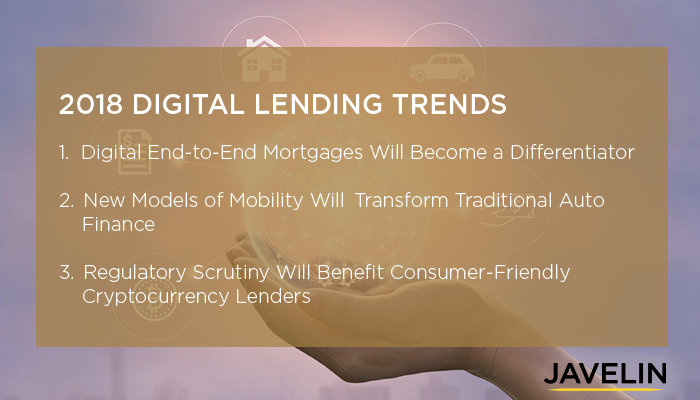

2018 Digital Lending Trends

- Date:March 01, 2018

- Author(s):

- Test

- James Wilson

- Report Details: 8 pages, 3 graphics

- PAID CONTENT

Overview

While most areas in retail banking have embraced the power of going digital, lending has been a clear laggard. It is only over the last few years that lending has truly embraced the digital revolution. Spurred by threats from alternative providers and the expectations of consumers whose experiences were shaped by digital interactions elsewhere, lenders are throwing off the shackles of analog processes. For prospective borrowers this means far less friction between the application and funding stages of a loan. And for lenders, the acquisition, loyalty, and cost benefits of transitioning to digital are finally being realized. In this year’s Digital Lending Trends report, Javelin explores three trends that illustrate just how much digital technology is changing the landscape for borrowers and lenders. Fortunately for all stakeholders, the digital revolution in lending is far from over and there are plenty of positive changes left to come.

Book a Meeting with the Author

Related content

January 26, 2026

The Key Step on the Bridge to Investing Maturity Path: Helping Customers Think Beyond Today

When it comes to cultivating the next generation of investors, most banks today land squarely in Stage 2 of Javelin Strategy & Research’s six-stage Bridge to Investing Maturity Pat...

December 03, 2025

How to Make Bank Websites a Better Place to Learn, Shop, and Buy

Javelin Strategy & Research’s analysis of online public websites for five leading FIs—Ally, Bank of America, Chase, Chime, and U.S. Bank—indicates that shopping for a financial pro...

November 18, 2025

The Bridge to Investing Maturity Path

Although banks and credit unions typically wait to target young investors until they amass enough wealth to serve profitably, advances in digital banking technology are changing th...

Make informed decisions in a digital financial world