Gen Z Demands a Different Approach to Payments

Gen Z’s lack of access to credit and growing exposure to artificial intelligence require new purchasing tools and methods

San Francisco, CA, May 24, 2018: Gen Z – consumers born after 1995 – have grown up in a smartphone world and financial services organizations need to modify their strategies and distribution approaches to effectively engage with this segment. A new Javelin Strategy & Research report, Technologies Influencing Generation Z Payments Adoption, examines how Generation Z’s interaction with technology is influencing and shaping their expectations and use of payments – and how financial providers can capitalize on them.

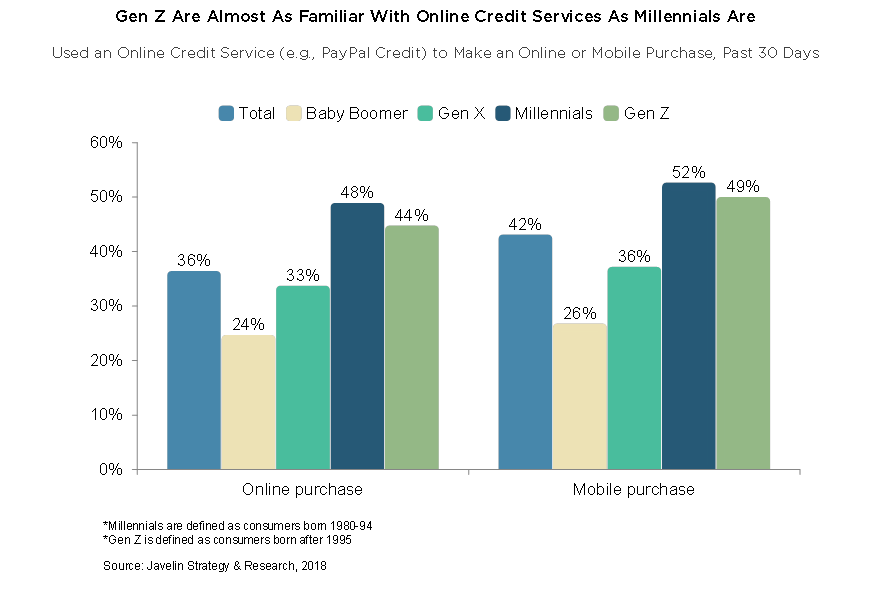

Gen Z transacts in a way not seen in previous generations. Their credit card ownership is depressed to historically low levels, yet their purchase rate via mobile over the past 30 days (64%) is much higher than the average consumer’s mobile purchase rate of 38%. Gen Z has also shown a willingness to use online credit services – 52% have used it in the past 30 days to make a purchase.

Gen Z’s use of non-traditional sources of credit is not surprising given the evolution of sites such as Facebook or Google with which they heavily engage. For Gen Z, shopping or sending money to a friend on a social media site has always been the norm, so going outside of the traditional financial ecosystem for their payment needs isn’t a foreign concept. Usage of online payment services is only one symptom of Gen Z’s different payment expectations.

Gen Z’s use of non-traditional sources of credit is not surprising given the evolution of sites such as Facebook or Google with which they heavily engage. For Gen Z, shopping or sending money to a friend on a social media site has always been the norm, so going outside of the traditional financial ecosystem for their payment needs isn’t a foreign concept. Usage of online payment services is only one symptom of Gen Z’s different payment expectations.

“Parts of the purchase cycle that were once done separately — product research, financing, and purchase — have started to converge,” said Michael Moeser, Director of Payments at Javelin Strategy & Research. “Financial providers need to recognize that the parts of this cycle they once owned are increasingly being completed elsewhere, often on social media or through a digital assistant, and they need to respond or risk being left behind.”

The report also reviews the key technologies Gen Z currently uses to engage not only with their banks and card issuers but with the world at large - and how these technologies are shaping this generation’s expectations around payments.

###