Overview

USE OF CREDIT TO EXTEND PREPAID (GPR) INTO

FINANCIAL SERVICES TERRITORY

The Rise of Hybrid Credit/Prepaid Cards

A unique genre of payment products are emerging which combine elements of prepaid cards with a small dollar credit line. These products are surfacing during a time when more consumers continue to face financial difficulties in general, and credit problems in particular. Hybrid credit/prepaid cards can be loaded via cash or direct deposit, as well as loaded utilizing a line of credit or payroll advance loan.

The Rise of Hybrid Credit/Prepaid Cards report is one of the first research efforts to date that exclusively focuses on this emerging segment of consumer payment cards. This fusion of prepaid and credit offers small credit lines (under $1,000) meant to meet short-term credit needs, and typically require the consumer to establish a direct deposit or deposit account relationship with the issuer. While generally providing short term, expensive credit, most hybrid credit/prepaid cards are positioned to provide credit at lower cost than payday loans.

While the current economic environment creates a significant opportunity for this new payment type, increased consumer adoption may translate into greater risks for issuers managing a new payment card that combines aspects of prepaid cards and small dollar consumer lending. Because the products typically operate under both depository and credit regulations, issuers and program managers must be careful to think through their customer servicing responsibilities and capabilities.

"It is clear that we are at the convergence of a consumer need and a range of creative solutions that address that need. They offer consumers the convenience of electronic POS payments with the facility of short term, low dollar amount loans," Ken Paterson, Director of the Credit Advisory Service at Mercator Advisory Group comments. "The economic climate is certainly supportive of their development, and a number of product approaches are vying to capture this opportunity."

The Rise of Hybrid Credit/Prepaid Cards offers best practices for the issuance, management and marketing of these products, making it a critical read for those looking to capitalize on the opportunity that these products present. This report also reviews a number of product offerings to highlight similarities and differences in this growing product segment.

Highlights of the report include:

- Hybrid credit/debit cards coming to market employ a prepaid card as the transaction device, plus a credit facility and deposits as sources of load.

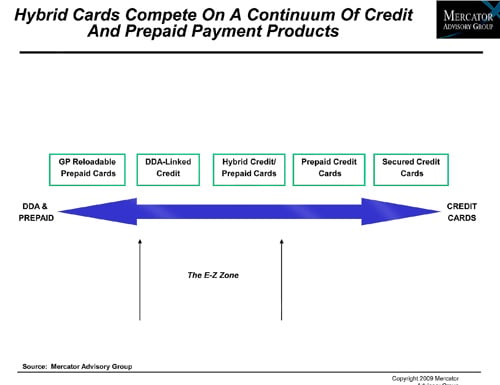

- These hybrid cards typically target subprime and no file/thin file consumers and compete on a continuum of products ranging from pure prepaid to secured credit cards.

- Loan products in this space are addressing consumers short-term borrowing needs recognized by the FDIC in its small-dollar loan initiatives. In todays economic environment, the user base is proving even broader than anticipated for some issuers.

- In hybrid credit/prepaid cards, the two functions are addressed by different consumer protections under Fed Regulations Z and E, a situation which has not yet become problematic, but which may offer future challenges.

- Issuers of hybrid and competing payment products are advised to anticipate regulatory and consumer-driven changes that may be required to ensure continued growth.

One of the 17 Exhibits included in this report

Companies mentioned in this report: H&R Block, Meta Payment Systems, Jackson Hewitt, Money Gram, Millennium Bank, Wells Fargo, First Bank & Trust, Fishback Financial, and Primary Innovations LLC (Cash America, Inc.)

The report is 32 pages long and contains 17 exhibits

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781)-419-1700 or send E-mail to [email protected].

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments industry. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the worlds largest payment issuers, acquirers, processors, and associations to leading technology providers.

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world