Overview

Boston, MA

September 2006

Thin File and Global Credit Scoring

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

As issuers look for opportunities to grow credit volume, they are increasingly interested in reaching untapped markets. In the United States, the 'thin file' population has traditionally been ignored due to limited or non-existent bureau data. Internationally, especially in embryonic markets, there is a lack of substantial financial data with which to assess the creditworthiness of potential customers.

"The importance of addressing consumers with a limited credit profile is increasingly a focus for solution providers and global issuers," states Melanie Broad, Analyst in Mercator Advisory Group's Emerging Technologies Service and author of the report. "The ability of credit issuers to offer their product to a broader portion of any given population is imperative for continued growth in credit volumes and market share."

The report takes a broad look at the issues such as data standardization and the availability of positive and negative information that influence credit scoring in he US and around the globe. In the US emerging products and solutions from companies including Fair Isaac, PRBC, VantageScore and eFunds are examined with an emphasis on their ability to score 'thin file' customers.

The report goes on to evaluate the solutions that providers are offering in global markets, and the problems encountered in developing global scoring solutions. Many of the solutions available to global issuers are examined along with an analysis of some of the key limitations to a unified global scoring metric.

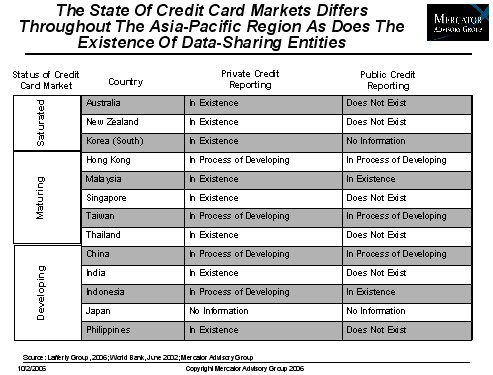

In order to highlight the opportunities and difficulties involved in promoting credit in a new region, the report specifically drills down into the Asia-Pacific market with particular emphasis on the market for credit in China. The research evaluates the current state of the Asia-Pacific market while also showing the beginnings of credit bureau development in such countries.

One of the three exhibits included in this report

The report contains 29 pages and 3 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world