Overview

Boston, MA

May 2006

To Steer Or Not To Steer? That's Not The Question

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

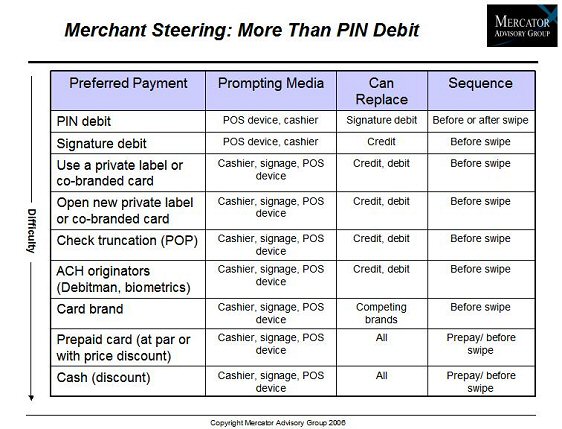

This report explores the topic of cardholder steering, the process by which card issuers and merchants seek to influence consumers' choice of payment vehicles. In today's environment, "steering" often connotes "PIN-steering," the process by which merchants influence consumers' choice of PIN over signature debit. In reality, steering encompasses a wide array of techniques, including card issuer steering techniques can be thought of as shaping consumer intentions before the sale, merchant steering techniques, on the other hand, have the advantage of immediacy of shaping choice at the point-of-sale.

From the cardholder's viewpoint, steering can be characterized as an ongoing set of tradeoffs presented to them by issuers and merchants. Some of these are financially motivated, while others are social/cultural, or simply related to awareness and experience with the payment type. The preponderance of issuer steering methods related to financial incentives and penalties for the cardholder. In today's competitive environment, rewards-based incentives are the most common and highly visible financial incentives, although the report notes that some elements of pricing, such as EFT surcharges, can be important dis-incentives to use.

On the merchant/POS side of the equation, there exist a variety of financial incentives as well, including private label card rewards or partner discounts. But it is important to note the many awareness/experience and social/cultural factors the merchant can influence by virtue of controlling the point-of-sale. Customers can be very sensitive to the environment and social pressures at the checkout: social acceptability of payments (e.g. no large bills, no checks that draw undue attention), the speed of a transaction in a crowded line, not wanting to try out an unfamiliar transaction type, and of course a willingness to oblige a simple request (either by the cashier or by the POS terminal) to use a particular type of payment.

The report also looks specifically at the topic of PIN prompting, a technology-based approach by which large merchants attempt to steer debit transactions toward lower cost PIN debit rather than signature debit. At large merchants, this practice has proven very successful in modifying consumer behavior and reducing merchant costs. Ken Paterson, Director of the Credit Advisory Service at Mercator Advisory Group and the author of this report indicates that; "Some forms of steering, like PIN-prompting at big box stores, may become so prevalent that they shape consumer assumptions. PIN debit could become "what you use" at a big box store, and signature is what you use elsewhere. If this results in a significant volume shift, debit issuers may need to reconsider the structure of rewards and surcharges associated with their PIN and signature programs."

One of the 16 Exhibits in this report

Figure 13: Internet Payments are Skewed Toward Credit Today; Enabling PIN Debit Could Alter the Mix

The report is 30 pages and contains 16 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Honor All Cards: The U.S. Credit Card Model Takes a Hit

The Honor All Cards principle—that any merchant with a Visa and/or Mastercard sticker in the window accepts all card products on those networks—could be undermined by a recent sett...

Make informed decisions in a digital financial world