$2.1B in Cross-Border Revenue on the Table for Remittance Transfer Providers

Javelin Strategy & Research Finds That Remittance Customers Are High-Tech and Mobile-Savvy Consumers

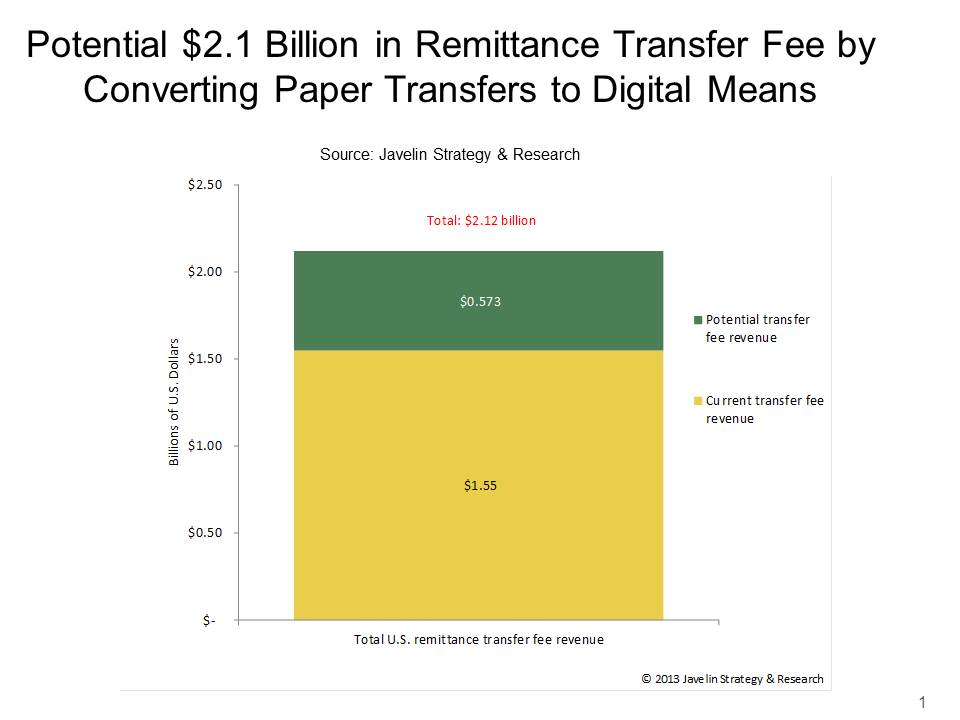

San Francisco, CA, September 12, 2013: Today, Javelin Strategy & Research (@JavelinStrategy) released International Remittance Transfers: How to Tap $2.1B in Cross-Border Revenue. The firm’s report provides revenue market sizing for remittance providers, an in-depth overview of the current users and recommendations for maximizing providers’ return on investment. Javelin estimates that remittance providers collected $1.55 billion from outbound U.S. remittance transfers in 2012. Yet, providers failed to collect over a half billion ($573 million) in revenue because consumers elected to send cash or checks through the mail, missing out on an opportunity to collect revenue on the transaction.

“Providers are leaving money on the table when consumers choose to use non-official means to send money internationally,” said Aleia Van Dyke, Analyst of Payments at Javelin Strategy & Research. “Maintaining competitive pricing and reinforcing the convenience of digital channels are just a couple ways remittance providers can coax cash-friendly consumers to send their money through electronic means.”

Surprisingly, Javelin data confirmed that remittance transfers are not reserved solely for underbanked consumers—those that do not have a checking account-- or immigrant workers. High?tech early adopters are more than twice as likely as all consumers to have made an international transfer., Mobile remittance transfers are quickly gaining popularity as well, especially with those consumers who already make mobile purchases. Over half of consumers who have made a mobile contactless purchase are likely to make a mobile remittance transfer.

Javelin Strategy & Research’s International Remittance Transfers: How to Tap $2.1B in Cross-Border Revenue report provides a market sizing, an overview of the current user base, an examination of new regulations changing the market, and analysis of the growth of online and mobile remittance transfers. The research is based on online surveys totaling more than 9,000 consumers and in-depth interviews with companies including MoneyGram, Visa, Wells Fargo, PayPal, and Earthport.

Learn More: International Remittance Transfers: How to Tap $2.1B in Cross-Border Revenue

Related Javelin Research

- Virtual Currencies and Bitcoin: Crossing the Chasm

- Checking vs. Prepaid: Threat or Opportunity?

- Real-Time Payments 2013: Struggling Toward Revolutionary Change

About Javelin Strategy & Research

Javelin Strategy & Research, a division of Greenwich Associates, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research