Overview

March 2008

US Wireless POS: Gets Up from the Table and Runs Out the Door

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Mercator Advisory Group is pleased to announce the release of its latest report, "US Wireless POS: Gets Up from the Table and Runs Out the Door.

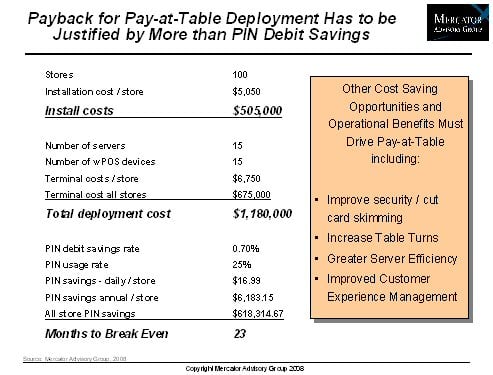

For C-level and operational leadership at merchants, ISO's, payment processors and others considering rolling out wireless point of sale solutions, this new report finds that US deployment of pay-at-table solutions continues to lag expectations. The pay-at-table proposition is stuck between compelling business benefits and a set of barriers that affect not only the merchant buying the gear but the distribution channel selling it.

The mobile merchant is the surprising wireless POS breakout story. Mobile POS using cellular data networks, AT&T in particular, delivers a straightforward benefit to a broad base of small businesses. The report further details the shift toward monthly recurring revenues and transaction-based pricing made by the wWAN POS proposition and its potential impact on POS terminal manufacturer revenues.

The report concludes with an overview of the offerings of principle providers in the wireless POS segment.

Highlights from this report include:

- Wireless POS for the mobile merchant using cellular networks now dominates the wireless POS segment with some 200,000 units including legacy systems in place.

- Proximity-based wireless POS such as pay-at-table is still in very early stage deployment in the US with less than 20,000 units shipped in 2007.

- Managed services such as data communications, payment transaction fees, gateway services and advertising placement will represent over 50% of wireless terminal related revenues by 2010. These revenue lines can boost margins considerably.

- Complexity hampers the pay-at-table proposition as merchants must change how they deliver service while ISO and channel partners deal with support challenges.

- The simplicity of mobile network based wPOS make it a winner.

"Several years ago, the pay-at-table wireless point of sales proposition looked like a slam dunk winner. Today, a balance of barriers and benefits continues to stall growth," comments George Peabody, Director of Mercator Advisory Group's Emerging Technologies Advisory Service. "It's the simpler mobile merchant wireless POS story that is making sense, and money for merchants, distributors and the terminal manufacturers. The advantages of true mobility, based on cellular networks, continue to pile up."

Companies mentioned in the report include VeriFone, Hypercom, Ingenico, Way Systems, AT&T, Verizon, ExaDigm, Linkpoint, Blue Bamboo, Banque Misr, Cara, Swiss Chalet, Hooters of America, Legal Seafoods, Ruth's Chris Steak House, and Ray's Killer Creek.

One of the 7 Figures included in this report

The report is 26 pages long and contains 7 exhibits and 3 tables.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world