Overview

The report titled 16th Annual U.S. Closed-Loop Prepaid Cards Market Forecasts, 2018–2022 provides an analysis of the growth and development of the prepaid cards industry through 2022. The report examines loads, growth potential, and market dynamics in the United States across all closed-loop prepaid card segments.

Mercator Advisory Group’s forecast report identifies key segments that will continue to decline over the next few years as well as those that should see growth. However, the economy, politics, and consumer behavior will all influence which segments grow and which decline.

This report reviews and forecasts load dollar volume for closed-loop segments. This forecast highlights the segments approaching market saturation as well as those that will continue to experience annual growth.

"Prepaid providers should be evaluating their businesses and looking for ways to diversify," commented C. Sue Brown, Director of Mercator Advisory Group's Prepaid Advisory Service, the author of the report. “Opportunities in the prepaid market shift with economic, political, and regulatory changes. New technologies such as the internet of things, connected car, and use of prepaid for transit and tolls may provide growth markets in the years to come.”

This document contains 24 pages and 15 exhibits.

Companies and other organizations mentioned in this research report include:

Aetna, Amazon, Apple, EZ Pass, FasTrak, International Federation of the Phonographic, Medicaid, Medicare, Skype, Starbucks, United Health, Viber, Walmart, WhatsApp

One of the exhibits included in this report:

Highlights of the report include:

- Closed-loop prepaid cards are commonly known as gift cards — for gifting and/or self-use/budget control as well as for use as incentive, and rewards cards.

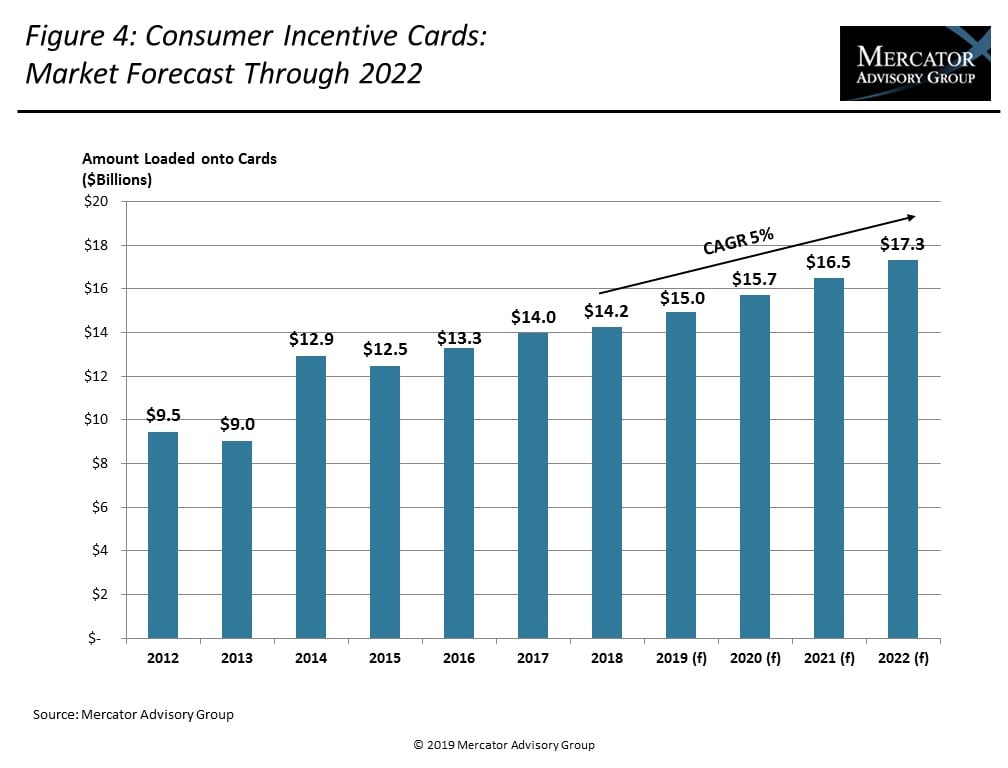

- The fastest-growing closed-loop prepaid card market segments in 2018 were Prepaid Mobile Minutes and Data, Tolls, and Consumer Incentives.

- Load amounts in the Tolls and Transit segment will be influenced by infrastructure spend as well as the cost of fuel (gas, diesel, natural gas).

Book a Meeting with the Author

Related content

2026 Prepaid Payments Data Book

The Prepaid Card Data Book creates a baseline to highlight key metrics for the prepaid industry in brief, consolidated updates. This evaluation of the prepaid and stored-value mark...

22nd Annual U.S. Open-Loop Prepaid Card Market Forecast, 2025-2029

Open-loop prepaid programs show resilience and positive growth opportunities across nearly all market verticals. Javelin Strategy & Research continues its annual assessment of open...

2026 Prepaid Payments Trends

Prepaid card programs motor along while innovation bubbles beneath the service. In the coming year and beyond, Javelin sees three major themes playing out in the space. First, the ...

Make informed decisions in a digital financial world