Real-time payment in the U.S. is complicated but success is achievable – if the right strategy is used

Adopting real-time is a matter of prioritization and willingness to change

SAN FRANCISCO, March 20, 2019 – Payment modernization in the form of real-time payments is advancing faster globally than in the U.S. to solve market challenges of transparency and accessibility. As the U.S. market begins to adopt real-time payment schemes, payment providers should look at the experiences of their global counterparts for guidance. Javelin Strategy & Research’s latest report, Prioritizing Real-Time Payments: Making Progress to Advance Modernization, provides key insights from the assessment of more than 150 unique real-time and instant payment global methods. The report explores trends driving modernization, business models required to reach ubiquity, and an assessment of use cases that can help jumpstart adoption.

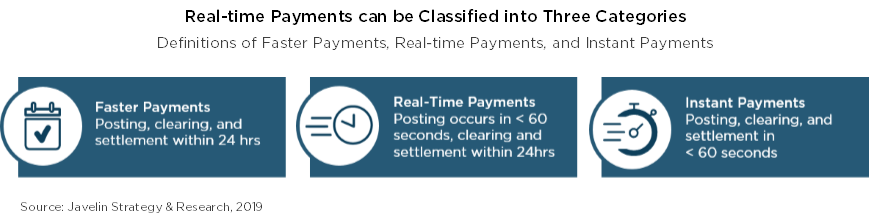

Real-time payment can be segmented into three categories — faster payments, real-time payments, and instant payments— which are not only dependent on when the payment posts to the receiver’s account but how the payment is settled between the sender and receiver. As issuers, merchants, card associations, and payment service providers look to incorporate the real-time channel, they must decide which of the three real-time classifications are best for them, if any.