Mobile is Key to Boosting Adoption of Paying Bills at Bankers’ Websites

Javelin Strategy & Research Identifies 29 Million Consumers Banks Could Convert to Paying Bills at Their Websites

San Francisco, CA, September 12, 2013: Financial institutions must take action to alter the fate of flat online banking adoption through 2018. Javelin estimates banks can increase household adoption of online banking by 22% by targeting 29 million Americans who are just one step away from paying their bills at the bank. Today, Javelin Strategy & Research(@JavelinStrategy) released 2013 Online Banking and Bill-Payment Forecast: 29 Million Holdouts Primed for FI Bill Pay, a report that identifies a new segment of nearly 11 million consumers --Digital Drifters, who bank online and use mobile banking but do not pay bills at their bank. A majority of them pay bills online – they just do so at a biller’s websites. The report provides key recommendations to cater to these young, tech-savvy, mobile-minded consumers who crave control as they monitor and manage their growing finances.

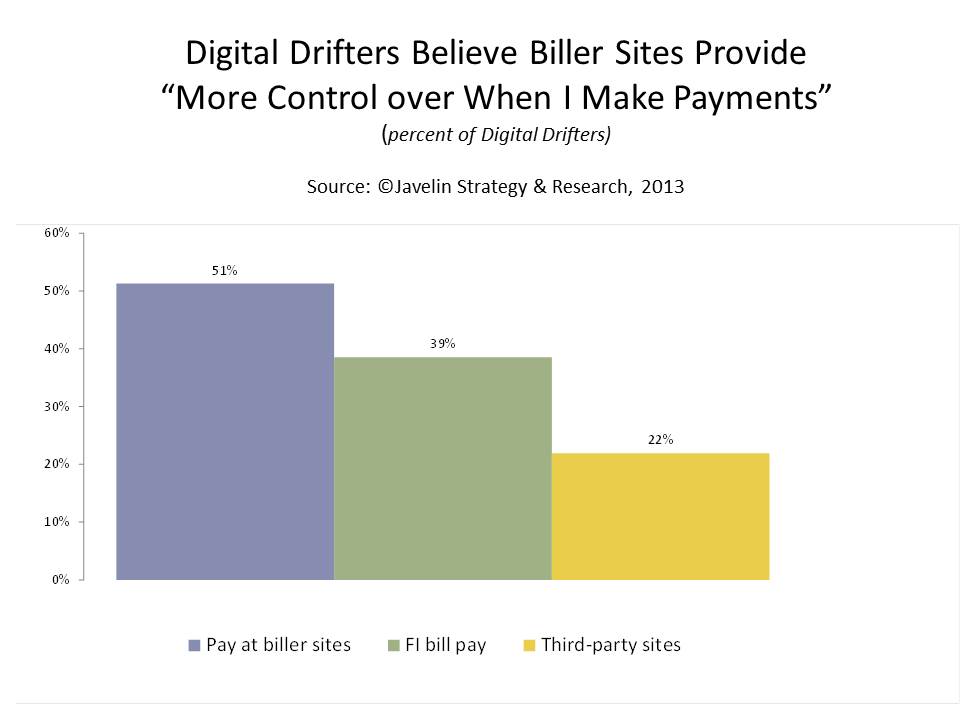

More than half of young, savvy Digital Drifters perceive paying bills at the biller site provides more control over their payments, vs. 39% who say this statement applies to bill payments at a bank. FIs and bill?pay innovators can reposition their services by emphasizing their legitimate strengths, which Digital Drifters’ currently downgrade in comparison with paying at biller websites.

“Mobility is rapidly rewiring the way consumers think. Mobile-toting Americans demand simplicity, any-time convenience, immediate answers, pre-emptive alerts, personally relevant information and advice, an attitude of transparency, and time-saving options– all done safely and securely. To win converts, bill paying services must satisfy those broad expectations and also offer specific bill-payment capabilities that clearly outperform the methods consumers use today,” said Mark Schwanhausser, Director of Omnichannel Financial Services at Javelin Strategy & Research.

Javelin Strategy & Research’s 2013 Online Banking and Bill-Payment Forecast: 29 Million Holdouts Primed for FI Bill Pay report analyzes the five-year outlook for online banking and paying bills at financial institutions and at biller websites. It also explores mobile expectations and mobile banking as keys to boosting adoption of bill pay at FIs. It is based on one online survey of more than 5,600 consumers.

Learn More: 2013 Online Banking and Bill-Payment Forecast: 29 Million Holdouts Primed for FI Bill Pay

Related Javelin Research

- How to Upgrade Online and Mobile Account Opening for an Omnichannel Era

- 21st Century PFM for A Mass Audience: How to Build Everyday Online and Mobile PFM

About Javelin Strategy & Research

Javelin Strategy & Research, a division of Greenwich Associates, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research