Mobile Payment Readers “The Square-Effect”— Drive Cash Down by 10%

Javelin Strategy & Research Finds Consumers are Abandoning Traditional Cash in Favor of Electronic Options

San Francisco, CA, May 21, 2014: The point of sale (POS) retail market is evolving like never before, as traditional paper-based payments (cash and check) have increasingly lost favor with consumers and merchants and are quickly being replaced by plastic cards and alternative payments. Today, Javelin Strategy & Research released 2014 Retail Point of Sale Payment Forecast: The Mobile Payment Square-Effect and Prepaid Card Popularity Drive Cash Down by 10% report which evaluates the forecast changes in the retail POS market, tracking payments mix data from 2012 through the forecast year of 2019.

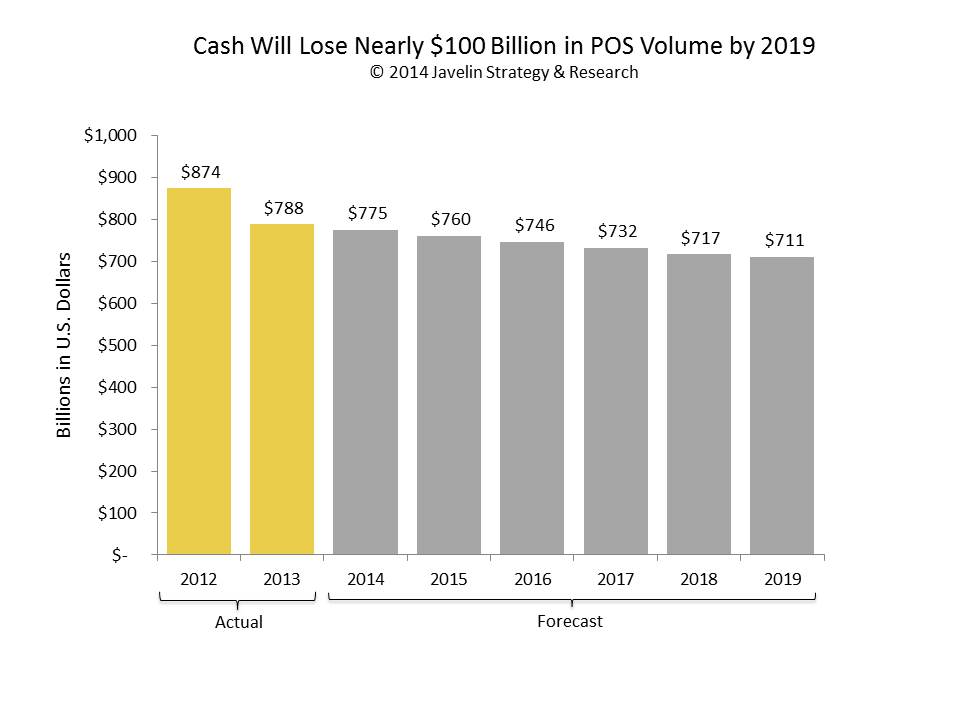

For many years, cash and paper checks dominated consumers' wallets, with consumers using cash for smaller dollar-value transactions and selecting checks for big-ticket items. This trend has taken a dramatic turn, as consumers increasingly abandoned their traditional paper-based payments for card payments. From 2012 to 2013, cash dropped by 10% of volume of transactions, a total of $86B and is forecasted to drop further over the next six years. Cash is still the most commonly used payment option for in-store purchases, with 65% of all consumers using cash to make a purchase in the past seven days. Despite the regular use of cash, debit and credit dominate total POS spending.

For many years, cash and paper checks dominated consumers' wallets, with consumers using cash for smaller dollar-value transactions and selecting checks for big-ticket items. This trend has taken a dramatic turn, as consumers increasingly abandoned their traditional paper-based payments for card payments. From 2012 to 2013, cash dropped by 10% of volume of transactions, a total of $86B and is forecasted to drop further over the next six years. Cash is still the most commonly used payment option for in-store purchases, with 65% of all consumers using cash to make a purchase in the past seven days. Despite the regular use of cash, debit and credit dominate total POS spending.

"For years, many small merchants have been unable to accept electronic payments due to high processing costs or an inability to support a traditional terminal (e.g., small vendors at farmers markets or mobile food trucks). But the necessity of cash and checks has been eroded by the popularity of mobile card readers — like those offered by Square, PayPal, and Intuit — which easily and inexpensively enable mobile devices to accept card payments," said Nick Holland, Senior Analyst, Payments for Javelin Strategy & Research.

Javelin Strategy & Research released 2014 Retail Point of Sale Payment Forecast: The Mobile Payment Square-Effect and Prepaid Card Popularity Drive Cash Down by 10% report which details Javelin's forecasts for total retail POS payments volume and analyzes share and transaction growth at the POS for credit cards, debit cards, cash, paper checks, prepaid cards, gift cards, and mobile proximity payments. It is based on a survey of over 10,000 consumers and a forecast model of payment transactions.

Related Javelin Research

- Mobile Payments Market: Tablet Shopping Surges as Mobile Retail Sales Top $60 Billion

- EMV in USA: Assessment of Merchant and Card Issuer Readiness

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin's independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research