Overview

The report titled 13th Annual U.S. Prepaid Cards Market Forecasts, 2016–2019 provides an analysis of the growth and development of the prepaid cards industry through 2019. The report examines load, growth, and market dynamics in the United States across all prepaid segments.

Mercator Advisory Group’s forecast report identifies key segments that will continue to undergo declining loads over the next few years as well as those that should see growth. The economy, politics, and consumer behavior will all influence which segments grow and which decline.

"The fundamental business proposition of prepaid cards as a valuable payments tool continues to be strong. Nonetheless, prepaid providers should be evaluating their businesses and looking for ways to diversify," Ben Jackson, director of Mercator Advisory Group's Prepaid Advisory Service, and author of the report, comments.

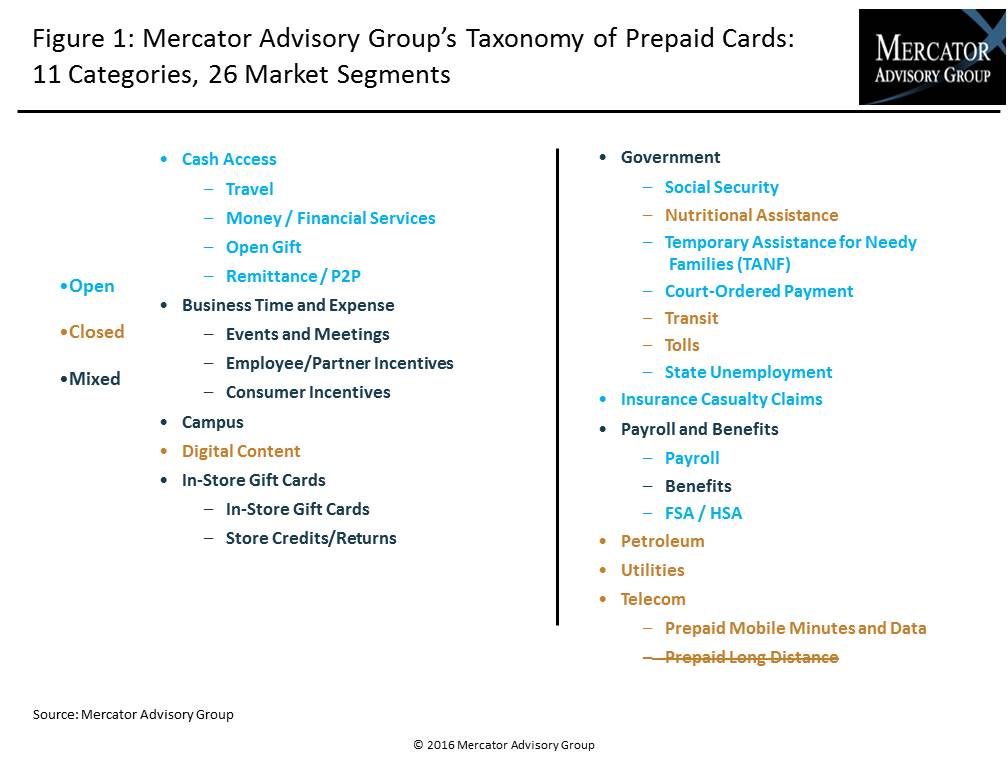

One of the exhibits included in this report:

Highlights of the report include:

- The results of the U.S. elections and the changes coming in the federal government could benefit some closed-loop prepaid segments and harm others, but a level of uncertainty remains for the industry.

- Mercator Advisory Group has decided to count the TANF category differently this year and has dropped prepaid long distance from its coverage. The reasons for these changes are explained in more detail in the sections covering those respective segments.

- Mercator Advisory Group forecasts that growth in the closed-loop prepaid loads in the United States will be 2% through 2018, reaching a total of $312 billion.

- The Store Credits (Returns) will decline through 2019 as consumer shopping and payments behavior changes the way returns are handled.

- Mercator Advisory Group forecasts slow growth across all segments, but several segments could see faster growth depending on macroeconomic factors.

- Energy prices will affect the Petroleum and Utilities segments and could drive loads in those segments up or down.

- Tolls and Transit loads will be influenced by infrastructure spend and gas prices as well.

- Nutritional Assistance, Incentives, Benefits, and Campus card loads will be affected by government policy, including tax law changes, funding for programs, and general regulatory requirements.

Book a Meeting with the Author

Related content

2026 Prepaid Payments Data Book

The Prepaid Card Data Book creates a baseline to highlight key metrics for the prepaid industry in brief, consolidated updates. This evaluation of the prepaid and stored-value mark...

22nd Annual U.S. Open-Loop Prepaid Card Market Forecast, 2025-2029

Open-loop prepaid programs show resilience and positive growth opportunities across nearly all market verticals. Javelin Strategy & Research continues its annual assessment of open...

2026 Prepaid Payments Trends

Prepaid card programs motor along while innovation bubbles beneath the service. In the coming year and beyond, Javelin sees three major themes playing out in the space. First, the ...

Make informed decisions in a digital financial world