Javelin Strategy & Research’s new study shows US Consumer-based Cash Payments Reached $1.33 Trillion in 2019

SAN FRANCISCO, Calif., February 13, 2020 – The role of cash in today’s world continues to be hotly debated. New payment methods—or variations on existing methods—are proliferating, resulting in a continuous question of cash’s role in today’s increasingly digital world. Javelin published the 2020 Health of Cash Study, the fifth annual examination of US consumer payment habits sponsored by Cardtronics. The report provides a holistic view of cash usage in the United States.

“Cash often is treated as a holdover payment method from a pre-digital era that is used sparingly and under certain conditions. However, the study found that, in reality, cash continues to play a vital role for many consumers and remains a prominent fixture of most Americans’ spending arsenal,” said Krista Tedder, Head of Payments at Javelin Strategy & Research. “To engage all consumers in digital commerce cash must be part of the payment industry's narrative.”

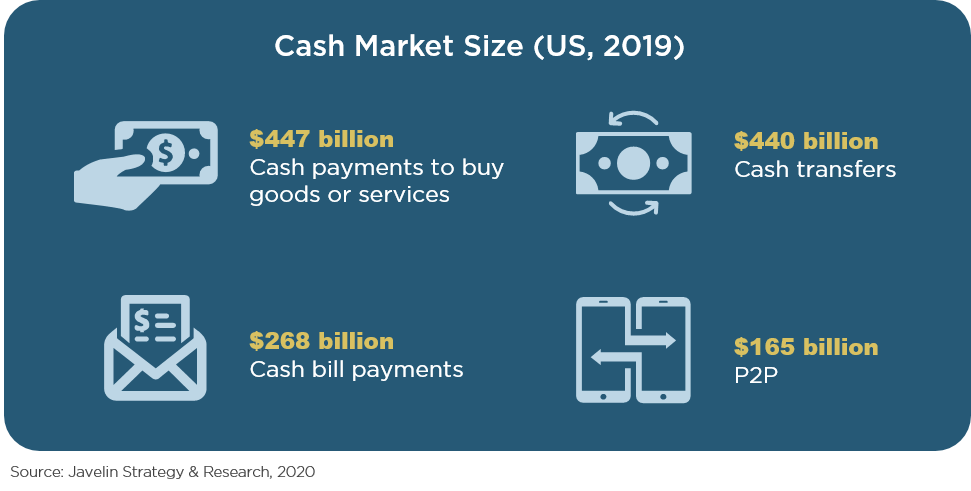

The 2019 market size for consumer-based cash payments reached $1.33 trillion, reinforcing its importance. Consisting of four main categories – cash payments to buy goods or services, cash transfers, cash bill payments, and cash person-to-person payments – cash continues to be used for a variety of reasons and by a variety of people.

Download the full report: 2020 Health of Cash Study to know more about the complexity of the US consumer and how cash fits into the daily lives of Americans. What is evident through the data is that consumer cash needs are not adequately managed through banks and credit unions, but through third party financial service providers and technology companies. Cash for retail sales and bill pay activity requires the payments industry to look at digital self-service differently, focusing innovation on receiving all forms of payments including cash. The cash transfer rates (money orders and domestic/international remittance) demonstrates that banks and credit unions are not providing necessary services. In general, the usage of cash is significant in the United States yet efforts to modernize the payment ecosystem continue to neglect the cash user population.

Download the full report: 2020 Health of Cash Study to know more about the complexity of the US consumer and how cash fits into the daily lives of Americans. What is evident through the data is that consumer cash needs are not adequately managed through banks and credit unions, but through third party financial service providers and technology companies. Cash for retail sales and bill pay activity requires the payments industry to look at digital self-service differently, focusing innovation on receiving all forms of payments including cash. The cash transfer rates (money orders and domestic/international remittance) demonstrates that banks and credit unions are not providing necessary services. In general, the usage of cash is significant in the United States yet efforts to modernize the payment ecosystem continue to neglect the cash user population.

- more -

About Javelin

Javelin Strategy & Research helps its clients make informed decisions in a digital financial world. It provides strategic insights for financial institutions, government, payments companies, merchants, fintechs and technology providers. Javelin’s independent insights result from a rigorous research process that assesses consumers, businesses, providers, and the transactions ecosystem. It conducts in-depth primary research studies to pinpoint dynamic risks and opportunities in digital banking, payments, fraud & security, and lending. Escalent acquired Javelin Strategy & Research in December 2019. For more information, visit https://www.javelinstrategy.com. Follow us on Twitter and LinkedIn.

About Escalent

Escalent is a top human behavior and analytics firm specializing in industries facing disruption and business transformation. Escalent acquired Javelin Strategy & Research in December 2019. As catalysts of progress for more than 40 years, Escalent tells stories that transform data and insight into a profound understanding of what drives human beings. And it helps businesses turn those drivers into actions that build brands, enhance customer experiences and inspire product innovation. Visit escalent.co to see how it is helping shape the brands that are reshaping the world.

###