Overview

Recent economic pressures have shrunk the American middle class, and put pressure on the customer base of most financial services providers. Technology provides an opportunity for companies to build profitable customers by helping individuals set goals, manage their money, and build wealth, according to Mercator Advisory Group’s research report, The Six Million Dollar Customer: Using Technology to Build a Profitable Customer Base.

Banks, credit unions, and other financial services providers have tried to build success by focusing on narrow niches such as the ultra-wealthy, mass affluent, or even the unbanked and underserved. This niche thinking is costing them increased profitability in the long run because it does not recognize the ways in which they help customers build wealth and thus become more profitable customers. Combining a life-cycle approach with new technology can build a portfolio of customers who each have a profitable personal portfolio.

“Financial services is one of the few sectors that actually has the power to build the kind of customers that it wants, but it requires rethinking the approach to the delivery of those services,” commented Ben Jackson, Director, Prepaid Advisory Service and author of the report.

This research report contains 33 pages and 16 exhibits.

Companies mentioned in this report include: American Express, Bank of America, Betterment, Citigroup, Digit, FIS, Mint, On Budget, Simple, SmartyPig, Square, and Wealthfront.

Members of Mercator Advisory Group’s Prepaid Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

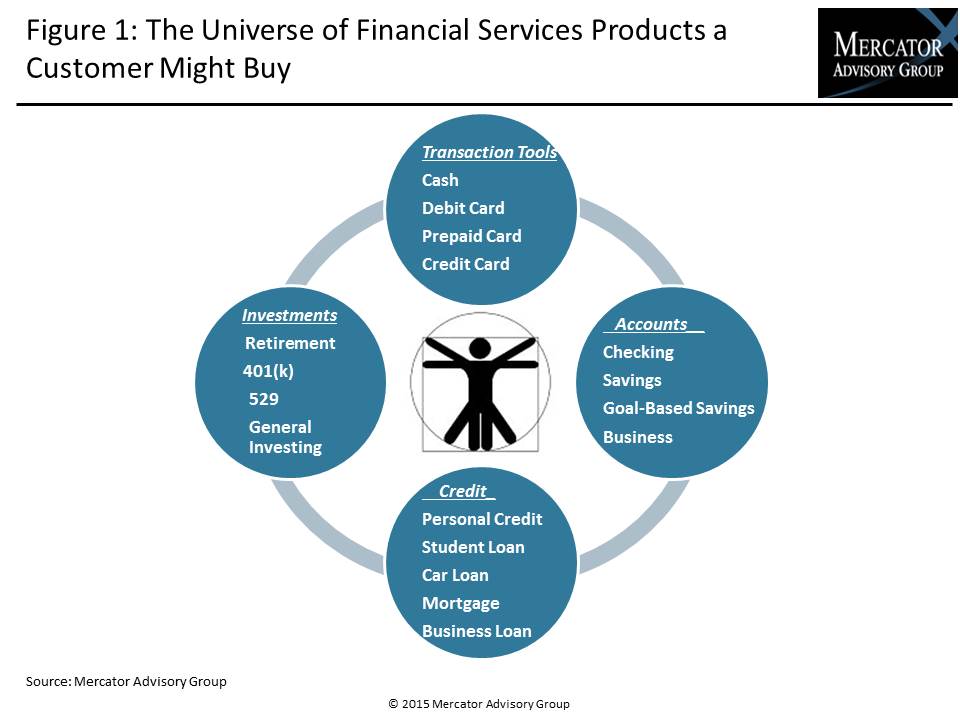

One of the exhibits included in this report:

Highlights of the research report include:

- The customer base for most financial service providers is eroding as income and asset growth stagnates.

- Banks, credit unions, and other financial service companies can build the kind of customers they want.

- Financial services technology has advanced to a point where customers can be led through a process that builds their individual wealth while also improving providers’ bottom lines.

- Automation combined with traditional banking and financial know-how will enable customers to reach their financial goals in a way that benefits banks, credit unions, and other financial services providers.

- Financial institutions will need to change their thinking from silos to barn building to combine tools and areas of the banks in order to build the wealth of their customers, and consequently, their own profitability.

- The added bonus is that this satisfies the desire of legislators, consumer groups, and regulators for more financial service products to help people at all socioeconomic levels.

Book a Meeting with the Author

Related content

2026 Prepaid Payments Data Book

The Prepaid Card Data Book creates a baseline to highlight key metrics for the prepaid industry in brief, consolidated updates. This evaluation of the prepaid and stored-value mark...

22nd Annual U.S. Open-Loop Prepaid Card Market Forecast, 2025-2029

Open-loop prepaid programs show resilience and positive growth opportunities across nearly all market verticals. Javelin Strategy & Research continues its annual assessment of open...

2026 Prepaid Payments Trends

Prepaid card programs motor along while innovation bubbles beneath the service. In the coming year and beyond, Javelin sees three major themes playing out in the space. First, the ...

Make informed decisions in a digital financial world