2013 U.S. Commercial Card Market Update

- Date:April 17, 2013

- Author(s):

- Michael Misasi

- Research Topic(s):

- Commercial & Enterprise

- Credit

- PAID CONTENT

Overview

Commercial card spending has been growing at a rate in the high teens since 2009, and with global commercial expenditures estimated in the hundreds of trillions of dollars, there is still a long way to go before the market's potential is exhausted. The new research report 2013 U.S. Commercial Card Market Update updates projections and market sizing presented in a 2011 Mercator Advisory Group report on the market.

"The commercial card market has really evolved in the last couple of years," commented Michael Misasi, senior analyst at Mercator Advisory Group and author of the report. "Extremely flexible technology solutions are enabling middle-market issuers to expand the addressable market for commercial cards and compete with the global banks that once dominated the business."

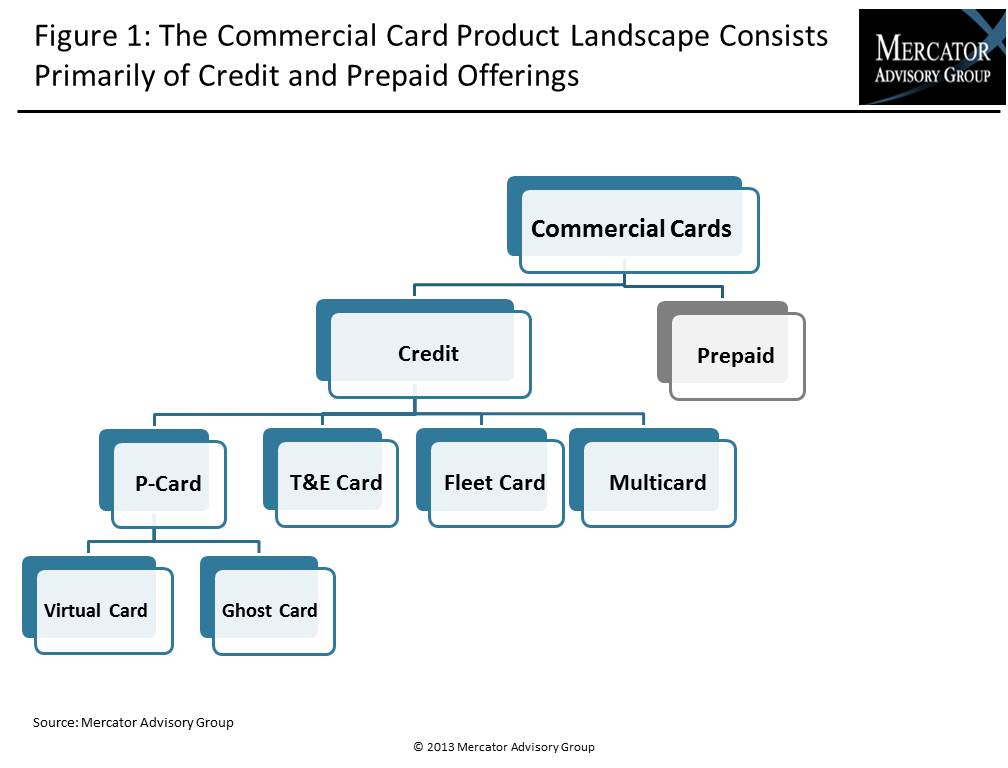

One of the exhibits included in this report:

Highlights of the report include:

- Commercial card purchase volume estimates for leading networks and issuers

- Volume growth projections for P-cards, T&E cards, and commercial prepaid cards

- Commercial card revenue estimates for several issuing banks

- An analysis of commercial card usage in the public sector

The report is 26 pages long and contains 16 exhibits.

Companies mentioned in this report include: American Express, Bank of America, Citibank, Commerce Bank, JPMorgan Chase, MasterCard, PNC, Regions Bank, SunTrust, U.S. Bank, Visa, Wells Fargo, and Wex.

Members of Mercator Advisory Group's Commercial and Enterprise Payments and Credit Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world