Preparing for Wearables in Financial Services Beyond Smartwatches and Google Glass

Javelin Strategy & Research Examines Current Wearables Market and How Financial Institutions are Making Strides

San Francisco, CA, July 31, 2014: Notable financial institutions (FI), technology vendors, and app developers such as Barclays, U.S. Bank, Wells Fargo, Fiserv, and PayPal are experimenting to demonstrate that wearables such as Google Glass and smartwatches can deliver financial alerts, pay for goods and services, and give consumers greater digital control over their finances. Today, Javelin Strategy & Research released Investing in Wearables for Financial Services – Why Now? report, which examines current wearable experiments such as Google Glass, smartwatches, and fitness bands and how FI investment in wearable technology is likely to evolve.

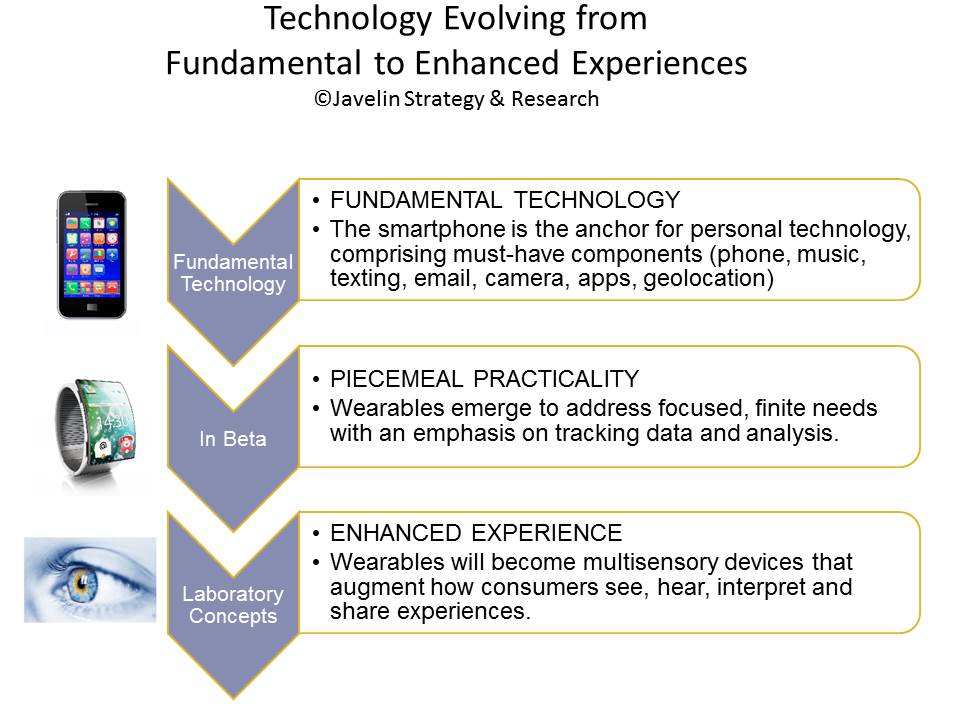

Wearables present an immediate opportunity for FIs that can embrace inevitable experimental setbacks and capitalize on breakthroughs. Javelin views smartwatches as the first wave of financial wearables that can leverage existing adoption. But the bigger, longer-term payoff will come when wearables incorporate advances in speech recognition and augmented reality. For example, 53% of consumers indicate a willingness to use voice banking, a key technology that can be incorporated in wearables that have yet to emerge.

Wearables present an immediate opportunity for FIs that can embrace inevitable experimental setbacks and capitalize on breakthroughs. Javelin views smartwatches as the first wave of financial wearables that can leverage existing adoption. But the bigger, longer-term payoff will come when wearables incorporate advances in speech recognition and augmented reality. For example, 53% of consumers indicate a willingness to use voice banking, a key technology that can be incorporated in wearables that have yet to emerge.

“Platforms succeed when they entice developers to create apps that keep consumers coming back for more. Some developers and financial institutions initially will be satisfied with the softer ROI that can come with being the first to market and establishing a foothold with targeted products and services,” said Mark Schwanhausser, Director, Omnichannel Financial Services at Javelin Strategy & Research. “For FIs, justifying investments for wearables is likely to start with bolstering a tech-savvy brand image that can attract customers. But larger, sustained investments will require evidence that wearables are pervasive enough to result in cost savings and revenue.”

Learn More: Investing in Wearables for Financial Services – Why Now?

The report examines current wearables experiments such as Google Glass, smartwatches, and fitness bands; how wearable technology is likely to evolve and why; and five conditions that must be true for wearables to become pervasive. In addition, the report outlines the short- and long-term return on investment (ROI) for wearable investments, and prescribes ways financial services innovators can invest now to lead the way.

Related Javelin Research

- Leveraging an Omnichannel Approach to Drive $1.5B in Mobile Banking Cost Savings

- Managing Money in the ‘Mobile‐First’ Era: A Blueprint for On‐the‐Go Personal Finance Management

- Biometrics in Banking and Payments: Versatile Voice Faces an Apple‐Led Fingerprint Revolution

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research