Overview

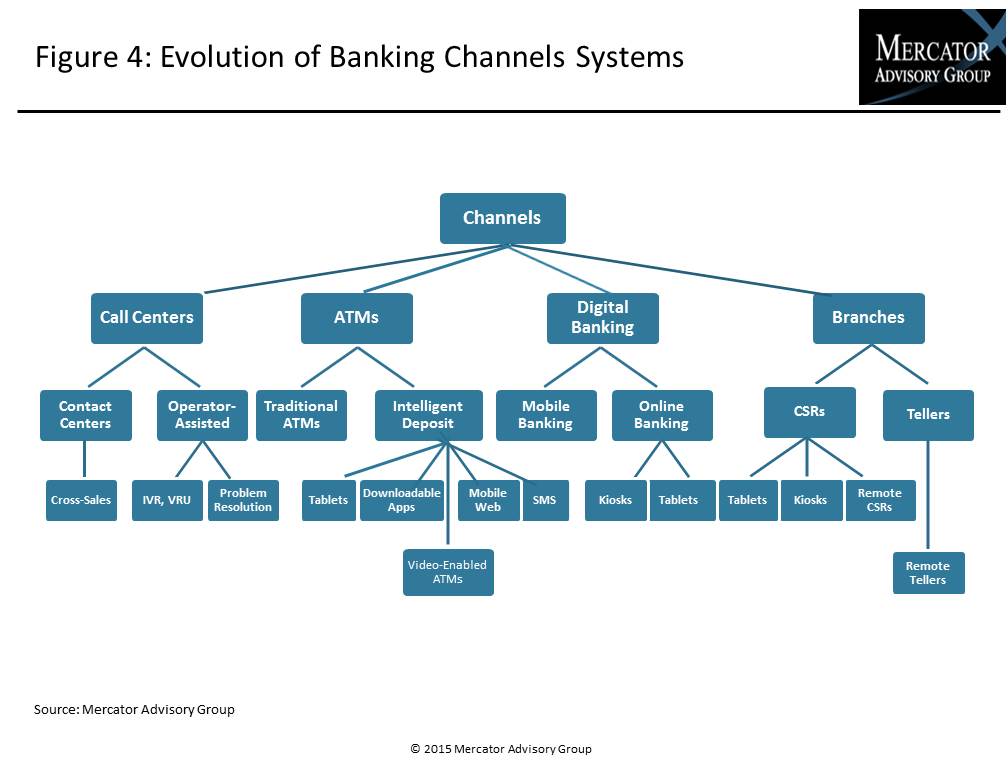

Banking systems and channels continue to evolve as banks and credit unions deploy “intelligent deposit” ATMs and expand digital banking capabilities to include new smartphone and tablet apps and solutions. Financial institutions face challenges due to the increasing complexity of today’s banking systems as they become a coordinated and interrelated collection of legacy and contemporary IT infrastructures that cross channels’ systems.

In research note,The Importance of Systems Monitoring in Banking, Mercator Advisory Group shows why robust system monitoring is crucial for modern banking systems and channels.

“These sophisticated machines and devices must be monitored in real time and with more precision than ever, or financial institutions run the risk of customer dissatisfaction because of downtime or equipment not working correctly,” comments Ed O’Brien, director of Mercator Advisory Group’s Banking Channels Advisory Service and author of the research note.

This research note is 14 pages long and has 8 exhibits.

Companies mentioned in this research note include: INETCO, NCR, and Wincor Nixdorf.

Members of Mercator Advisory Group Banking Channels Advisory Service have access to this research note as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

One of the exhibits included in this report:

Highlights of this note include:

- Opportunities and challenges facing banks and credit unions as they evolve and expand they banking systems and channels

- Mercator Advisory Group survey data on U.S. consumers’ use of a broad array of new customer-facing banking features and channels

- The necessity for robust systems monitoring systems today and the sense of urgency for faster systems that can detect potential issues before they occur, with real-time alerts and self-diagnostics to help minimize downtime and maximize customer satisfaction

- Review of three example solutions, from INETCO, NCR, and Wincor Nixdorf.

Book a Meeting with the Author

Make informed decisions in a digital financial world