Javelin Identifies $1.5 B in Mobile Banking Cost Savings by Leveraging Omnichannel Approach

Javelin Strategy & Research Identifies Mobile Deposit Changing the Role for Branch Interactions

San Francisco, CA, July 9, 2013: Mobile bankers are valuable bank customers; rich, young, and flush with profitable bank products and services. And the service is saving institutions money; as the number of mobile bankers has grown, branch visitation has decreased considerably. Today, Javelin Strategy & Research released Leveraging an Omnichannel Approach Financial Institutions Fight for $1.5 B in Mobile Banking Profits, which provides best practices and recommendations to encourage consumers to maximize the potential of their mobile devices – and save financial institutions money in the process.

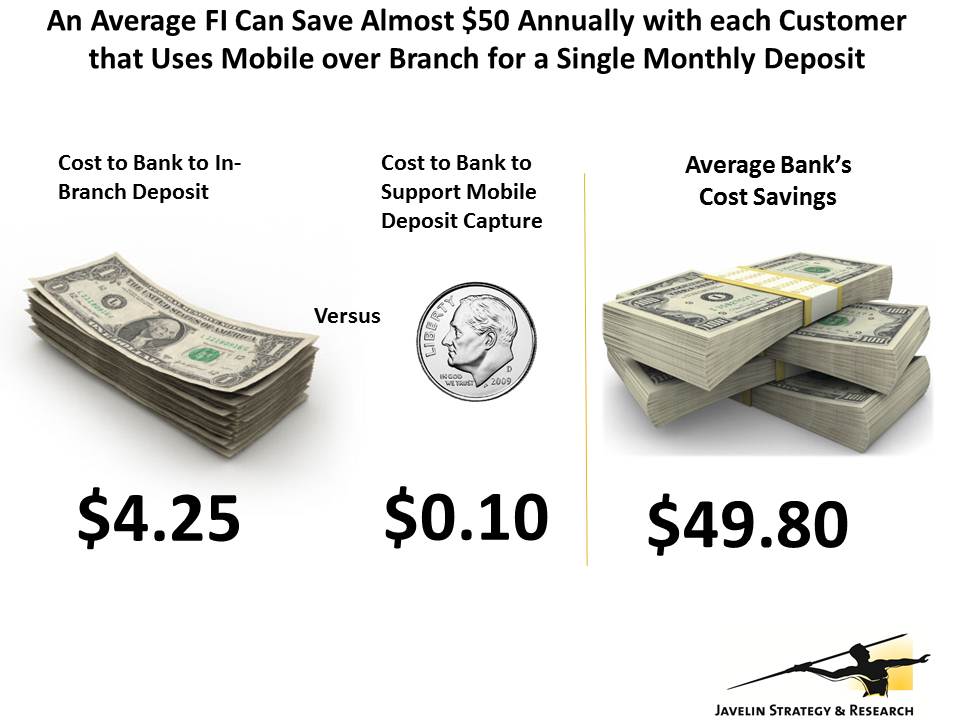

The evidence is growing that the rising consumer adoption of digital technologies alters the branch-based distribution model. Since 2010 branch visits have dropped dramatically by 10 percentage points, while mobile banking has risen by same amount. For the typical FI, an in-person transaction costs $4.25 while a mobile transaction costs about $0.10, so the move to mobile is key to a lower cost delivery strategy.

“Despite mobile bankers’ lower preference for in-person transacting; there are still specific financial behaviors where mobile transacting is overlooked in favor of less-efficient, more expensive channels. By switching just one mobile banker’s in-person deposit to mobile per month, the average institution saves almost $50 per annum per mobile banking customer, adding up to $1.5 billion in cost savings for the industry,” said Mary Monahan, EVP and Research Director – Mobile at Javelin Strategy & Research.

Javelin Strategy & Research’s Leveraging an Omnichannel Approach Financial Institutions Fight for $1.5 B in Mobile Banking Profits provides financial institutions with a clear path to making the most out of the mobile banking channel, as well as how to provide consumers with a cohesive omnichannel experience to maximize FI’s return on the digital investment. It is based on four online surveys of more than 18,000 consumers. The report contains 38 pages and 29 graphs.

Learn More: Leveraging an Omnichannel Approach Financial Institutions Fight for $1.5 B in Mobile Banking Profits

About Javelin Strategy & Research

Javelin Strategy & Research, a division of Greenwich Associates provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

(925) 219-0116

[email protected]

www.javelinstrategy.com/research