2009 - CPS - Issue #2 - Prepaid

- Date:September 09, 2009

- Author(s):

- Mercator Research

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Consumer Prepaid Cards:

Growing Beyond the Retail Core

Second of Four Consumer Reports from

Mercator Advisory Group's Primary Data Series

Boston, MA - September 10, 2009 -- The prepaid card industry continues to grow at a phenomenal rate. New card implementations are constantly being added by program sponsors and managers and strong distribution channels such as prepaid malls and online vendors are giving consumers more access to new and old prepaid products. However, consumer use of prepaid products is adding to both the complexity and strong growth of the product, with consumers finding new uses for prepaid cards such as household budgeting and as a checking account/debit replacement.

Based on primary consumer surveys the Consumer Prepaid Cards: Growing Beyond the Retail Core report illustrates how consumer behaviors and preferences are contributing to the growth and intricacy of prepaid, and why this trend is likely to continue. This is the second Primary Consumer Payments report being offered as part of Mercator Advisory Group's newly launched Primary Data Series (PDS). This new offering by Mercator Advisory Group provides access to a library of valuable resources that combine both relevant payments and banking data with experiential analysis focused on today's most critical and strategic issues.

"The consumer viewpoints documented in this survey confirm the reality that for cardholders as well as issuers, prepaid means many things to many people." Ken Paterson, VP for Research Operations at Mercator Advisory Group and the primary author of the report comments. "Some may be firmly entrenched in using a single familiar category like closed loop prepaid cards purchased in-store. Others may have discovered prepaid as a DDA/debit alternative or a payment alternative for online purchases. And others with no experience may yet discover the category as a merchant issues a rebate or credit via a prepaid card. The consumer prepaid marketplace has different meanings for all, and therefore no shortage of growth opportunities."

Highlighting consumers' evolving use of gift/prepaid cards, this report is based on a national sample of 1,012 online consumer survey panel survey responses completed between May 28 and June 4, 2009. The report outlines consumer patterns of card usage and purchase patterns critical for issuers, program managers, and program sponsors in this dynamic payment segment.

Highlights of the report include the following:

-

As a broad category, private label retail cards (closed loop) are the most commonly and frequently used prepaid cards among the 45% of consumers making prepaid card purchases in the last year.

-

While consumers most often say they buy a specific retailer's gift card in that retailer's store, distribution through other retailer locations in "prepaid malls" and online are critical sales channels. Consumers often have a specific card and purchase location in mind, while at other times may be more prone to browse.

-

In spite of last year's concern about retailer bankruptcies and how they might affect prepaid card sales, consumers indicate they have become more selective of the retailers they choose rather than broadly avoiding these cards. However, general purpose network-branded cards did reap some benefits.

-

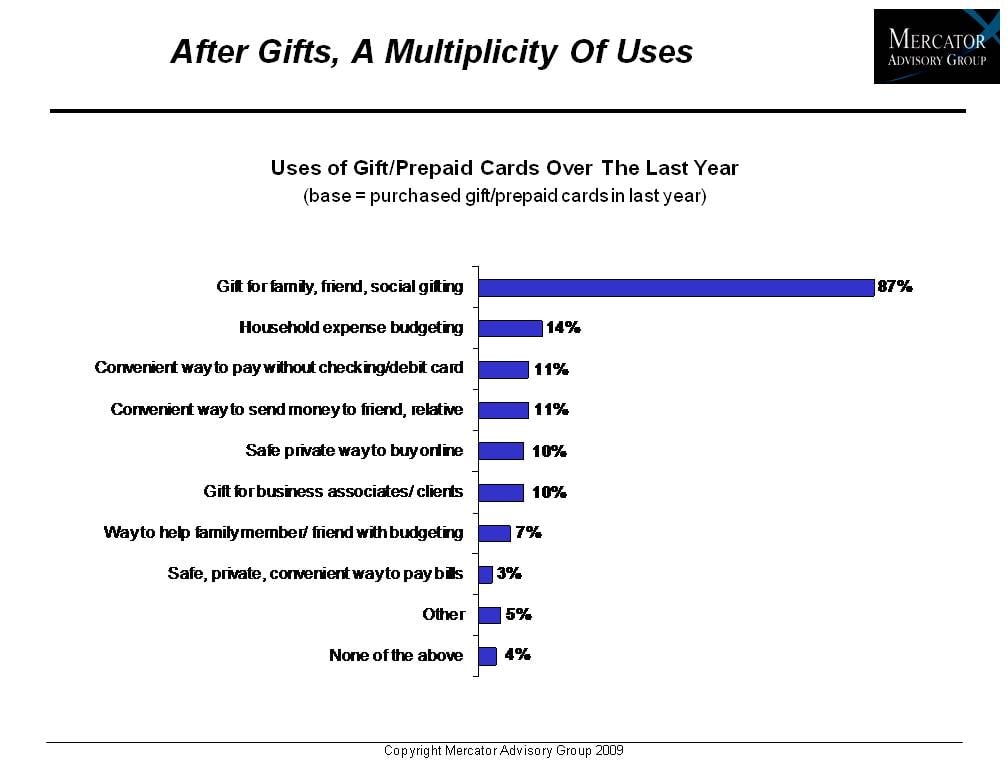

While gift-giving motivates most purchases, consumers have many purchase motivations. In particular, nearly one in five card purchasers use cards to help them manage the household budget, or the budget of a friend/family member outside the household.

-

Consumer experience with reload capabilities of general purpose cards is relatively low, but closed loop reload experience, such as at coffee vendors, is more widespread.

One of the 17 Exhibits included in this report

This report is 38 pages long and contains 17 exhibits

Access to the PDS library is offered as a subscription-based membership, separate of Mercator's Advisory Services (Debit, Credit, Prepaid, International, Banking, Emerging Tech.) because it is composed of large national sample surveys, a compilation of primary data (Cross Tabs), analysis (summaries of the data set) and companion power points. This collection of cost-effective primary data and analysis can be leveraged to validate research initiatives and business strategies, refine operations and fulfill objectives.

For more information about this report and Mercator's Primary Data Series, call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Mercator Advisory Group is the leading independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world