Community Banks and Credit Unions Positioned to Suffer as Consumers Switch Banks

JAVELIN Finds Consumers Prefer to Switch Among the Top 20 FIs

San Francisco, CA, November 19, 2015: Banks and credit unions typically aim to be the first place customers turn when they think about their money and buying financial products, but many financial institutions are the primary bank in name only. Although bankers typically think of bank switching to mean customers are leaving outright, a recent JAVELIN study underscores that customers more commonly switch their share of wallet rather than switch FIs. Community banks and credit unions are at greatest risk of having consumers turning to the Top 20 banks instead, according to JAVELIN’s report Bank Switching: Combating ‘Silent Churn’ to Maximize FI Primary Status.

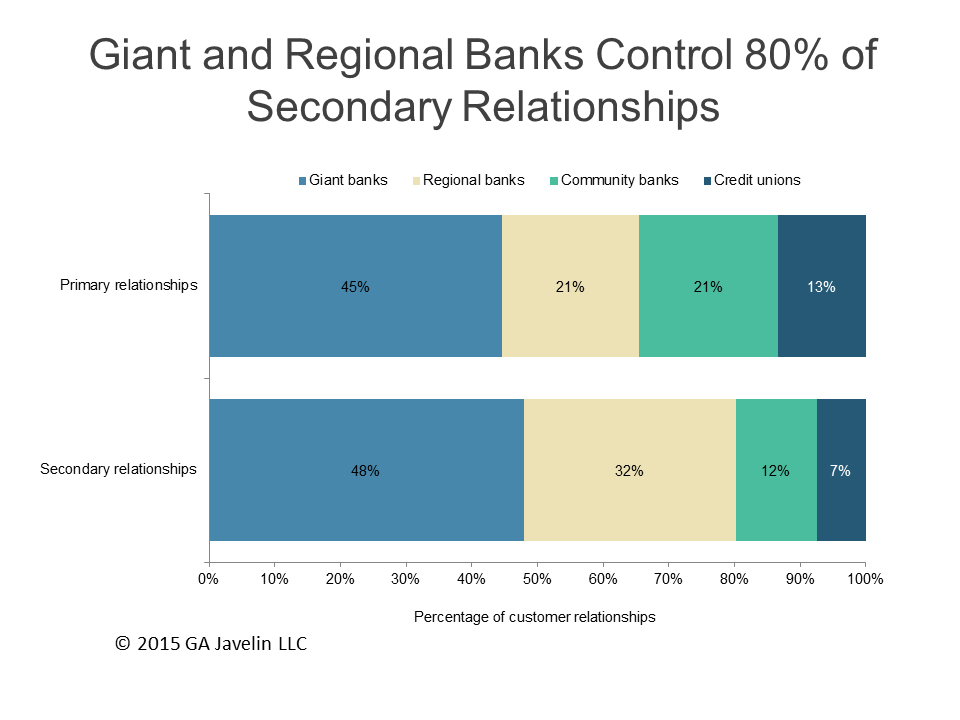

Although community banks and credit unions control 34% of the primary relationships, they control only 20% of secondary relationships. The implication is that many consumers identify a smaller bank or credit union as their primary FI, but they look to a larger bank when they shop for additional products. Smaller institutions face an existential threat from ‘silent churn.’

Although community banks and credit unions control 34% of the primary relationships, they control only 20% of secondary relationships. The implication is that many consumers identify a smaller bank or credit union as their primary FI, but they look to a larger bank when they shop for additional products. Smaller institutions face an existential threat from ‘silent churn.’

“Despite winning the checking account, financial institutions are losing profitable credit cards, loans and other services to secondary FIs, due to commoditization, said Ian Benton, Research Specialist at Javelin. “Consumers tend to shop for additional financial products based on fees and interest rates if they perceive that their primary bank’s online and mobile capabilities do not offer significant advantage to managing more of their finances.”

The report, Bank Switching: Combating ‘Silent Churn’ to Maximize FI Primary Status, includes survey of over 8,500 consumers.

Related JAVELIN Research

- Turning Digital Banking Into a Financial Journey Starts With the First Paycheck

- Strengthening Security Engagement With Gamification

- Push Notifications Change the Game for Financial Alerts

About JAVELIN

JAVELIN, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research

Twitter: @JavelinStrategy