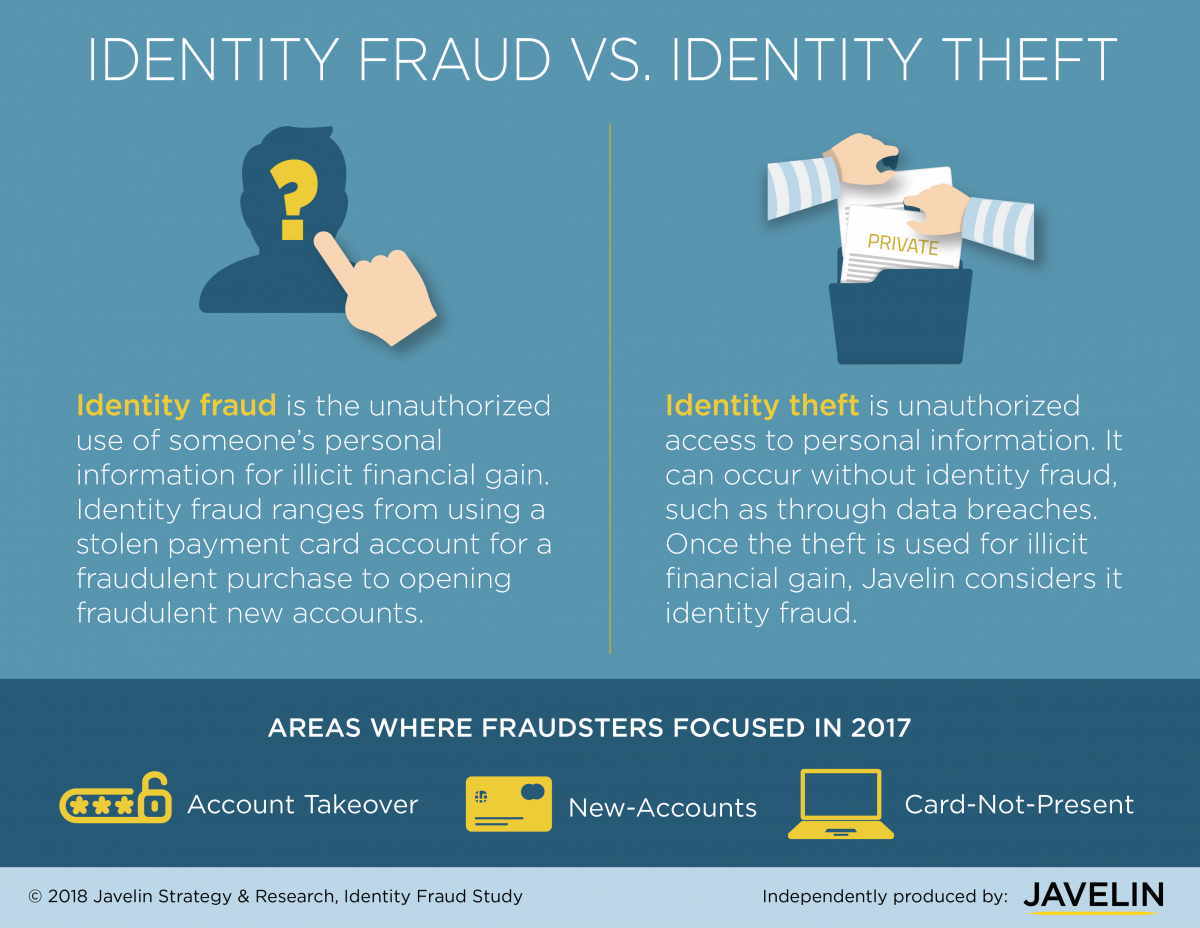

With all of the data and tools at their disposal and unprecedented levels of sophistication, criminals are engaging in complex identity fraud schemes that are leaving record numbers of victims in their wake. This degree of complexity, which can target a single victim but span multiple organizations, means that an organization can no longer reasonably expect to protect its customers through its efforts alone. In 2017, there were 16.7 million victims of identity fraud, a record high that followed a previous record the year before. None of the factors that contributed to this record and the other records set the past two years have subsided. As the disease of identity fraud reaches the level of an epidemic, prevention will require a new level of cooperation to eliminate the places that fraud has found to hide, fester, and spread, while effective detection and resolution will become more important than ever before.

RECOMMENDATIONS

Consumers

Turn on two-factor authentication wherever possible. Enabling two-factor authentication on sites that have that capability, where a separate action must be taken beyond providing a username and password to access an account, can make it significantly more difficult for fraudsters to take over your accounts. For sites without two-factor authentication, use strong passwords or a password manager to secure accounts.

Secure your devices. With consumers increasingly relying on their digital devices to obtain goods and services, making purchases and sharing personal information, criminals have shifted their focus to these devices for the access they can provide to accounts and the information they store or transmit. Secure online and mobile devices by instituting a screen lock, encrypting data stored on the devices, avoiding public Wi-Fi and/or using a VPN, and installing anti-malware.

Place a security freeze. If you are not planning to open new accounts in the near future, a freeze on your credit report can prevent anyone else from opening one in your name. This is especially important if you have been a victim of a data breach that has exposed sensitive personally identifiable information. Credit freezes must be placed with all three credit bureaus and prevents everyone except existing creditors and certain government agencies from accessing your credit report. Although costs vary per state, typically each bureau charges less than $20. Should you need to open an account requiring a credit check, the freeze can be lifted through the credit bureaus.

Sign up for account alerts everywhere. A variety of financial service providers, including depository institutions, credit card issuers and brokerages, provide their customers with the option to receive notifications of suspicious activity — as do businesses in other industries, such as email and social media providers. These notifications can often be received through email or text message, making some notifications immediate, and some go so far as to allow their customers to specify the scenarios under which they want to be notified, so as to reduce false alarms.

Protect yourself from unauthorized online transactions. As EMV makes fraud at physical stores more challenging, fraudsters are now targeting online merchants. Some financial institutions offer alerts for online transactions, the ability to institute limits on online transactions, or even advanced controls through 3-D Secure (e.g., Verified by Visa, SecureCode from Mastercard, etc.). These can help quickly detect and even prevent online fraud.

KEY HIGHLIGHTS OF THE STUDY

Methodology

2018 Survey Data Collection

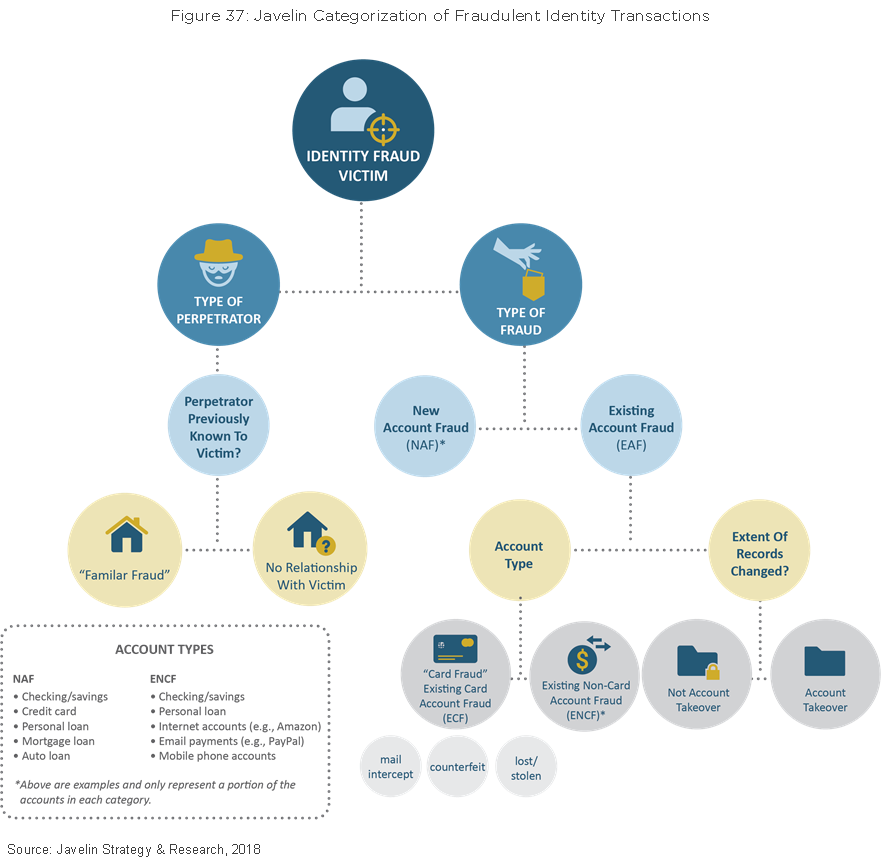

- Existing card accounts: This category includes both the account numbers and/or the actual cards for existing credit and card-linked debit accounts.

- Existing non-card accounts: This category includes existing checking and savings accounts, and existing loans and insurance, telephone, and utilities accounts.

- New accounts and other frauds: This category includes new accounts or loans for committing theft, fraud, or other crimes using the victim's personal information.

Deviation From FTC and 2003 Methodology and Reporting

Survey Questionnaire

Margin of Error

Contributing Organizations

Book a Meeting with the Author

Related content

Crypto Investment Scams: How Banks Can Disrupt These Criminal Operations

Cryptocurrency investment scams have evolved into organized, global operations that are stealing billions of dollars from consumers. Recent enforcement actions and platform disrupt...

Foolproof Payments: How AI is Revolutionizing Payment Fraud

Payment fraud is becoming harder to detect as transactions move faster and fraud tactics evolve. Fraud teams are being pushed to make quick decisions with limited context, leading ...

2025 Know Your Customer and Know Your Business Solution Scorecard

KYC and KYB tools play critical roles in preventing fraud and supporting compliance efforts. This report compares 17 leading KYC and KYB vendors in the U.S. market and examines how...

Make informed decisions in a digital financial world