Baby Boomers are an Overlooked Opportunity for Digital Banking

Javelin Unveils a Roadmap That Shows Financial Institutions How to Target and Better Serve Baby Boomers

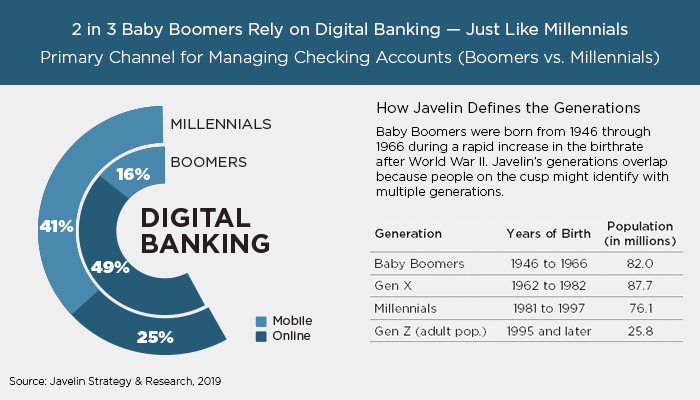

SAN FRANCISCO, March 14, 2019 - About 2 in 3 Boomers primarily manage their checking account in digital channels — just like Millennials. The obvious difference is that Boomers turn first to online banking, while Millennials prefer mobile banking. The How to Serve Baby Boomer’s Unmet Financial Needs report, released today by Javelin Strategy & Research, spotlights where and how digital banking falls short for Baby Boomers. The report identifies over eighty features that could provide relief for Boomers today and for younger generations for years to come.

The nation’s 82 million Baby Boomers face historically complex financial headaches. Like no generation before them, Boomers are racing to save for retirement, managing unprecedented debt loads, helping aging parents manage financial affairs from afar, seeking more effective ways to manage their financial chores, and grappling with 401(k) investments. FIs can deepen digital relationships and engagement by honing in on the features that will provide this generation a better way to bank.

“This isn’t about choosing to serve one generation over another,” said Mark Schwanhausser, Director of Digital Banking at Javelin Strategy & Research. “It’s about solving problems that will only intensify for later generations. If banks address these problems for Boomers today, younger customers will thank them for years to come.”

How to Serve Baby Boomer’s Unmet Financial Needs provides a road map that FIs can use to target and better serve five types of Boomers: catch-up savers racing the retirement clock, sandwich generation Boomers managing finances for students and aging parents, comfortably retired Boomers, debt-burdened Boomers, and Boomers grappling with 401(k)s and investing.

Related Reports

- The ‘Big Bang’ of Mobile Banking Adoption Is Over: Digital Banking Forecast 2021, November 2018

- 2018 Mobile Banking Scorecard: Tactical Tweaks Take Priority Over Strategic Enhancements, October 2018

- 2018 Online Banking Scorecard: Javelin Spotlights FIs That Do It Best, September 2018

###

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, is a research-based advisory firm that helps its clients to make better-informed business decisions in a digital financial world. Our analysts offer unbiased, actionable insights and unearth opportunities that help financial institutions, government entities, payment companies, merchants, and other technology providers. For more information, visit https://www.javelinstrategy.com. Follow us on Twitter and LinkedIn.

Media Contact