2014 Mobile Banking Financial Institution Scorecard: Competition Heats Up As Mobile Offerings Mature

- Date:December 23, 2014

- Author(s):

- Mary Monahan

- Report Details: 51 pages, 45 graphics

- Research Topic(s):

- Mobile & Online Banking

- Digital Strategy & Experience

- Digital Banking

- PAID CONTENT

Overview

The 2014 Mobile Banking Financial Institution Scorecard is the definitive view of the top 30 mobile banking providers by deposit size as the customer sees them — with feature availability determined through public web research and conversations with customer service representatives. This objective approach is applied to an updated set of criteria, including the platforms and features that matter in 2014. This year, the scorecard displays top financial institutions’ performance in the key areas of accessibility, functionality, app user ratings, and alerts and notifications, with detailed charts of more than 55 data points for each FI for comparison. This report also features consumer data-driven trends designed to help identify key strengths and growth opportunities for mobile banking providers. Consumer data in this report includes mobile device ownership rates, mobile banking access methods, smartphone and tablet operating system market shares, financial behaviors, and mobile banking pain points. The survey- and mystery shopping-driven data are included alongside actionable recommendations to help FIs both acquire new mobile bankers and better serve the existing users. This seventh annual scorecard is the trusted source for ranking providers in digital banking’s fastest growing channel: mobile.

Primary Questions:

- What mobile banking products and services are banks offering, and how have they changed over the past year?

- Which banks provide the most complete mobile banking package?

- Who are the industry leaders in mobile banking?

- What do consumers want from mobile banking?

- How do mobile bankers differ from all other consumers?

- How are financial institutions’ mobile banking strategies changing over time and why?

- What should mobile banking look like in the future?

Companies Mentioned:

| Ally Bank | Citigroup | Huntington | TD Bank |

| Bank of America | Citizens Bank | KeyBank | Union Bank |

| Bank of the West | Comerica | M&T Bank | USAA |

| BB&T | Discover Financial | Navy Federal | Wells Fargo |

| BBVA Compass | Fifth Third | CUPNC | Zions Bank |

| BMO Harris | First Niagara | Regions | |

| Capital One | First Republic | Santander | |

| Chase | HSBC | SunTrust |

Methodology

The consumer data in this report was collected from a random-sample survey of 3,225 respondents conducted online from June to July 2014. Data was gathered and weighted to target respondents based on representative proportions of gender, age, income, and ethnicity compared with the overall U.S. adult population. The overall margin of sampling error is +1.73 percentage points at the 95% confidence level. The margin of error is larger for subsets.

The selection of FIs was made based on their deposits as of March 31, 2014. The reviewed FIs include only those engaged primarily in retail banking and excluded those focused on investment banking.

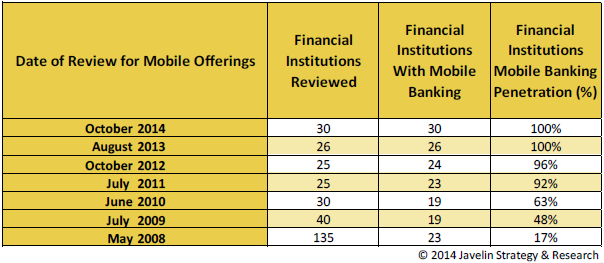

In 2009, Javelin reviewed 40 FIs and found 19 that offered mobile banking; in 2014, Javelin reviewed the top 30 FIs, all of which offer mobile banking. The following chart shows the progression of mobile banking scoring over time.

Mobile Banking Penetration Among Top FIs Is 100%

Three main criteria (mobile access, general features, and alerts and notifications) were evaluated in this survey. The overall determination of weighting and criteria was based on analyst opinion. Bank and credit union websites and interactions with customer service representatives (CSRs) were used to assess the mobile capabilities of each FI. Interactions with CSRs were in the form of mystery shopper techniques, which were used to mimic consumer communications. Whenever possible, CSRs for an online or mobile banking department were contacted. Accuracy of customer service responses was determined by a minimum of three calls to each FI’s CSRs. The average number of calls was 13. Collection of mobile banking data occurred September to November 2014.

Criteria and Weighting

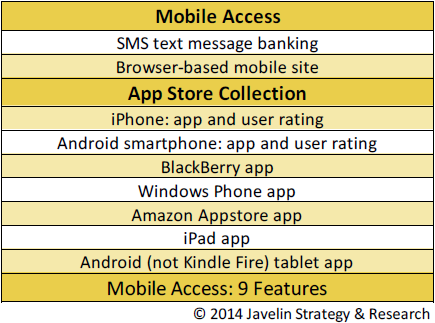

Alongside smartphones and feature phones, as defined by Javelin, mobile banking devices include the tablet. Nearly half (48%) of consumers own tablets in 2014, which indicates that tablet apps are essential mobile banking tools in an FI’s repertoire. The overall mobile access score was calculated by a combination of mobile access mode and type of mobile devices through which access was possible.

The mobile banking accessibility category included consumer ratings of mobile apps on Google Play and Apple App Store. User ratings were also assigned their own awards categories.

Mobile Banking Accessibility

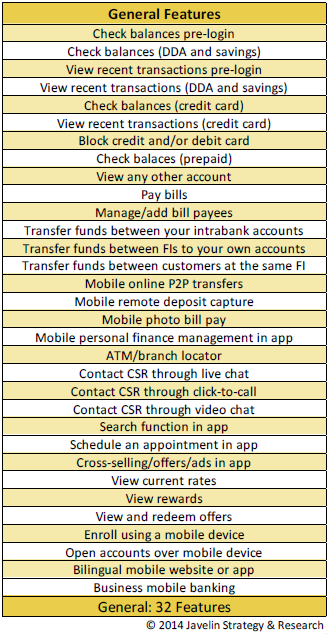

The criteria by which FIs’ mobile banking was judged were categorized as “mobile monitoring” (e.g., checking balances and viewing recent transactions), “money movement” (e.g., transferring funds, paying bills, and mobile person-to-person [P2P] transfers), and “advanced capabilities” (e.g., mobile remote deposits, viewing current rates, mobile photo bill pay, and enrolling through a mobile device). These three subdivisions accounted for a total of 32 general features of measurement in mobile banking functionality. Features that were in beta testing or not widely available did not receive points. Points were awarded if a downloadable app was available and not restricted to select users, such as business consumers or consumers in certain states.

The weighting of these mobile features ranged from 0.5 to 5 points, with most of the features being weighted 2 points. Overall, a total 70 points were possible in the general features section. The general features scored for each FI are shown in Figure 3.

Mobile Banking Functionality

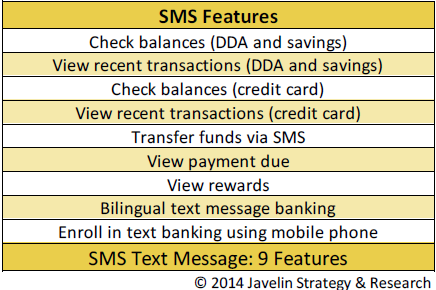

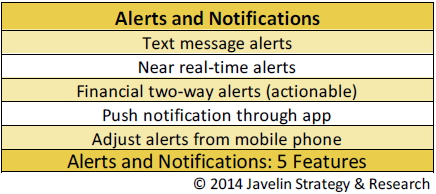

The SMS text message capabilities of each FI were scored separately. This category was divided into two sections: alerts and text message banking. A total of 14 features — 5 for alert items and 9 for text message banking items — were calculated. A total 18 points were possible in these two sections. It should be noted that not all FIs that provided text alerts also offered text message banking.

Alerts, Notifications, and SMS Text Message Banking

Book a Meeting with the Author

Related content

Growing Adoption, Low Satisfaction Raise Risks for Mobile Customer Service

Mobile banking has surged past online use, becoming the primary channel for everyday financial tasks. Yet as reliance grows, so do expectations for fast, intuitive support and mean...

Data Snapshot: Finances Are Shared, but Digital Banking Isn’t

Financial institutions, with digital banking experiences built largely for individuals, are missing the financial reality of most Americans. Consumers’ finances don’t exist in a va...

2026 Digital Banking Trends

This will be a year in which the industry’s attempts to add investing capabilities, boost digital sales, and simplify money movement will expose deep digital weaknesses and challen...

Make informed decisions in a digital financial world