Overview

“At first glance, prepaid and debit appear so similar that one could conclude that the payments industry took two separate paths to end up with the same product. Initially prepaid product providers were developing solutions to offer users a bankcard-like product. Now financial institutions are seeing inspiration in GPR card attributes, comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and co-author of the report.

This research report has 16 pages and 8 exhibits.

Companies mentioned in this report include: Ace Cash Express, American Express, Bancorp Bank, Bank of America, Chase Bank, Citi Bank, Green Dot, InComm, Mastercard, Meta Bank, Netspend, PayPal, Square, U.S. Bank, Visa, Walmart, and Wells Fargo.

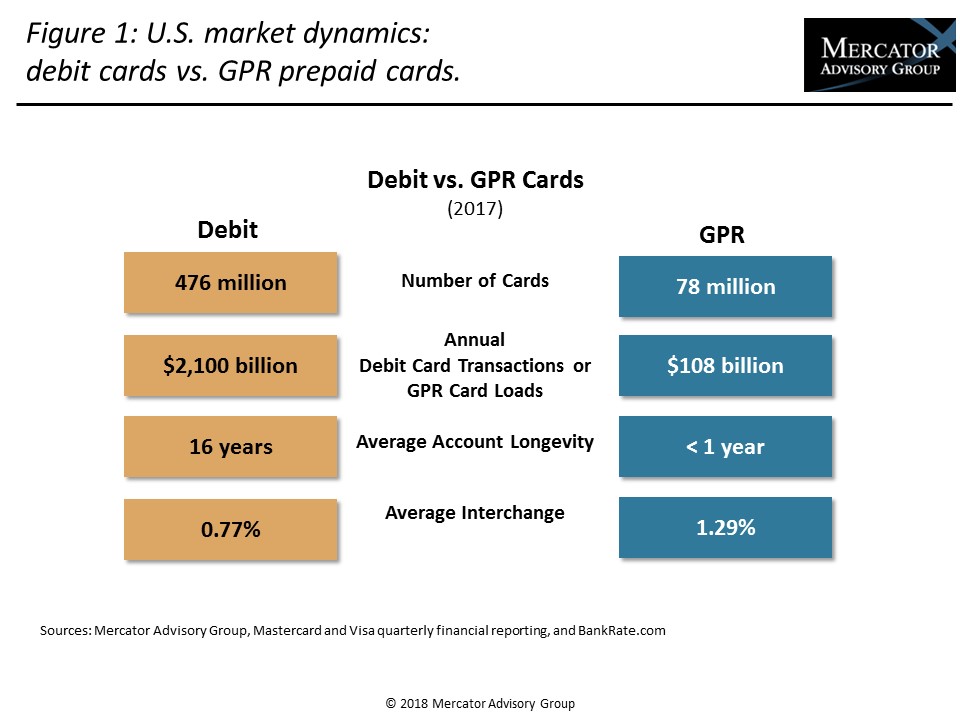

One of the exhibits included in this report:

- A comparison of some of the regulatory differences between debit and GPR cards.

- Market sizing for prepaid and debit, including a look at the decline in the unbanked population in the U.S.

- Review of the features and functionality of leading GPR cards and entry level checking accounts from five U.S. banks.

- The role that GPR cards have and continue to play in banking and payments innovation.

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world