Nearly Half of U.S. Consumers Want to View All Financial Accounts in One Place

Mobile-On-the-Go Personal Finance Management (PFM) is Needed to Shop, Spend and Save, according to Third Party Bank

San Francisco, CA, February 28, 2013 – In the six years since Apple launched its first iPhone, smartphones have imbued consumers with always-on, always-with-me, real-time expectations. This creates an urgent need for the financial services industry to break free of 1980s thinking about personal finance management (PFM) and redefine it for the mobile mass market in the 21st century. Javelin Strategy & Research’s latest report 21st Century PFM for a Mass Audience: How to Build Everyday Online and Mobile PFM evaluates four tiers of 17 specific PFM features that underscore Americans’ strong desire for help as they shop, spend and save.

Javelin estimates only 21% of U.S. consumers -- or more than 49 million adults -- mix and match current PFM features from software like Quicken, online banking, and various websites. But PFM is primed to evolve from niche products for do-it-yourself budgeting and investing to virtually ubiquitous, specialized online and mobile tools that will help Americans make smarter everyday financial decisions on the go.

Javelin estimates only 21% of U.S. consumers -- or more than 49 million adults -- mix and match current PFM features from software like Quicken, online banking, and various websites. But PFM is primed to evolve from niche products for do-it-yourself budgeting and investing to virtually ubiquitous, specialized online and mobile tools that will help Americans make smarter everyday financial decisions on the go.

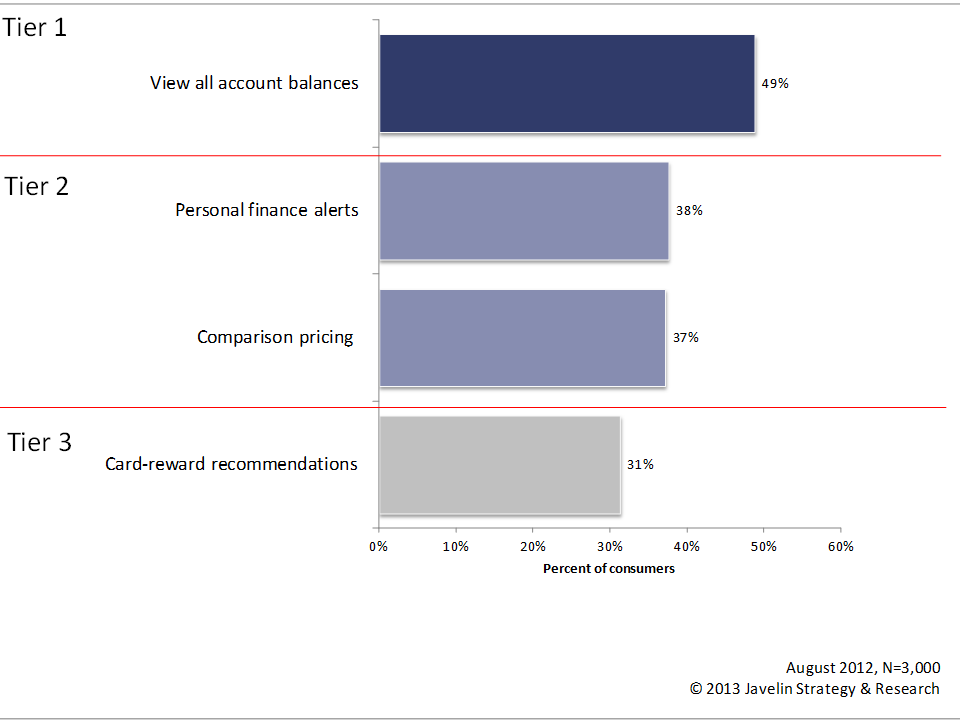

Once again, consumers reinforced that they crave a way to view all their account balances in one place, with nearly half of the U.S. consumers (49%) prioritizing this feature over all the other PFM services. This is a foundational PFM building block that not only can strongly influence where customers turn first to oversee their finances, but it also can give FIs and other PFM players an intimate portrait of their customers’ ability to buy, borrow, repay, save, and invest.

“The industry cannot capitalize on the power of personal finance management until it breaks free of 1980s thinking about who uses PFM and why,” said Mark Schwanhausser, Director of Multichannel Financial Services at Javelin Strategy & Research. “Americans of all varieties have a healthy appetite for PFM tools that will stretch their dollars further -- not just in banking but also when they are shopping and rely on mobile devices.”

For both privacy and security reasons, many consumers are apprehensive about adopting PFM services. FIs and PFM players must counter these legitimate concerns by acting like a fiduciary, providing valuable PFM services, building trust, and safeguarding personal information. PFM players can build trust by providing daily acts of helpfulness, by deepening engagement and proving reliability, and by demonstrating a commitment to transparency about how PFM data will be used to benefit the customer.

The report 21st Century PFM for a Mass Audience: How to Build Everyday Online and Mobile PFM evaluates consumers’ PFM service preferences and provides FIs with insight into how to effectively develop and execute PFM services that target different demographic groups and mobile-centric Moneyhawks™ segment. The report contains 41 pages and 19 graph

About Javelin Strategy & Research

Javelin Strategy & Research, a division of Greenwich Associates, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

(925) 219-0116

[email protected]

www.javelinstrategy.com/research