Overview

Mercator Advisory Group’s most recent report, 17th Annual U.S. Open-Loop Prepaid Cards Market Forecast 2020-2024, Part One reveals some categories will grow under the pressure of COVID-19, while others are under assault.

Predicting the future is always a challenge, and the COVID-19 storm clouds from 2020 onward make the task even more of a crystal-ball exercise.

Nonetheless, for the 17th year, Mercator Advisory Group has attempted to balance all the forces affecting the prepaid market to produce a picture of the prepaid industry’s future.

This report provides a five-year forecast (to 2024) as well as Mercator’s market estimate of the dollars loaded on open loop prepaid debit card programs in the U.S. market in 2019.

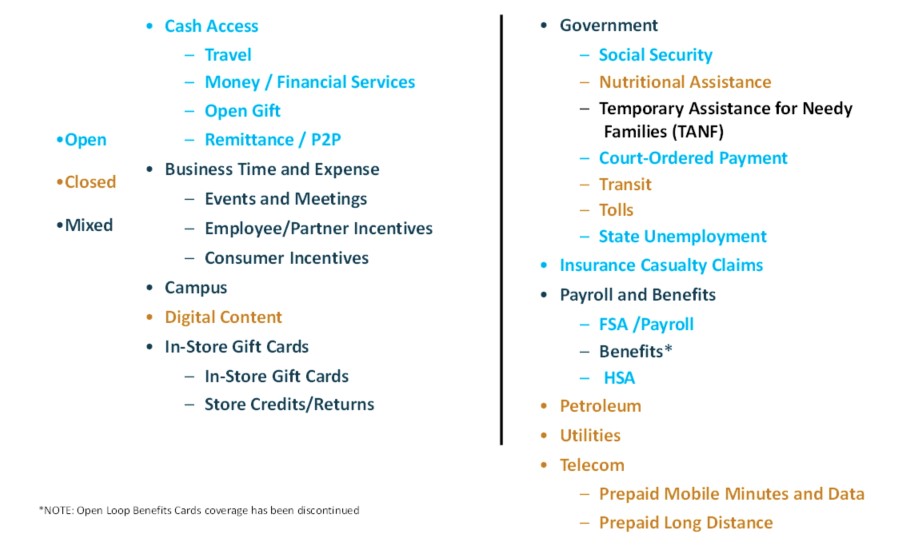

“The Cash Access category covered in this Report includes not only Open-Loop Gift, which will experience growth under the pressure of the virus, but travel, which has nearly imploded,” said Theodore Iacobuzio, VP and General Manager of Research at Mercator Advisory Group and the author of the report.

The second part of this report deals with the other categories of open-loop cards as delineated in the taxonomy.

This report is 16 pages long and contains 21 exhibits.

Companies mentioned in the survey results shown include: American Express, Blackhawk, Fiserv, FIS, Global Payments, Green Dot, InComm, Mastercard, Netspend, Visa

One of the exhibits included in this report:

Highlights of this report include:

- Growth in the open loop prepaid card category as a whole was positive in 2019, reaching a very healthy 13.6% year-over-year (YOY).

- While the strong economy of 2019 propelled continued growth in many segments, the effects of the COVID-19 pandemic on consumer and business spending are expected to be significant beginning with 2020.

- Mercator Advisory Group forecasts that growth in the open loop prepaid loads in the United States will be 4.1% through 2024, reaching a total of $466.2 billion.

- Money and Financial Services are a bright spot in the Cash Access core open loop category. This sector is expected to continue on its growth trajectory, in spite of the challenging market environment, thanks to its use in certain consumer groups and applications.

Book a Meeting with the Author

Related content

2026 Prepaid Payments Data Book

The Prepaid Card Data Book creates a baseline to highlight key metrics for the prepaid industry in brief, consolidated updates. This evaluation of the prepaid and stored-value mark...

22nd Annual U.S. Open-Loop Prepaid Card Market Forecast, 2025-2029

Open-loop prepaid programs show resilience and positive growth opportunities across nearly all market verticals. Javelin Strategy & Research continues its annual assessment of open...

2026 Prepaid Payments Trends

Prepaid card programs motor along while innovation bubbles beneath the service. In the coming year and beyond, Javelin sees three major themes playing out in the space. First, the ...

Make informed decisions in a digital financial world