Mobile Imaging Moves Beyond Mobile RDC to Bridge the Transaction Gap

Javelin Strategy & Research Identifies the Present and Future of the Mobile Imaging

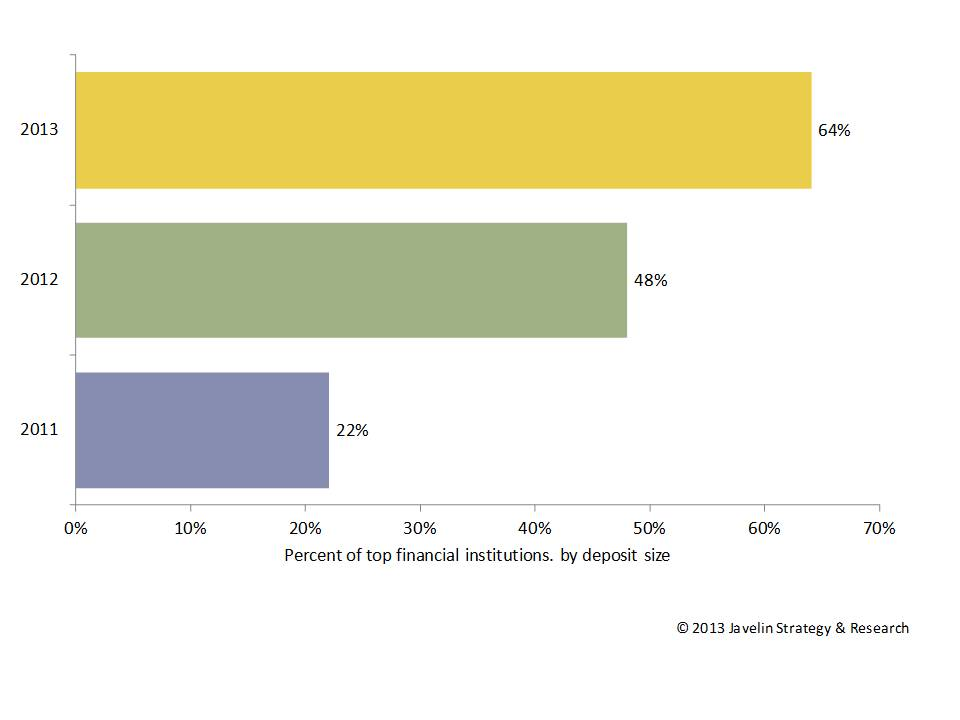

San Francisco, CA, February 21, 2012 – As the smartphone-toting population crosses the 50% barrier, there are new opportunities and challenges to rethink and re-engineer the consumer transaction experience using new imaging technologies. Javelin Strategy & Research’s latest report Mobile Imaging: Going beyond Mobile Remote Deposit Capture to Bridge the Consumer Transaction Gap provides key information from selecting which mobile imaging services FIs should offer, to successfully rolling-out and targeting the services to reach broad adoption, to vendor coverage. Currently, 64% of the top 25 retail banks by deposit offer mobile deposit, with many of the largest banks in the U.S. rolling out mobile remote deposit capture (RDC) services in the past year.

Two out of Three Top FIs offer Mobile RDC

As of 2012, the two largest smartphone operating systems were Android and iOS at 48% and 32% marketshare, respectively. With the influx of customers owning smartphones, the impetus for FIs to provide mobile RDC is growing, with a full 58% of iPhone users finding mobile deposit desirable, followed by Windows Phone and Android smartphone users.

“With consumer mobile ownership and adoption on the rise, FIs cannot wait to implement and offer key mobile services to their broad customer base,” said Mary Monahan, Executive Vice President and Research Director - Mobile at Javelin Strategy & Research. “We are finding mobile RDC’s usage growing with one in four smartphone or tablet owners using this service in the past 90 days, as well as other mobile imaging technologies. To maintain a solid relationship with their customers, FIs need to hurry before consumers come expect the service, rather than delight in its offering. ”

Mobile imaging solutions can help bridge the customer transaction gap: Typing in a credit card number in an online environment is merely cumbersome; but in a mobile environment, it becomes an impediment to a sales conversion. Institutions should consider prioritizing mobile apps to upgrade with mobile imaging technologies by looking at consumer device ownership and mobile imaging attractiveness by mobile device OS. With the Apple and Google as the smart device market leaders, this is where institutions should put their immediate focus.

Javelin Strategy & Research’s 2013 Mobile Imaging report evaluates consumers’ preferences and issues with mobile RDC, imaging for bill payment, adding an online bill payee, credit card rate comparisons, and balance transfers, and provides FIs with insight into how to effectively develop and implement mobile imaging services. It is based on the analysis of the top 25 financial institutions by deposit size and three online surveys of more than 11,000 consumers. The report contains 36 pages and 18 graphs.

Learn More: Mobile Imaging: Going beyond Mobile Remote Deposit Capture To Bridge the Consumer Transaction Gap

About Javelin Strategy & Research

Javelin Strategy & Research, a division of Greenwich Associates, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research