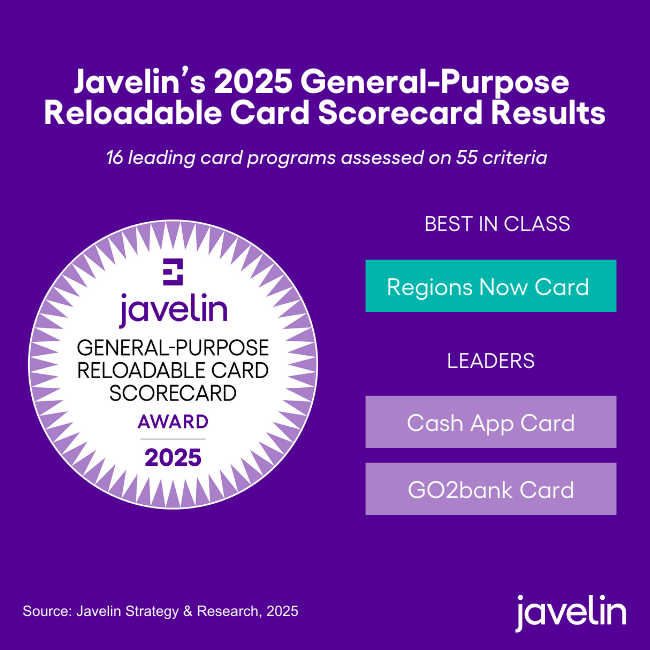

Regions Now Card Named Best-in-Class in Javelin’s 2025 General-Purpose Reloadable Card Scorecard

Cash App Card and GO2bank Visa Debit Card stand out as Leaders as prepaid cards transform from high-fee stopgaps into dynamic tools for loyalty, budgeting, and customer acquisition.(San Francisco, CA) – Javelin Strategy & Research today released its 2025 General-Purpose Reloadable (GPR) Card Scorecard, evaluating 16 leading programs on 55 criteria for cost, benefits, features, and customer experience. Regions Now Card® was named Best-in-Class, with Cash App Card and GO2bank Visa® Debit Card named as Leaders. This year’s scorecard finds a diversification in the purpose of GPR cards. While the genesis of these cards was easy retail options available to consumers who need a payment card, they have evolved to programs that are centered around brand loyalty, linking to other account types or as a starter product for organic customer acquisition and growth.

The GPR market is one of the largest single products in the prepaid ecosystem, with an annual load value exceeding $300 billion. Once designed primarily for consumers without access to traditional banking, GPR cards now also serve as budgeting tools, loyalty drivers, and even entry points into broader financial relationships.

Regions Now Card claimed the top spot across the board thanks to quality and consistent performance across categories, finishing in the top three for Additional Benefits & Features and Ongoing Experience. Meanwhile, Cash App Card and GO2bank Visa Debit Card each placed as Leaders, despite not topping any single category. All three programs demonstrated the strength of a well-rounded product strategy: reliable performance across the board proved more valuable than excelling in one area while neglecting others.

“The GPR card market has shifted from high-fee products for underbanked consumers to a broad spectrum of programs designed to build loyalty and long-term relationships,” said Jordan Hirschfield, Director of Prepaid Payments at Javelin Strategy & Research. “But it’s important to note that the programs which performed the best prove that the sum can be greater than the parts in these products, and a well-rounded product needs to be very good across the board rather than sacrificing one element to be great at another.”

This year’s analysis finds a rising frequency of card reloads. The average number of reloads per user increased from 3.51 to 3.99 annually, alongside a significant decline in the share of users who never reloaded their cards. This reflects a blossoming of new use cases—such as peer-to-peer linked cards and retailer-driven offerings—that are reshaping how consumers engage with prepaid products.

“GPR cards can be many things to many different kinds of sponsor banks and card users. The market offers a blank canvas to sponsor banks to create tools that meet very specific needs of target consumers with a product that another sponsor bank could use totally differently, all while providing the consumer a simple payment tool no matter what benefits they receive,” continued Hirschfield.