Overview

In the last few years, whenever the topic of Bitcoin arose among financial services industry professionals, it provoked either negative connotations associated with reputed criminal uses such as money laundering or outright dismissal as something only Silicon Valley tech-libertarians would be interested in. In the last year or so, the tone of conversation on the topic has shifted as respected names in the industry like NYSE and Goldman Sachs have revealed not just interest in Bitcoin but plans to invest in the technology.

Bitcoin is innovative because it allows individuals to exchange value across the Internet without the involvement of trusted third parties that may impose costs or delays. The most obvious application of such a technology would be in the payments space, particularly in enabling cross-border remittances. However, Mercator Advisory Group’s research report, Understanding Bitcoin: Blockchain Applications Beyond Payments argues that this is just one of the many applications possible with this technology and by no means the most interesting one. The blockchain could fundamentally alter a whole range of services that today require middlemen to maintain centralized databases. These applications range from using bitcoins to trade real-world assets like securities or land titles to structuring “smart contracts” that could pave the way for on-demand services like Airbnb without the need for an Airbnb to act as the middleman.

“The shared ledger known as the blockchain represents a global consensus of events that have happened up until the latest block, all in the form of Bitcoin transactions. These two aspects—immutability and decentralization—give Bitcoin technology immense promise, far beyond simply enabling person-to-person transactions,” comments Nikhil Joseph, Emerging Technologies Analyst at the Mercator Advisory Group and author of the report.

This report contains 21 pages and 11 exhibits.

Companies mentioned in this report include: Circle Financial, Coinbase, Coinprism, Ethereum, Factom, MasterCard, Ripple Labs, and Visa.

Members of Mercator Advisory Group’s Emerging Technologies Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

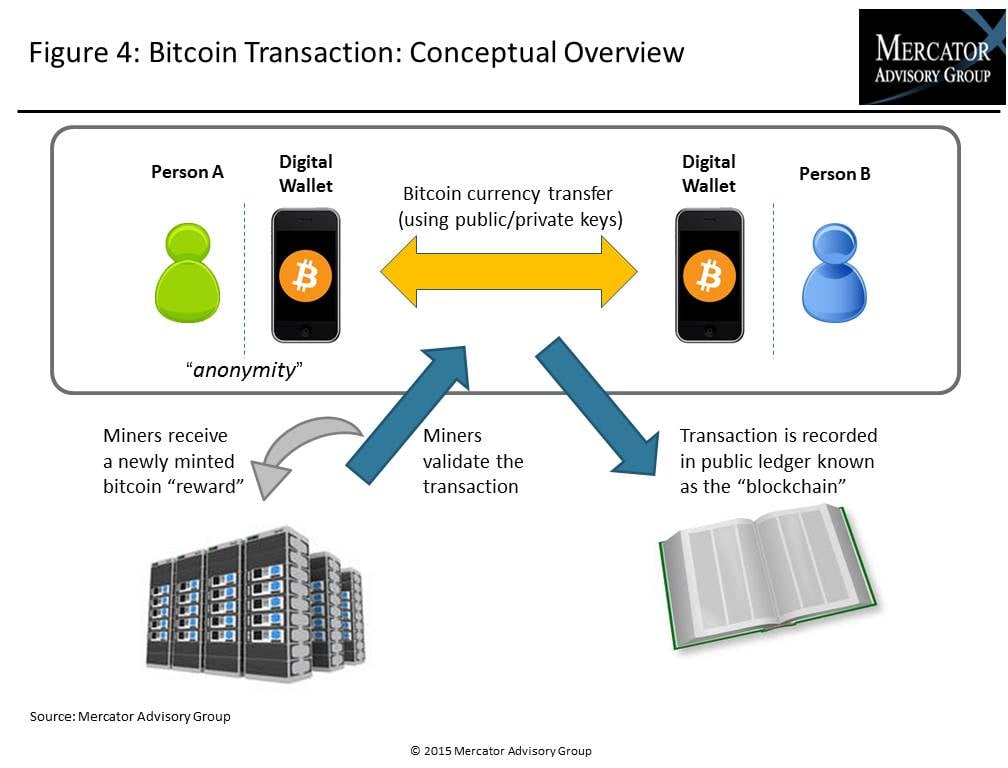

One of the exhibits included in this report:

Highlights of this report include:

- An easy-to-understand explanation of the cryptography behind Bitcoin and why the technology represents a fundamental innovation

- Breakdown of the key elements in a Bitcoin transaction and the role that “miners” play in the Bitcoin ecosystem

- Analysis of how Bitcoin compares to card networks in facilitating retail payments and where it falls short

- Explanation of ways in which the blockchain could be used to build digital asset exchanges to trade anything from securities to land titles

Book a Meeting with the Author

Related content

Building the Bridge to Payments: 3 Investment Trends for 2026 and Beyond

Investment in fintechs’ payment technology in 2026 is being shaped by a strong shift toward “bridging technologies” that connect legacy systems with emerging capabilities. Investor...

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

Make informed decisions in a digital financial world