Meeting Mobile Expectations with a Customer Service Continuum

SAN FRANCISCO, October 9, 2019 - Nearly 140 million Americans are active mobile banking users. For many, mobile banking has become their primary account management tool. However, more than half (58%) do not believe they can resolve customer service issues through their bank’s mobile app. Most continue to turn to the call center or the branch for even simple requests.

The report, “Creating a Mobile Customer Service Continuum” released today by Javelin Strategy & Research, explores more than 30 competitive examples of how banks are addressing consumers’ expectations. The report discusses the fragmented mobile customer service experience, the risks that it poses to banks, and how leading institutions are integrating tools and content to help customers serve themselves effectively.

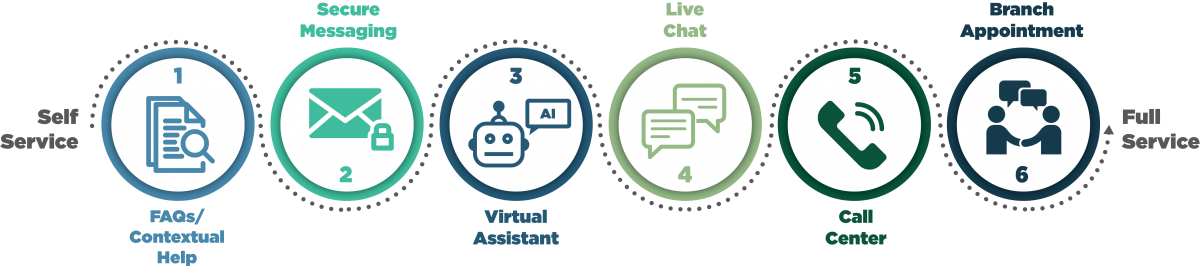

Banks Must Balance Self-Service and Speed of Response in Servicing Options

Source: Javelin Strategy & Research, 2019

Few banks have integrated effective servicing options that enable them to escalate customers’ requests in pursuit of a digital resolution. “Since the advent of mobile banking, the default servicing choice has been to send customer to the call center,” says Emmett Higdon, Director of Digital Banking at Javelin Strategy & Research. “We’ve trained customers to rely on that channel, so it’s little surprise that less than 10% of digital bankers turn to messaging or chat options offered by their primary bank.”

The report goes on to illustrate how even simple transactions can be derailed by inadequate support. A lack of clarity in simple things like transactional limits and timing erodes customer confidence in the interaction and, ultimately, in the channel. By providing a servicing continuum that extends from simple search and FAQs to AI-powered assistants to live chat and personal assistance through the branch and call center, banks can avoid disrupting transactions and applications, and lift consumer confidence in, and satisfaction with, mobile banking.

Related Reports

- 2019 Mobile Banking Scorecard: Choosing Between Transactions and Transformation, June 2019

- The ‘Big Bang’ of Mobile Banking Adoption Is Over: Digital Banking Forecast 2021, November 2018

- How Online Vs. Mobile Is Shifting To Browser Vs. App, December 2018

###