CNP Fraud Rapidly Rising Irrespective of EMV Adoption

Javelin Forecasts CNP Fraud to Double over POS Fraud by 2018 in the United States

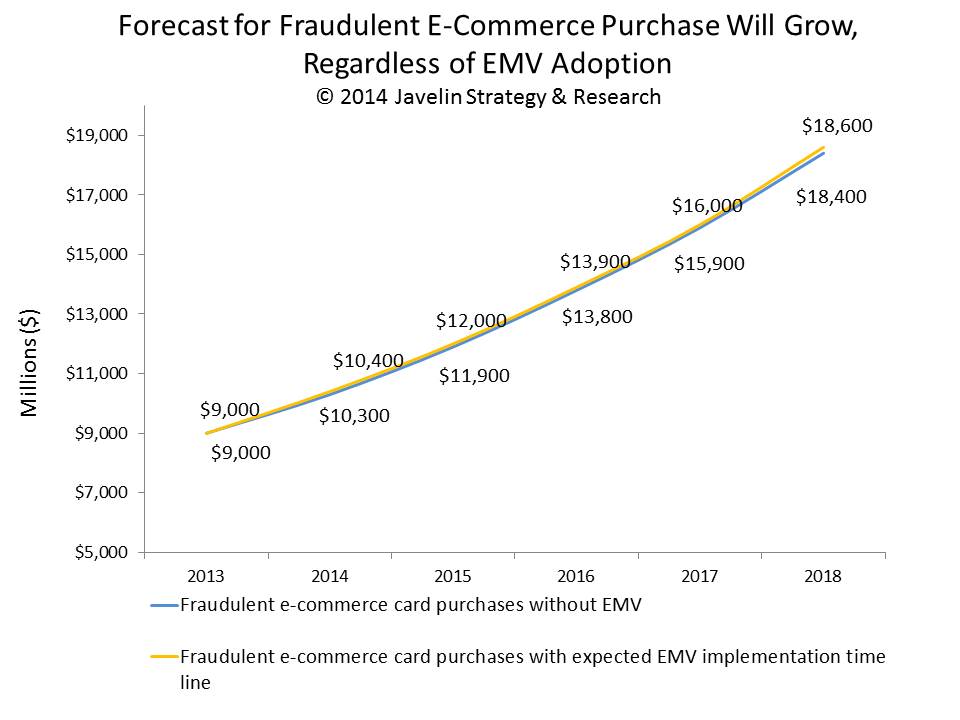

San Francisco, CA, October 30, 2014: As the United States looks to implement EMV, Javelin examined the United Kingdom EMV market as a looking glass into the future U. S. market. While the rapid proliferation of EMV adoption in the UK produced a significant drop in POS fraud, it did not address where card fraud is most problematic—e-commerce and m-commerce. Javelin Strategy & Research’s report, Fixing CNP Fraud: Solutions for a Pre-and Post-EMV U.S. Market warns that online card fraud will rapidly increase despite and irrespective of the US transition to EMV.

Card-not-present (CNP) fraud in the United States is expected to be nearly 4 times greater that POS card fraud in 2018. CNP fraud will grow substantially, but this growth is due to an increase in transaction e-commerce volume and has little to do with a change in criminal behavior post-EMV.

“EMV is not a holistic solution to card fraud and therefore should be implemented in parallel with solutions that are designed to deal with where fraud is growing the most---online,” according to Nick Holland, Senior Payment Analyst at Javelin Strategy & Research. “CNP fraud cannot be underestimated in growth or expense.”

“The payments industry reliance on static card data in the foreseeable future will make it increasingly important to counter this vulnerability with advanced encryption technology and tokenization,” according to Al Pascual, Director of Fraud & Security at Javelin Strategy & Research. “Fraudsters will inevitably find chinks in the armor, but technological solutions to the most pernicious forms of card fraud should be prioritized and addressed.”

The Javelin Strategy & Research report Fixing CNP Fraud: Solutions for a Pre-and Post-EMV U.S. Market forecasted 5 years of online and POS card fraud amounts to 2018, in order to show the expected influence of EMV implementation on the amounts of each fraud type. This report included detailed examination of trends in the UK market as well as a consumer survey of over 5,600 U.S. adults.

The report also profiles 15 CNP fraud mitigation solution vendors including Accertify, ACI Worldwide, Authentify, BehavioSec, BioCatch, Final, Jumio, NICE Actimize, Red Giant, Rippleshot, RSA Security, Signifyd, Tyfone, ValidSoft, and Zumigo.

Related Research

- EMV IN USA: Assessment of Merchant and Card Issuer Readiness

- Payment Card Data Security Report: Combating Breaches, Perfecting EMV, and Safeguarding Mobile Payments

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research