Overview

In this research, 2014 ATM Market Benchmark Report, Mercator Advisory Group reviews how the ATM channel has become the foundation for an increasing number of interactions of banks and credit unions and other financial institutions with their customers and members.

“The migration of ATMs beyond simple cash-dispensing machines to become more interactive and full-featured self-service hubs continues unimpeded,” comments Ed O’Brien, director of Mercator Advisory Group’s Banking Channels Advisory Service and author of the report.

This report is 21 pages long and has 14 exhibits.

Organizations mentioned in this report include: Bank of America, Chase, Citi, Cardtronics, Co-Op Financial Services, Diebold, Elan MoneyPass, INETCO, NCR, Payments Alliance International, and Wincor Nixdorf.

Members of Mercator Advisory Group Banking Channels Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

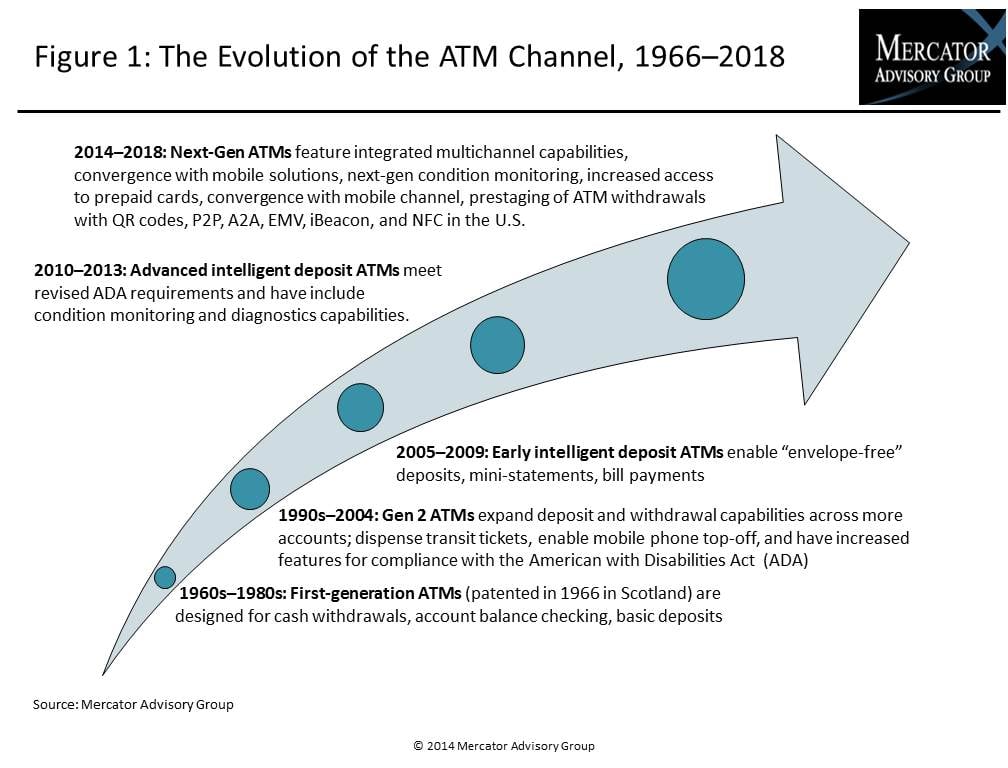

One of the exhibits included in this report:

Highlights of this report include:

- Examples of diverse expanded features in ATMs in use in many global markets that have made ATMs the hub of self- and assisted-service banking

- Evidence that the ever-evolving ATM channel has become a go-to channel for many banking customers, namely Mercator Advisory Group CustomerMonitor Survey results on trends in U.S. consumers’ ATM use, including use of their own banks’ ATMs versus other ATMs and other means of getting cash; frequency of ATM use; use of mobile deposit; willingness to pay for ATM convenience; willingness to try teller-assisted videoconferencing

- Market share of leading ATM deployers in the U.S. by type

- Examination of increased efficiencies and increased customer engagement and satisfaction

- Comparison of rates of ATM growth in various world regions

- Discussion of banks’ investments in ATMs as larger initiative of building out a customer-centric omnichannel banking environment

Book a Meeting with the Author

Make informed decisions in a digital financial world