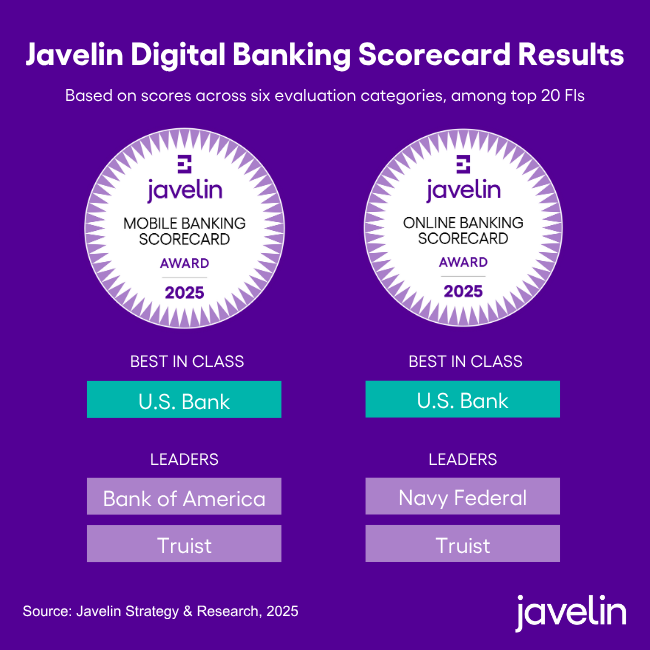

U.S. Bank Tops Javelin Strategy & Research’s 2025 Mobile and Online Banking Scorecards

Shortcomings Underscore Why Two-Thirds of Consumers Look Beyond Their Bank for Help with Their Finances(San Francisco, CA) Javelin Strategy & Research has released the 2025 editions of its annual Mobile Banking Scorecard and Online Banking Scorecard, with U.S. Bank again earning Best-in-Class honors in both channels as a result of investments in its virtual assistant, simplified transaction ledgers, aggregation-enhanced money movement and financial fitness, granular oversight of third-party data sharing, and an emerging personalized insights program.

Bank of America and Truist finished in second and third in mobile banking, while Navy Federal and Truist finished second and third in online banking.

The scorecards spotlight the widening advantage of big-budget banks, with leaders enjoying a hefty advantage even over rivals in the top-20. U.S. Bank, for example, scored 70% of the available points overall, well ahead of the 42% median score.

“Javelin’s scorecards help banks address one of the most frequent questions we hear—Where should we invest further in digital,” said Mark Schwanhausser, Director of Digital Banking. “No one wins in a feature war. No bank can do it all. A top priority for big banks today is generating additional customer engagement with existing functionality.”

Two-thirds of consumers have turned to a third-party financial app in the past year to help them move money, invest, and track or manage their personal finances. Often consumers look elsewhere because they aren’t aware their bank offers comparable features.

Key areas where Javelin saw enhancements aimed at ensuring customers understand the breadth of digital experiences available to them included:

- The role of chatbots is growing, but aspirations often outstrip current capabilities.

- Banks are centralizing security features and content to deputize customers in the fight against fraud.

- Banks are redesigning money movement menus—again—yet still fall short when it comes to helping customers understand the options.

- FIs are struggling to convert legacy DIY features and flows into more personalized help-me-do-it experiences.

Javelin’s scorecards provide the industry’s most detailed and strategic benchmark of retail banking digital experiences by evaluating more than 230 criteria in each channel at 20 of the largest retail financial institutions in the United States. They examine six categories of digital banking, including Ease of Use, Security Empowerment, Money Movement, Customer Service, Financial Fitness, and Relationship Deepening. Each category is weighted according to a survey of 10,641 consumers fielded in March and April 2025.