Overview

Venture Capital in Payments 2010:

How VC Funding Drives Global Payments Innovation

Research surveys global VC market, identifying most promising VC backed payments companies in recent years

Venture capital (VC) investments have provided the necessary funding and guidance to turn ideas and concepts into products and services in the market which drive industries forward. These investments are also critical in ensuring the most promising and viable ideas, technologies, and business models are screened with great due diligence and receive the most support.

Today, the global payments industry is facing mounting challenges including public pressure, regulatory scrutiny, difficult economic climate, wide-spread financial crisis, changing consumer behaviors, among others. Innovations are crucial to the health and growth of any industry.

Mercator's latest research Venture Capital in Payments 2010: How VC Funding Drives Global Payments Innovation, surveys the global VC market to identify, profile, and analyze some of the most promising payments companies worldwide that received VC investments over the past two years (2008-2009). By looking at the ideas, business models, and technologies that successfully secure VC investments, Mercator provides insights into what payments innovations are expected to have the best chances to change the way payments are made tomorrow.

"Though the venture capital industry is a highly specialized one, it has tremendous impacts on the evolution and development of almost all industries, with the payments industry being no exception." Terry Xie, Director of Mercator Advisory Group's International Advisory Service and principal analyst on the report comments. "By looking at the payments industry through investors' perspective, people in the industry can get the chance to see what is emerging over the horizon and can potentially change their way of thinking and doing business."

Highlights of the report include:

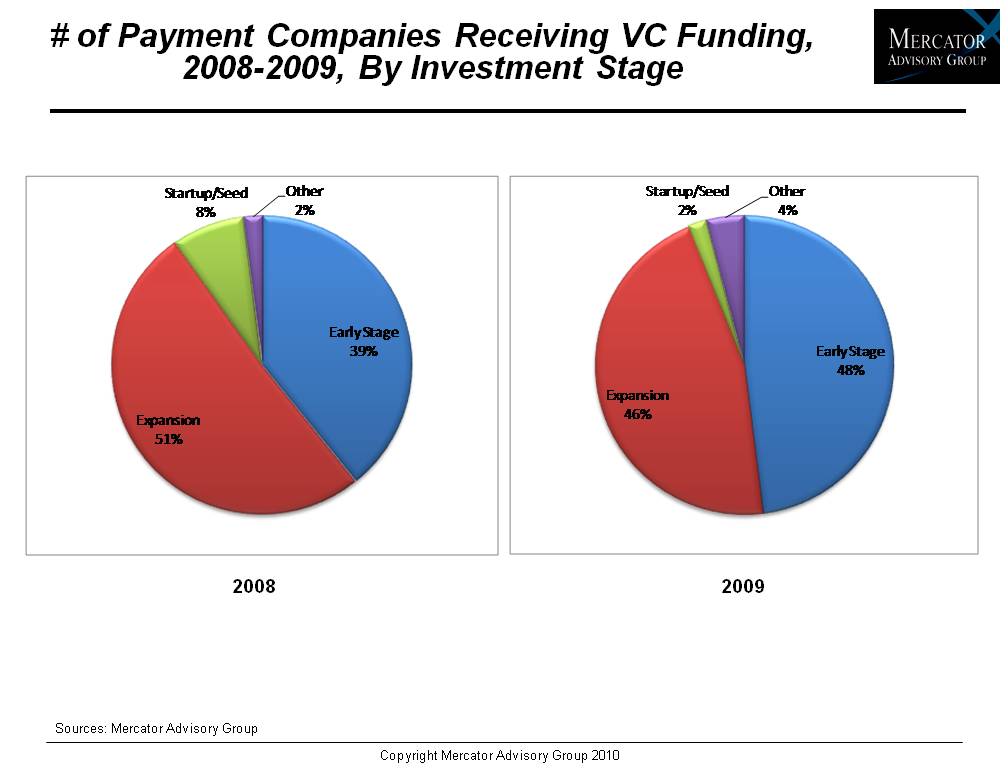

In 2009, the global payments industry still performed well with total VC funding growing by 27% from a year earlier with the number of companies receiving VC funding remaining roughly at the same level as in 2008.

U.S. dominates the global VC investment market in the area of payments. China and India, the two largest emerging markets in the world, also attracted significant attention from global VC investors.

The general trend is toward more diversified solutions with deeper segmentation of the consumers and commercial payments markets.

Online payments, mobile payments, and prepaid are the three sectors attracting a bulk of global VC funding in payments.

In 2010, the global venture capital market will recover and payments innovators worldwide will benefit from more active VC investments and more funding overall.

One of the 11 Exhibits included in this report:

This report contains 36 pages and 11 exhibits.

Companies covered in this report series include: Acculynk, Advanced Payment Solutions (APS), American EPay, Beijing Shenzhoufu, Bill.com, Bling Nation, Cardlytics, Dynamics, edo Interactive, eWise Systems, FINO, gWallet, iSend, InstaMed, IP Commerce, ItzCash, Jambool, Lending Club, mChek, MocaPay, the National Payment Card Association, oneTXT, OboPay, PaySimple, Plastyc, Progress Financial Corporation, Ready Financial Group, Retailo, Revolution Money, RightsFlow, Rixty, Shanghai HandPay, SparkBase, Square, Transaction Wireless, Trivnet, TxVia, Vindicia, WePay, WiredBenefits, among others.

VC investors mentioned in this report include: August Capital Management, Bain Capital, Canaan Partners, DCM, First Round Capital, FTV Capital, Intel Capital, Lightspeed Venture Partners, Oak Investment Partners, Seventure Partners, Total Technology Ventures, Village Ventures, and Visa.

Members of Mercator Advisory Group have access to current and past reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the banking and payments industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, and associations to leading technology providers.

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world