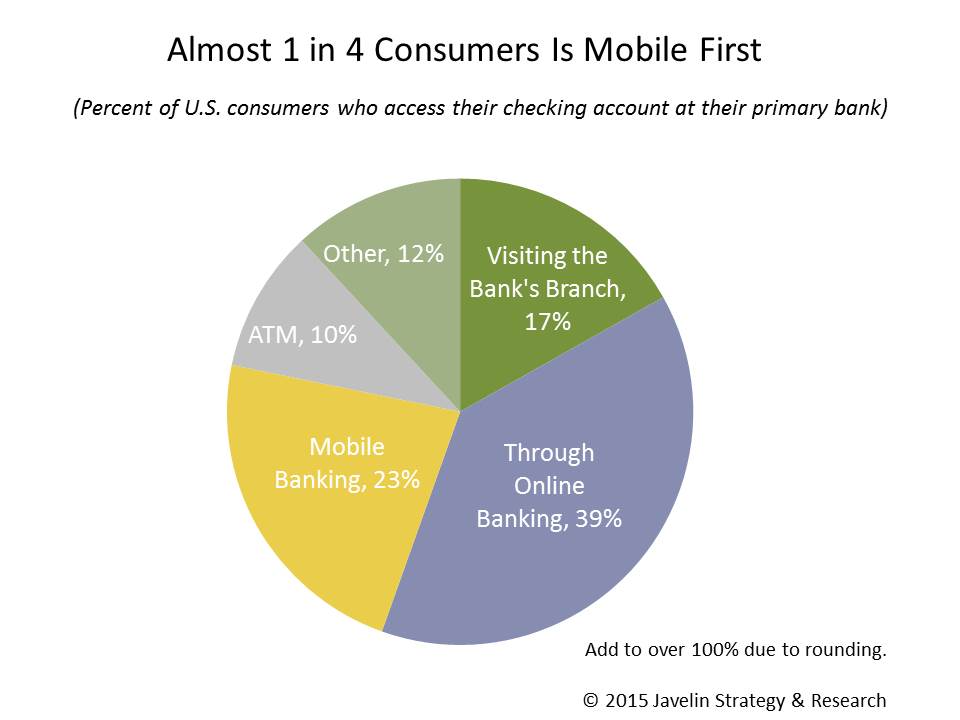

Mobile Leads as First Banking Screen of Choice for 1 in 4 U.S. Consumers

Javelin Strategy & Research Analyzes the Behaviors and Preferences of the 56 Million "Mobile First" Consumers

San Francisco, CA, May 28, 2015: Driven by the adoption of smartphones and tablets, the U.S. banking system has reached an important crossover point where the number of weekly mobile bankers now equals to number of weekly branch bankers. “Mobile first", consumers-- that is, those who primarily use a mobile device to access their checking account at their primary banks are almost 1 in 4 (23%). Today, Javelin Strategy & Research released The Rise of the Mobile First Consumer – and What that Means for Banking, which describes how to service mobile first bankers and includes deep insights into servicing branch first and online first customers.

The mobile first consumer uses multiple channels to access their banking, demonstrating high rates of online, mobile, ATM and average rates of branch use. They are more likely to be younger, female, and have children in the household than online-first or branch-first customers. They prefer to congregate at the giant banks, are fee-sensitive and are more likely to switch banks within the next 12 months. Capturing these consumers’ demands will involve rethinking customers’ mobile experiences from start to finish.

“Currently, mobile bankers are not able finish transactions on mobile devices and are purposefully shifted to online or branch channels for completion, causing frustration,” said Mary Monahan, Executive Vice President and Research Director at Javelin Strategy & Research. “Financial institutions should aim to create a unified view of the customer and offer a more seamless, easily navigated banking experience, to appeal to the broader user community.”

This report, The Rise of the Mobile First Consumer – and What that Means for Banking, is based on the primary research into the habits and preferences of the 56 million American adults that consider themselves to be mobile first. This report includes three online surveys of U.S. adult consumers to assess mobile behaviors and attitudes, as well as compares financial institutions of differing sizes from giant national, regional, and community banks, as well as credit unions.

Related Javelin Research

- Mobile Banking, Smartphone and Tablet Forecast 2013-2018: Smart Device Adoption Drives Mobile Banking Boom

- Reimagining the Banking Experience: GoBank, Moven, Serve and Simple

About Javelin Strategy & Research

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research