Attracting Women Customers for Digital Banking Engagement

Javelin Strategy & Research Explores if the color of Money is Green...or Pink or Blue?

San Francisco, CA, March 26, 2014: Bankers and the financial services industry have much to gain analyzing ways to make digital channels more compelling, more useful, and more satisfying to the nation's 126 million women. Today, Javelin Strategy & Research released Banking with Women Customers: Strategies to Increase Digital Banking Engagement, which explores how gender plays a role in financial decision-making, the financial products women buy, what influences them as they decide whether to swipe a debit or a credit card, habits for handling essential financial chores, desire for smartphone-powered control, and need for better online and mobile personal finance management.

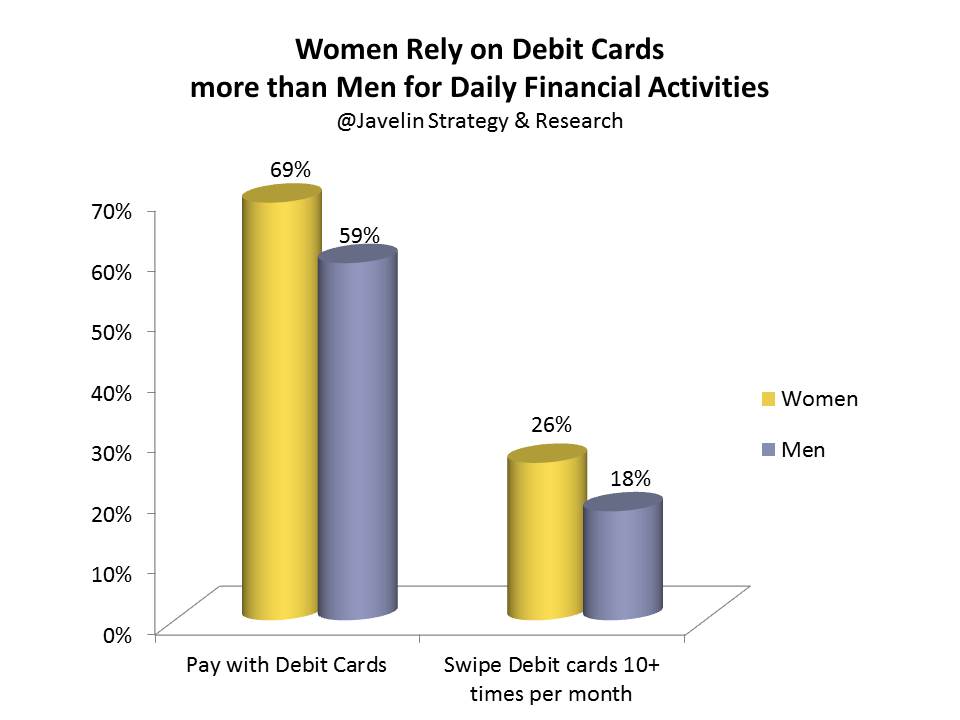

Women engage in more activities that point to day-to-day, on-the-go financial management, while men play a greater role in longer-term chores such as orchestrating more complex financial affairs and financial planning. As a result, women are significantly more likely than men to pay with debit cards than with credit cards. In a given week, women are more likely than men to swipe a debit card (69% vs. 59%).

Women engage in more activities that point to day-to-day, on-the-go financial management, while men play a greater role in longer-term chores such as orchestrating more complex financial affairs and financial planning. As a result, women are significantly more likely than men to pay with debit cards than with credit cards. In a given week, women are more likely than men to swipe a debit card (69% vs. 59%).

"Although women are not as likely as men to try new technology first, they hold the key to mass adoption," said Mark Schwanhausser, Director of Omnichannel Financial Services for Javelin Strategy & Research. "Banks need to incorporate online and mobile features that bolster women's desire for simplicity and to avoid slipping into debt. Smartphones, especially the camera feature, will attract women to banking services such as pay a bill from their checking account, depositing a check into their account, driver license to open a new account within minutes."

Javelin Strategy & Research released Banking with Women Customers: Strategies to Increase Digital Banking Engagement explores how gender plays a role in household financial decisions; women's use of financial products and services such as debit vs. credit cards, student loans, and investments; their mobile mindset and engagement in online and mobile banking; and their willingness to try new technology such as photo bill payments. The report is based on survey collected online from more than 6,000 consumers.

Learn More:Banking with Women Customers: Strategies to Increase Digital Banking Engagement

Related Javelin Research

- 21st-Century PFM for a Mass Audience: How to Build Everyday Online and Mobile PFM

- Financial Alerts Forecast 2013: Security + Personal Finance = ROI

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin's independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research