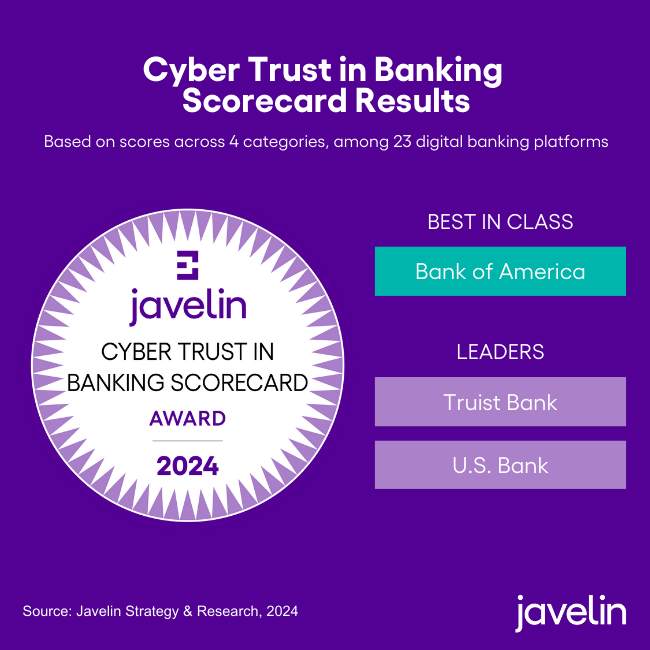

Bank of America Named Best in Class in Javelin’s 2024 Cyber Trust in Banking Scorecard

Truist Bank and U.S. Bank Recognized as Overall Leaders; Privacy Identified as the Key Driver of Consumer Trust(San Francisco, CA) – Javelin Strategy & Research released its 2024 Cyber Trust in Banking Scorecard today, revealing that privacy is the key driver of establishing and maintaining cyber trust. The scorecard evaluates and ranks 23 financial institutions (FIs) based on 121 relevant criteria across four categories: privacy, cybersecurity, education, and support.

Bank of America earned Best in Class for its outstanding performance in privacy controls, cybersecurity features, and education, a remarkable improvement from its 11th-place finish just two years ago. The bank stood out for offering options that are often limited among the evaluated financial institutions, including comprehensive opt-out choices for tracking, targeted advertising and marketing, an extensive array of educational resources, and the ability for users to revoke permissions for third-party applications.

Truist Bank ranked second overall, leading in the heavily weighted privacy category by offering significantly more data sharing opt-out options, including the unique feature of an “opt-out through a button on the webpage,” which reflects consumers' growing preference for convenience. U.S. Bank secured the third best overall ranking, excelling in both cybersecurity and education, due to enhanced visibility into third-party connections and extensive coverage of educational topics.

“The trust between a consumer and their financial institution is critical,” said Suzanne Sando, senior analyst at Javelin Strategy & Research. “Privacy has emerged as the key driver of cyber trust among, as it relates to how banks and credit unions collect and use consumers’ personal information tracking.”

Consumers are increasingly concerned about privacy protection with their primary FIs. Javelin's findings show that trust is directly impacted by the type of information FIs collect and track. From 2022 to 2024, consumer favorability towards data tracking by their primary FIs dropped significantly, with the belief that FIs only collect necessary personal and behavioral data falling from 86% to 56%. This reflects a notable decline in trust around FIs' data-tracking practices.

For Javelin, this is a cautionary signal for banks. “Though the importance of privacy is not new for consumers, it emerged as the leading predictor of a consumer’s trust in their financial institution in 2024. All FIs must reevaluate how transparent they are with customers and members about their data collection and disclosure practices,” Sando said. “Often overlooked steps in fostering cyber trust are promoting autonomy and giving consumers control over who can access their data and how that data can be used. FIs should prioritize investments in fraud and cybersecurity technologies, as well as payments innovations, that provide consumer transparency, autonomy, and the most robust security.”

About Javelin Strategy & Research

Javelin Strategy & Research, part of the Escalent Group, helps its clients make informed decisions in a digital financial world. It provides strategic insights to financial institutions including banks, credit unions, brokerages and insurers, as well as payments companies, technology providers, fintechs and government agencies. Javelin’s independent insights result from a rigorous research process that assesses consumers, businesses, providers, and the transactions ecosystem. It conducts in-depth primary research studies to pinpoint dynamic risks and opportunities in digital banking, payments, fraud & security, lending, and wealth management. Learn more at javelinstrategy.com.