U.S. Consumers and Social Media: Banking's Social Revolution - Cross Tabs

- Date:June 26, 2011

- Author(s):

- Ken Paterson

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

U.S. Consumers and Social Media: Banking's Social Revolution

SIXTH OF EIGHT REPORTS FROM THE MERCATOR

CUSTOMERMONITOR SURVEY SERIES

Boston, MA -- Sixth in a series of eight topical consumer survey reports examining payment and banking topics, this report highlights consumers' complex relationships with retail banking delivery channels. Based on a national sample of 1,010 online consumer survey panel survey responses focused on banking channel topics completed between September 9-13, 2010, the report outlines consumer patterns of social media usage, and how that relates to use of banking delivery channels.

Highlights of the report include the following:

A majority of the survey's U.S. adult respondents visit a social network website at least once a month, and heavy, "power" users that visit social networks and also participate in other user-generated content sites are a distinct segment.

Over half of survey respondents visit Facebook monthly and a majority do not use any other social network website.

Over one in four social media users wrote a complaint online about their bank or credit union in the last year.

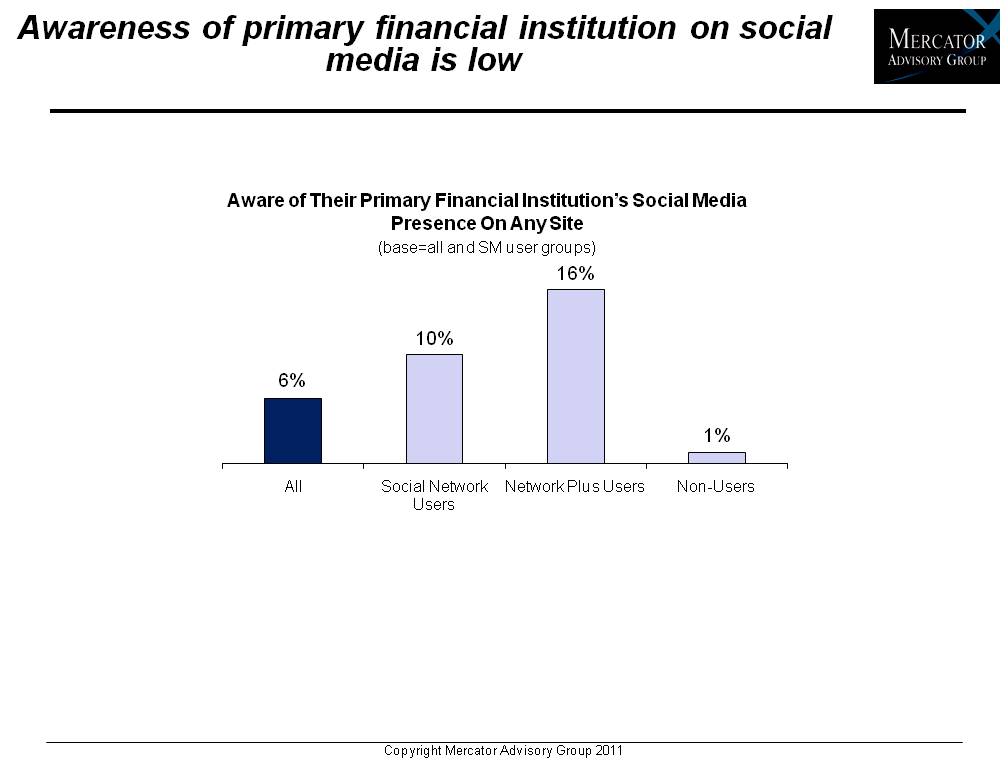

Very few social media users follow their primary financial institution online due, in large part, to a lack of awareness of their institution???s presence in social media.

Twitter users are more likely than others to follow financial services companies they do business with.

Ken Paterson, VP for Research Operations at Mercator Advisory Group and the author of the report comments that; "Social media users already represent the majority of bank customers, and the "power users" of social media represent a very distinctive customer sub-segment. Heavy users already have distinct patterns of service use, with a propensity to use online banks and mobile delivery channels. These customers in particular have high service delivery expectations, and have the ready forum to talk about their experiences, good or bad. In some respects, consumer behavior is evolving rapidly, in some respects more quickly than banking delivery channels can evolve."

One of the 24 exhibits included in this report.

The report is 44 pages long and contains 24 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world