Top Myths of Prepaid Cards are Busted

Javelin Explores Demographic Segments of Prepaid Card Market

San Francisco, CA, March 16, 2017: The ability to profitability serve prepaid card market has proven elusive for some while presenting a bounty for others. Strong adoption, particularly among certain demographic groups, has led to strong growth in overall purchase volume but few repeat customers. Javelin Strategy & Research examined various demographic consumer segments and debunked and confirmed a number of surprising stereotypes about prepaid cards. Our latest study, Navigating Prepaid Card Waters: Finding Opportunities in a Sea of Challenges, provides recommendations to market to these consumer segments and increase profitability of prepaid card market.

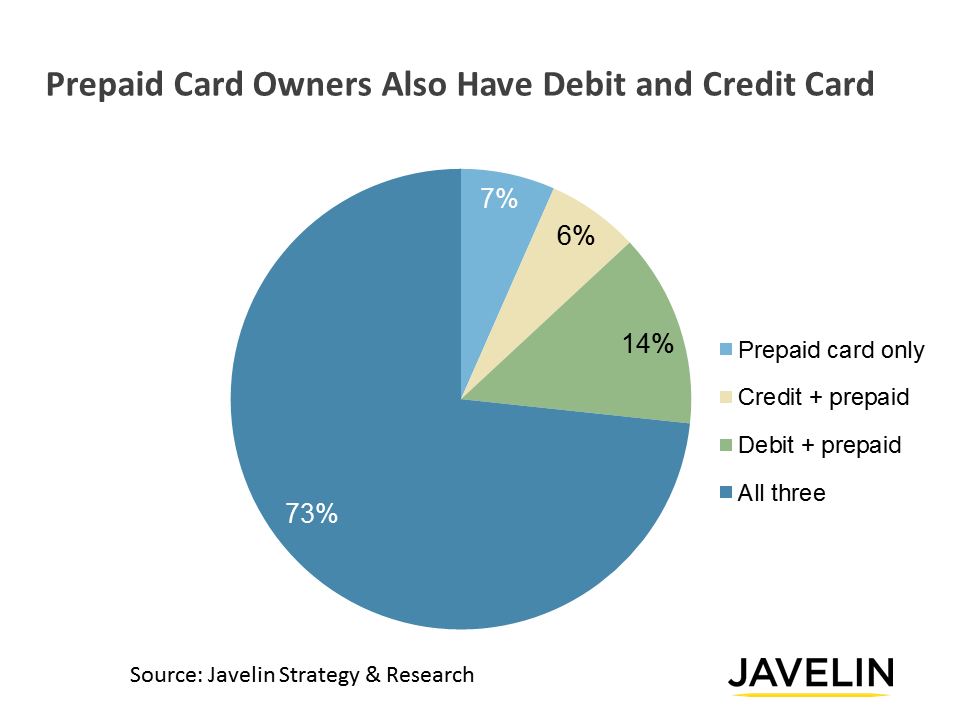

The notion that prepaid cardholders generally have only prepaid cards or fewer payment alternatives is a myth. More than nine in 10 prepaid cardholders have an alternative card type (debit or credit) at their disposal. Almost three-quarters (73%) of prepaid card owners have both a debit and a credit card, leaving 7% who only own a prepaid card.

Most people would believe that women are high adopters and users of prepaid cards, but Javelin’s research found that this myth was busted too. In general, men have significantly higher levels of prepaid card ownership than women especially among Millennials. Older women (ages 65+) use prepaid cards higher than their counterparts, yet this rate is still less than half the overall rate for each gender. There is a distinct opportunity to increase usage among younger women (18–44) to reach the levels of their male counterparts.

“The ability to profitability serve this market has been challenging for many players. The ease of customer acquisition has created a product with high customer churn and low issuer loyalty: Prepaid card lifespans are often measured in months, compared to credit cards and bank accounts, which are measured in years”, said Michael Moeser, Director of Payments, Javelin Strategy & Research.

Javelin’s report, Navigating Prepaid Card Waters: Finding Opportunities in a Sea of Challenges, uncovered many other facts that were contrary to popular belief. The report confirms or busts various myths including Millennial’s use of prepaid card, home ownership and other factors. The end goal of exploring these consumer demographics and behaviors resulted in marketing opportunities to grow the prepaid card market. In addition, the report explores the impact of CPPB finalization of rules on issuers and program managers.

Related Research

- P2P Market Sizing and Introduction of Real Time Payments

- 2016 Online Retail Payments Forecast

- Prepaid Cards: Power Users and Potential Impact of the CFPB

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, is a research-based consulting firm that advises its clients to make smarter business decisions in a digital financial world. Our analysts offer unbiased, actionable insights and unearth opportunities that help financial institutions, government entities, payment companies, merchants, and other technology providers sustainably increase profits.

Media Contact:

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com

Twitter: @JavelinStrategy