Overview

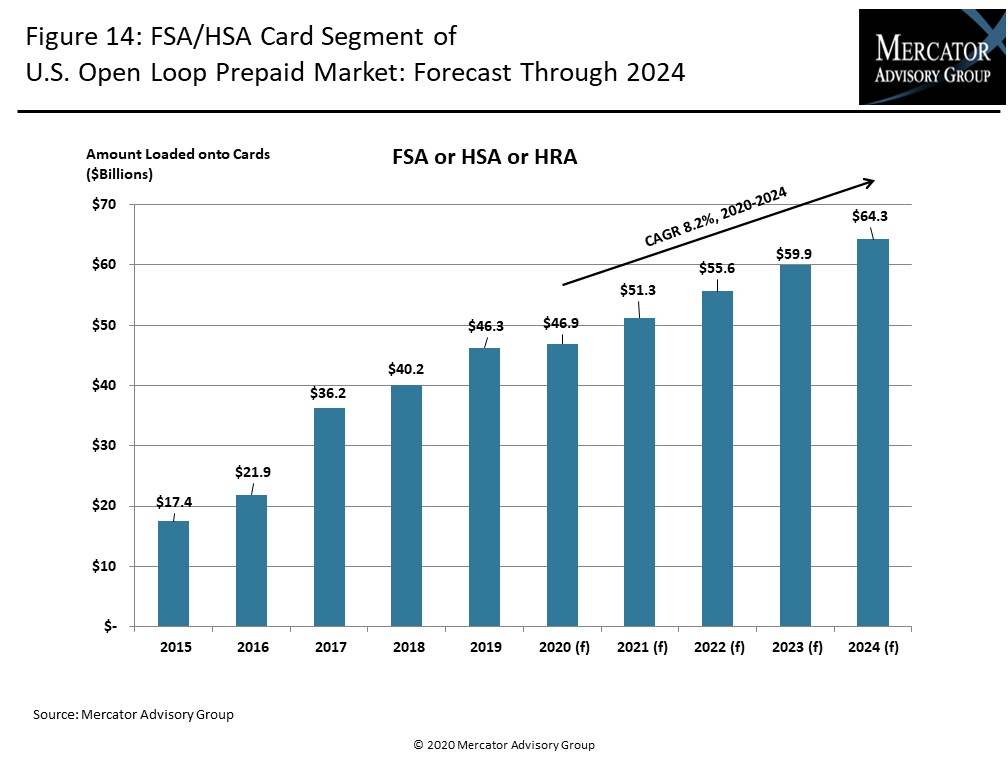

Mercator Advisory Group’s most recent report, 17th Annual U.S. Open-Loop Prepaid Cards Market Forecast 2020-2024, Part II, reveals that some verticals in open-loop prepaid show the capacity for growth, while others, including Campus, show drastic, and likely secular decline.

The Mercator Advisory Group forecast is derived from market knowledge gained through research done by Mercator since 2004.

However, even this archive of more than a decade of historical data provides little guidance on the future of markets that are growing rapidly and facing disruptive technology and services as well as historic new regulatory constraints. These factors, combined with dependence on funding sources tightly coupled to the economy and consumer sentiment, mean that the prepaid market is volatile and variable from one segment to another.

Considering the robust 2019 economy and new regulations that started April 1, 2019, followed by the social and economic disruption of 2020’s COVID-19 pandemic, the potential for dramatic shifts among prepaid card segments is readily apparent. Our findings for 2019, and our forecast for the future predict just this kind of volatility for some segments.

“Government funding is not necessary to the health of any given open-loop prepaid vertical, even if it doesn’t hurt,” said Theodore Iacobuzio, vice president and managing director Mercator’s research division. “For example, Open-Loop Restricted Access Network loads show secular growth into the new decade’s middle years.”

This report is 25 pages long and contains 16 exhibits.

Companies mentioned in the survey results shown include: Green Dot, Netspend, Monzo, Chime, Visa, Mastercard, Discover and American Express.

One of the exhibits included in this report:

Highlights of this report include:

- This is the second part of Mercator’s annual Prepaid Open-Loop Market Forecast, and covers all kinds of open loop cards except those in the Cash Access category, that were covered in part one.

- The open-loop prepaid market is highly segmented, as the industry develops different types of cards for different use cases, ranging from campus cards to in-store Restricted Access Network cards.

- Most of these segments showed some growth during 2019, owing to the strong economy in that year, though some segments were showing weakness that would be exacerbated by the arrival of the COVID-19 virus toward the end of the first quarter of 2020.

- While Mercator Advisory Group forecasts that growth in overall open loop prepaid loads in the United States at 4.1% through 2024, reaching a total of $466.2 billion, some segments, especially outside the Cash Access category, have suffered seriously under the impact of the virus and will take years to recover, if they recover at all.

- Government attitudes regarding prepaid cards as disbursal mechanisms for state funding vary, and in themselves represent exogenous events as serious as COVID-19 itself for the state of the business.

- It is safe to say that some categories of open loop prepaid cards will change in much the same way that the overall economy is going to change, and is currently changing, under the impact of the virus.

Book a Meeting with the Author

Related content

2026 Prepaid Payments Data Book

The Prepaid Card Data Book creates a baseline to highlight key metrics for the prepaid industry in brief, consolidated updates. This evaluation of the prepaid and stored-value mark...

22nd Annual U.S. Open-Loop Prepaid Card Market Forecast, 2025-2029

Open-loop prepaid programs show resilience and positive growth opportunities across nearly all market verticals. Javelin Strategy & Research continues its annual assessment of open...

2026 Prepaid Payments Trends

Prepaid card programs motor along while innovation bubbles beneath the service. In the coming year and beyond, Javelin sees three major themes playing out in the space. First, the ...

Make informed decisions in a digital financial world