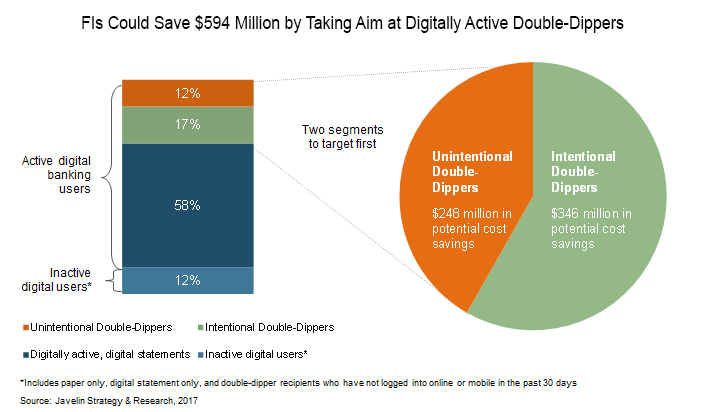

Banking Customers are ready for a Fresh Push to Go Paperless and FIs can save an estimated $594 million annually

Only 61% of checking account customers have committed to paperless statements.

San Francisco, CA, November 13, 2017: The time has come for financial institutions to require active digital banking users to ‘opt-in’ to paper statements. Javelin Strategy & Research’ s new report Marketing Paper Statement Turnoff: Why ‘Now’ is the Time for a Refreshed Push for Digital Statement, reviews the cost savings available to FIs and the compelling arguments they can use to convince their customers to give up paper statements.

A decade ago when digital banking was new, FIs played it safe by asking for volunteers to turn off paper, and they gave uncertain customers the choice of becoming a “double-dipper” by receiving both paper and digital statements. One unintended result is that today nearly one-third of active digital-banking customers continue to receive both paper and digital checking account statements – costing FIs an estimated $594 million annually.

“Consumers now reflexively reach for their smartphones in all aspects of their lives and banking is not an exception,” said Mark Schwanhausser, Director, Digital Banking at Javelin Strategy & Research. “The intent is not to take statements away from customers; it is to provide an alternative that convinces them that paper statements are as unnecessary and obsolete as a checkbook register.”

The report, Marketing Paper Statement Turnoff: Why ‘Now’ is the Time for a Refreshed Push for Digital Statement, outlines strategies for banks and credit unions to encourage their customers to willingly dump paper statements, identifies shortcomings at 28 of the nation’s biggest FIs, and recommends marketing themes that drive home why paper statements are obsolete for digitally active consumers.

Related Research by Javelin Strategy & Research

###

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, is a research-based advisory firm that helps its clients to make better-informed business decisions in a digital financial world. Our analysts offer unbiased, actionable insights and unearth opportunities that help financial institutions, government entities, payment companies, merchants, and other technology providers sustainably increase profits.

Joan Weber

203.625.4354

[email protected]

www.javelinstrategy.com

Twitter: @JavelinStrategy