The Emergence of Mass Pay Solutions

- Date:November 10, 2015

- Author(s):

- Sarah Grotta

- Research Topic(s):

- Commercial & Enterprise

- Debit

- Prepaid

- PAID CONTENT

Overview

“The capabilities of mass pay providers solve payment issues for several different markets, but the primary driver is the growth and globalization of what is referred to as the “gig economy” in which contingent or freelance workers are compensated by multiple companies,” comments Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group and author of the research note.

This research note has 11 pages and 3 exhibits.

Companies mentioned in this research note include: Airbnb, Amazon, Blackhawk Network, Dwolla, Etsy, Google, Handy, HyperWallet, iStock, Lyft, MasterCard, Payoneer, PayPal, Task Rabbit, Tipalti, Uber, and Visa.

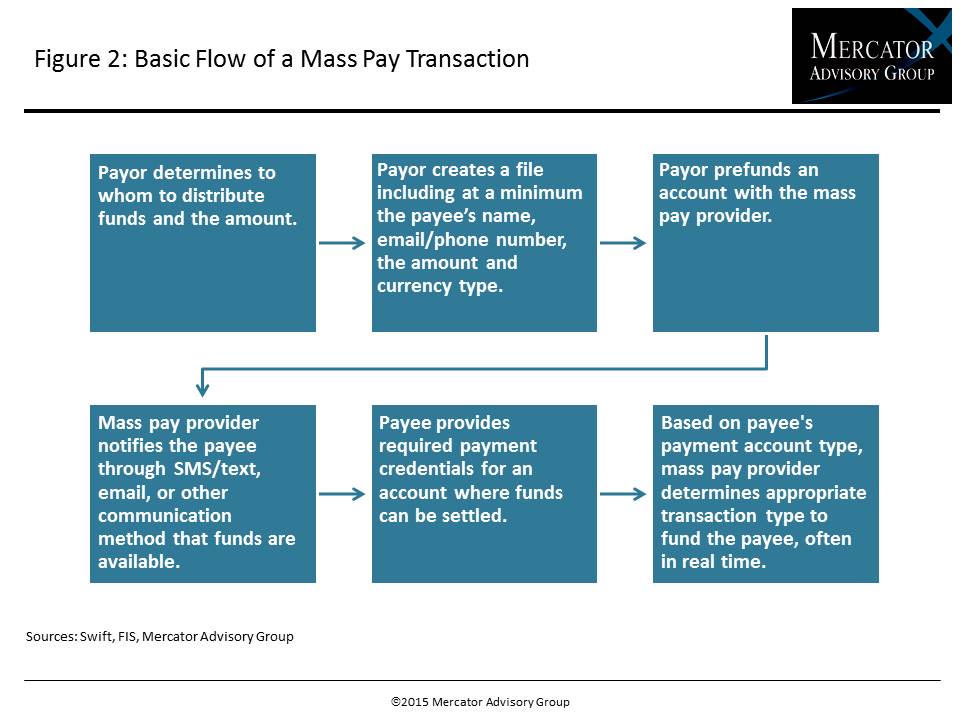

One of the exhibits included in this report:

Highlights of this research note include:

- Mass pay benefits and the issues it solves for businesses

- Estimating the addressable market

- Indicators suggesting a broad and growing need for this payment type

- Review of a selection of U.S.-based providers of mass pay platforms and solutions

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world